- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

Investors Who Bought Orient Green Power (NSE:GREENPOWER) Shares Three Years Ago Are Now Down 67%

This month, we saw the Orient Green Power Company Limited (NSE:GREENPOWER) up an impressive 46%. But over the last three years we've seen a quite serious decline. Indeed, the share price is down a tragic 67% in the last three years. So it's good to see it climbing back up. The rise has some hopeful, but turnarounds are often precarious.

Check out our latest analysis for Orient Green Power

Orient Green Power isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last three years, Orient Green Power's revenue dropped 1.7% per year. That's not what investors generally want to see. The share price decline of 31% compound, over three years, is understandable given the company doesn't have profits to boast of, and revenue is moving in the wrong direction. Of course, it's the future that will determine whether today's price is a good one. We don't generally like to own companies that lose money and can't grow revenues. But any company is worth looking at when it makes a maiden profit.

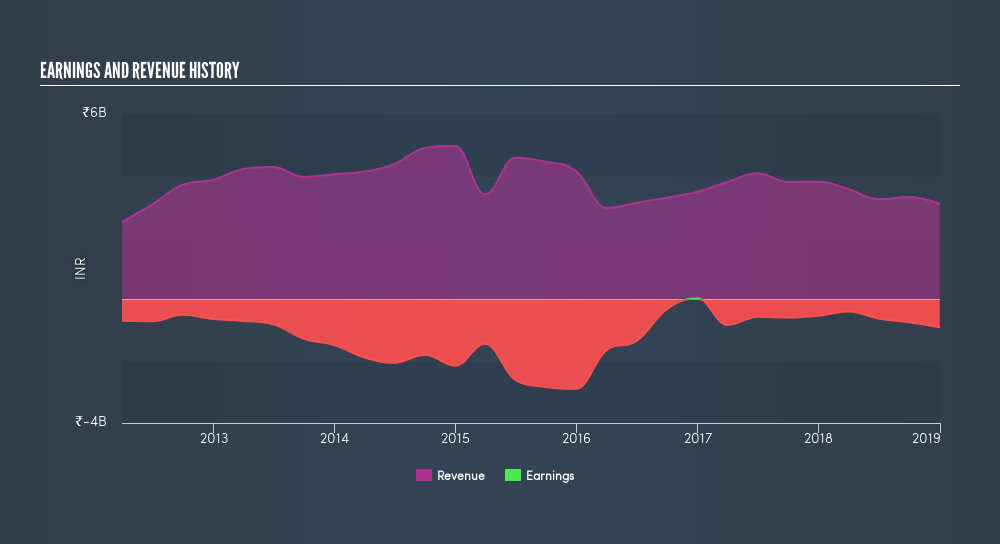

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

If you are thinking of buying or selling Orient Green Power stock, you should check out this FREEdetailed report on its balance sheet.

A Different Perspective

Orient Green Power shareholders are down 56% for the year, but the market itself is up 4.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 14% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

Of course Orient Green Power may not be the best stock to buy. So you may wish to see this freecollection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:GREENPOWER

Orient Green Power

An independent renewable energy company, owns, develops, and operates a portfolio of wind energy projects in India and Europe.

Adequate balance sheet low.