- India

- /

- Renewable Energy

- /

- NSEI:PTC

Indian Oil And 2 Other High-Yield Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

Over the last 7 days, the Indian market has risen 1.0%, with notable gains in the Financials and Information Technology sectors of 1.4% and 3.2%, respectively. With a remarkable 45% increase over the past year and earnings expected to grow by 17% per annum, identifying high-yield dividend stocks like Indian Oil can be an effective strategy to enhance your portfolio amidst these favorable conditions.

Top 10 Dividend Stocks In India

| Name | Dividend Yield | Dividend Rating |

| Castrol India (BSE:500870) | 3.04% | ★★★★★★ |

| Balmer Lawrie Investments (BSE:532485) | 3.88% | ★★★★★★ |

| D. B (NSEI:DBCORP) | 5.17% | ★★★★★☆ |

| VST Industries (BSE:509966) | 3.29% | ★★★★★☆ |

| Indian Oil (NSEI:IOC) | 7.83% | ★★★★★☆ |

| Bharat Petroleum (NSEI:BPCL) | 5.86% | ★★★★★☆ |

| NMDC (BSE:526371) | 3.35% | ★★★★★☆ |

| Balmer Lawrie (BSE:523319) | 3.04% | ★★★★★☆ |

| Redington (NSEI:REDINGTON) | 3.12% | ★★★★★☆ |

| PTC India (NSEI:PTC) | 3.65% | ★★★★★☆ |

Click here to see the full list of 16 stocks from our Top Indian Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Indian Oil (NSEI:IOC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Indian Oil Corporation Limited, along with its subsidiaries, refines, transports via pipelines, and markets petroleum products both in India and internationally, with a market cap of ₹2.46 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from petroleum products (₹8.25 trillion) and petrochemicals (₹262.95 billion).

