- India

- /

- Renewable Energy

- /

- NSEI:GREENPOWER

Here's Why Orient Green Power (NSE:GREENPOWER) Has Caught The Eye Of Investors

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

In contrast to all that, many investors prefer to focus on companies like Orient Green Power (NSE:GREENPOWER), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Orient Green Power

Orient Green Power's Improving Profits

In the last three years Orient Green Power's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Impressively, Orient Green Power's EPS catapulted from ₹0.28 to ₹0.74, over the last year. Year on year growth of 167% is certainly a sight to behold.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. The previous 12 months are something that Orient Green Power will want to put behind them after seeing a drop in EBIT margin and revenue for the period. This is less than stellar for the company.

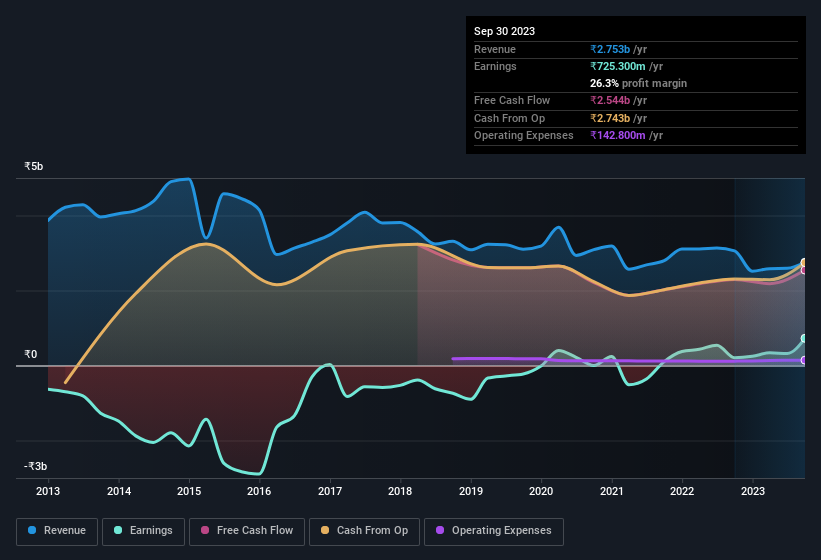

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Orient Green Power is no giant, with a market capitalisation of ₹14b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Orient Green Power Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. Our analysis has discovered that the median total compensation for the CEOs of companies like Orient Green Power with market caps between ₹8.3b and ₹33b is about ₹17m.

The Orient Green Power CEO received total compensation of only ₹4.5m in the year to March 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Orient Green Power Deserve A Spot On Your Watchlist?

Orient Green Power's earnings per share have been soaring, with growth rates sky high. With increasing profits, its seems likely the business has a rosy future; and it may have hit an inflection point. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that Orient Green Power has the hallmarks of a quality business; and that would make it well worth watching. However, before you get too excited we've discovered 3 warning signs for Orient Green Power (1 is concerning!) that you should be aware of.

Although Orient Green Power certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GREENPOWER

Orient Green Power

An independent power producer of renewable power, engages in the generation and sale of wind energy in India and Croatia.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives