- India

- /

- Renewable Energy

- /

- NSEI:NLCINDIA

A Piece Of The Puzzle Missing From NLC India Limited's (NSE:NLCINDIA) Share Price

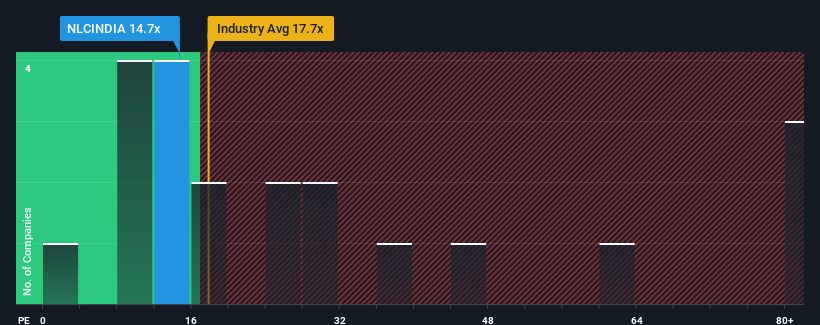

With a price-to-earnings (or "P/E") ratio of 14.7x NLC India Limited (NSE:NLCINDIA) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 30x and even P/E's higher than 55x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for NLC India as its earnings have been rising faster than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for NLC India

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as NLC India's is when the company's growth is on track to lag the market.

Retrospectively, the last year delivered an exceptional 26% gain to the company's bottom line. The latest three year period has also seen an excellent 47% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest earnings should grow by 21% each year over the next three years. With the market predicted to deliver 19% growth each year, the company is positioned for a comparable earnings result.

In light of this, it's peculiar that NLC India's P/E sits below the majority of other companies. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On NLC India's P/E

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of NLC India's analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future earnings could see some volatility.

Plus, you should also learn about these 2 warning signs we've spotted with NLC India.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Valuation is complex, but we're here to simplify it.

Discover if NLC India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NLCINDIA

Solid track record and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

GE Vernova revenue will grow by 13% with a future PE of 64.7x

A buy recommendation

Growing between 25-50% for the next 3-5 years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026