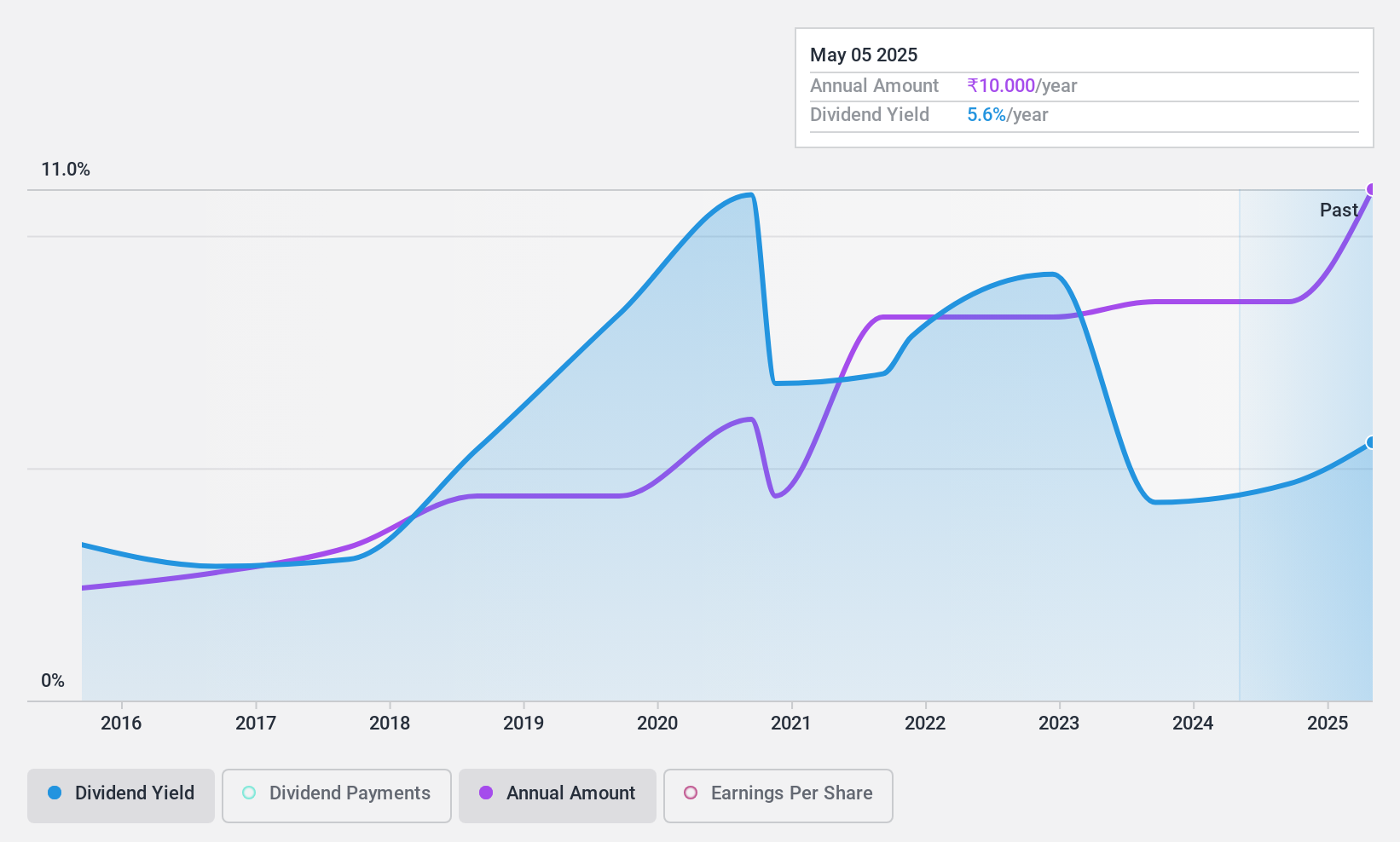

Dividend Yield: 7.8%

Indian Oil Corporation's dividend payments have grown over the past decade but have been volatile. The company's dividends are well-covered by earnings (payout ratio: 39.6%) and cash flows (cash payout ratio: 56.8%). Despite a high level of debt, IOC's dividend yield is in the top 25% of Indian market payers at 7.83%. Recent news includes a final dividend declaration of ₹7 per share for FY2023-24 and declining Q1 earnings for FY2024-25.

- Delve into the full analysis dividend report here for a deeper understanding of Indian Oil.

- Upon reviewing our latest valuation report, Indian Oil's share price might be too pessimistic.

PTC India (NSEI:PTC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: PTC India Limited, with a market cap of ₹63.25 billion, engages in the trading of power across India, Nepal, Bhutan, and Bangladesh through its subsidiaries.

Operations: PTC India Limited generates revenue primarily from its power trading segment, which accounts for ₹159.67 billion, and its financing business, which contributes ₹7.35 billion.

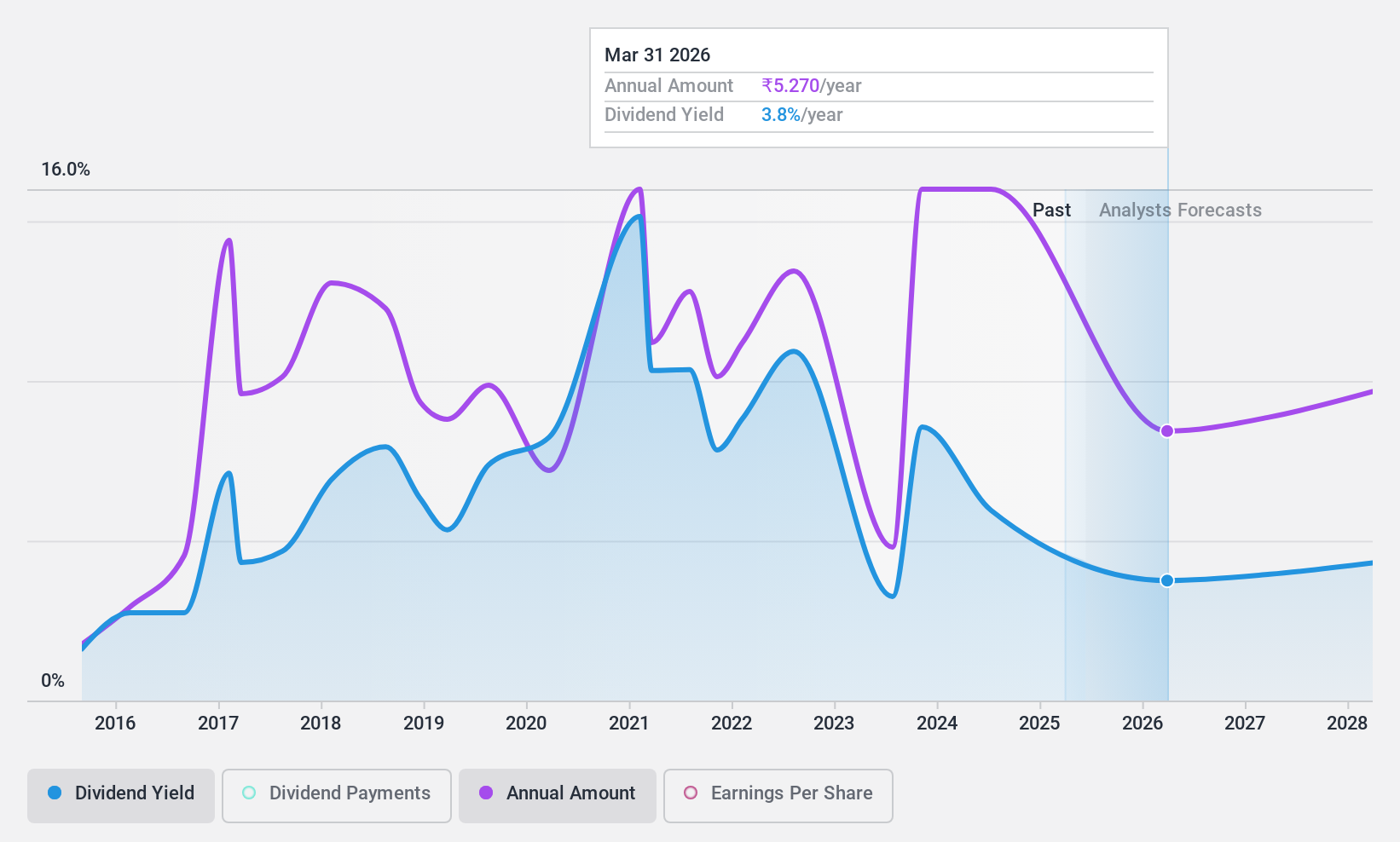

Dividend Yield: 3.7%

PTC India's dividend payments have been volatile over the past decade, though they are well-covered by earnings (payout ratio: 54%) and cash flows (cash payout ratio: 9.4%). The company's recent Q1 FY2025 earnings showed a net income increase to ₹1.74 billion from ₹1.30 billion a year ago, despite slightly lower revenue. PTC's dividend yield is in the top 25% of Indian market payers, and its price-to-earnings ratio of 14x suggests good value compared to the broader market.

- Click here to discover the nuances of PTC India with our detailed analytical dividend report.

- Our valuation report here indicates PTC India may be overvalued.

Redington (NSEI:REDINGTON)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Redington Limited offers supply chain solutions both in India and internationally, and has a market cap of ₹155.53 billion.

Operations: Redington Limited generates revenue from various segments, including ₹422.99 billion from IT products and ₹23.48 billion from mobility products.

