- India

- /

- Renewable Energy

- /

- NSEI:KPIGREEN

Market Participants Recognise KPI Green Energy Limited's (NSE:KPIGREEN) Revenues Pushing Shares 31% Higher

Despite an already strong run, KPI Green Energy Limited (NSE:KPIGREEN) shares have been powering on, with a gain of 31% in the last thirty days. This latest share price bounce rounds out a remarkable 516% gain over the last twelve months.

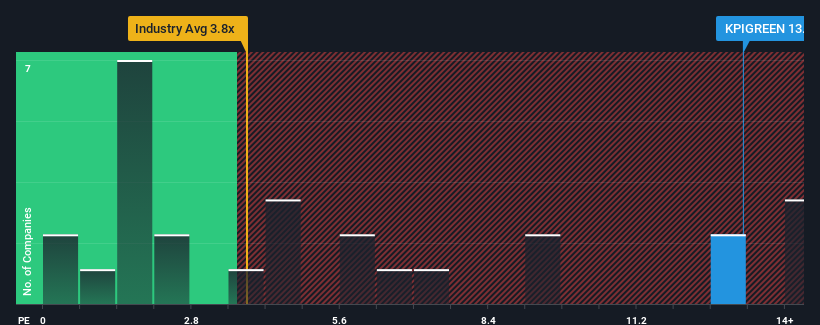

After such a large jump in price, you could be forgiven for thinking KPI Green Energy is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 13.2x, considering almost half the companies in India's Renewable Energy industry have P/S ratios below 3.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for KPI Green Energy

How KPI Green Energy Has Been Performing

Recent times haven't been great for KPI Green Energy as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to recover significantly, which has kept the P/S ratio from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on KPI Green Energy will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For KPI Green Energy?

The only time you'd be truly comfortable seeing a P/S as steep as KPI Green Energy's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company grew revenue by an impressive 71% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 58% as estimated by the sole analyst watching the company. That's shaping up to be materially higher than the 18% growth forecast for the broader industry.

In light of this, it's understandable that KPI Green Energy's P/S sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On KPI Green Energy's P/S

Shares in KPI Green Energy have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into KPI Green Energy shows that its P/S ratio remains high on the merit of its strong future revenues. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider and we've discovered 3 warning signs for KPI Green Energy (1 is potentially serious!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on KPI Green Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if KPI Green Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KPIGREEN

KPI Green Energy

Operates as an independent power producer that focuses on the development, construction, ownership, operation, and maintenance of renewable energy projects under Solarism brand name in India.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives