- India

- /

- Electric Utilities

- /

- NSEI:INDIGRID

India Grid Trust (NSE:INDIGRID) Is Increasing Its Dividend To ₹3.30

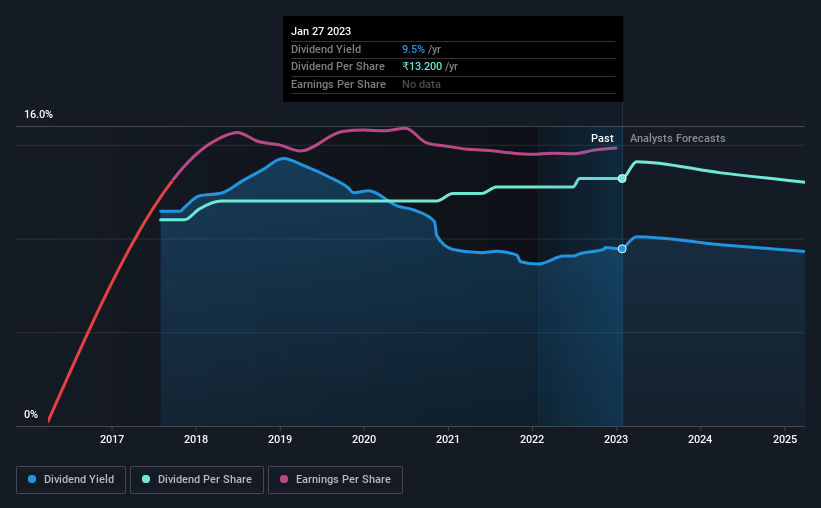

India Grid Trust (NSE:INDIGRID) has announced that it will be increasing its dividend from last year's comparable payment on the 24th of February to ₹3.30. This will take the dividend yield to an attractive 9.5%, providing a nice boost to shareholder returns.

See our latest analysis for India Grid Trust

India Grid Trust Is Paying Out More Than It Is Earning

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Before making this announcement, India Grid Trust's dividend was higher than its profits, but the free cash flows quite comfortably covered it. Healthy cash flows are always a positive sign, especially when they quite easily cover the dividend.

Looking forward, earnings per share is forecast to fall by 4.4% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could reach over 200%, which could put the dividend under pressure if earnings don't start to improve.

India Grid Trust Is Still Building Its Track Record

India Grid Trust's dividend has been pretty stable for a little while now, but we will continue to be cautious until it has been demonstrated for a few more years. The dividend has gone from an annual total of ₹11.00 in 2018 to the most recent total annual payment of ₹13.20. This works out to be a compound annual growth rate (CAGR) of approximately 3.7% a year over that time. It's good to see at least some dividend growth. Yet with a relatively short dividend paying history, we wouldn't want to depend on this dividend too heavily.

India Grid Trust May Find It Hard To Grow The Dividend

The company's investors will be pleased to have been receiving dividend income for some time. However, things aren't all that rosy. India Grid Trust has seen earnings per share falling at 4.3% per year over the last five years. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth.

India Grid Trust's Dividend Doesn't Look Sustainable

Overall, we always like to see the dividend being raised, but we don't think India Grid Trust will make a great income stock. The company is generating plenty of cash, which could maintain the dividend for a while, but the track record hasn't been great. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, India Grid Trust has 3 warning signs (and 2 which are concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDIGRID

Indigrid Infrastructure Trust

Operates as an infrastructure investment trust that owns and operates power transmission, renewable generation, and energy storage assets in India.

Acceptable track record second-rate dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)