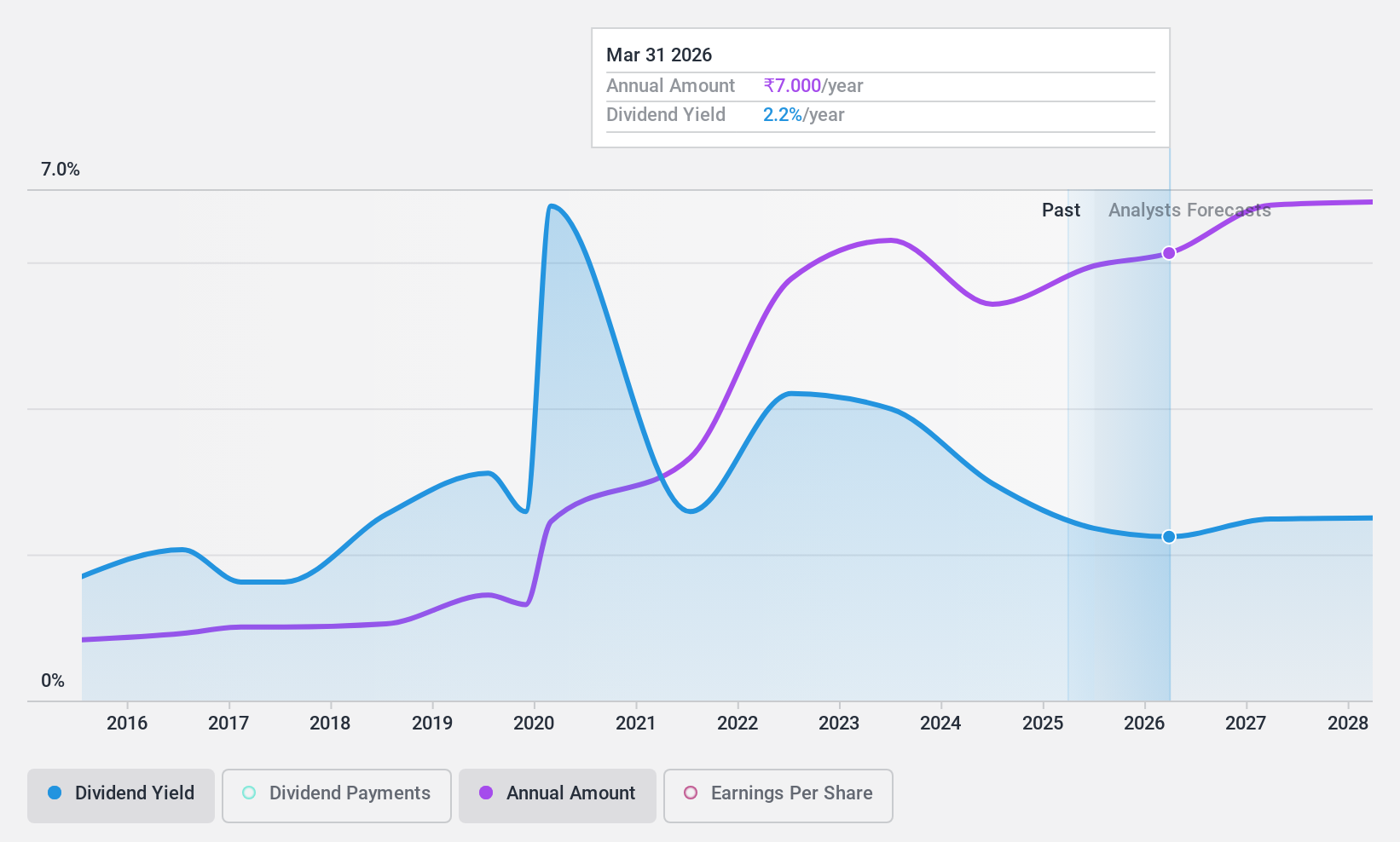

Dividend Yield: 3.1%

Redington's dividend yield of 3.12% places it in the top 25% of Indian market payers, and its dividends are well-covered by earnings (payout ratio: 39.8%) and cash flows (cash payout ratio: 50.6%). Despite a volatile dividend history over the past decade, recent announcements include a reduced dividend of ₹6.20 per share for FY2024. The company trades at a slight discount to its estimated fair value, with earnings expected to grow by 15.15% annually.

- Unlock comprehensive insights into our analysis of Redington stock in this dividend report.

- The valuation report we've compiled suggests that Redington's current price could be quite moderate.

Taking Advantage

- Embark on your investment journey to our 16 Top Indian Dividend Stocks selection here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:PTC

PTC India

Engages in the trading and generating of power in India, Nepal, Bhutan, and Bangladesh.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives