- India

- /

- Trade Distributors

- /

- NSEI:TARACHAND

Does Tara Chand Logistic Solutions (NSE:TARACHAND) Have A Healthy Balance Sheet?

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Tara Chand Logistic Solutions Limited (NSE:TARACHAND) does carry debt. But is this debt a concern to shareholders?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Tara Chand Logistic Solutions

What Is Tara Chand Logistic Solutions's Debt?

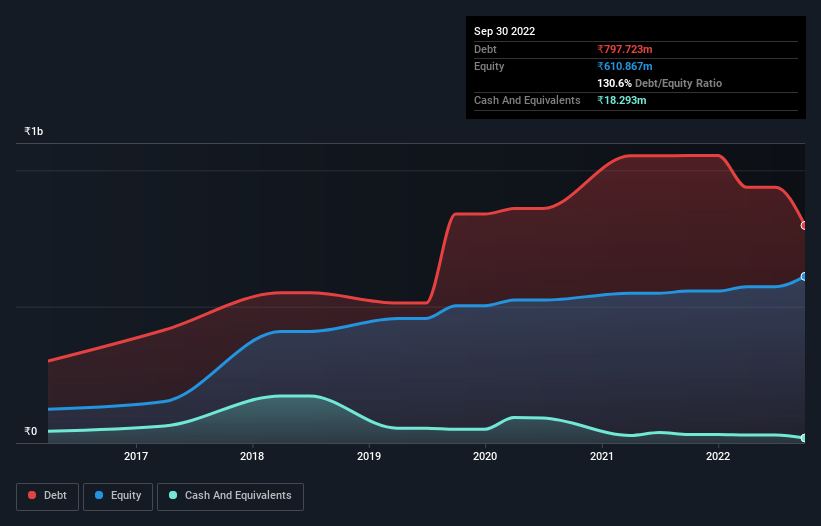

As you can see below, Tara Chand Logistic Solutions had ₹797.7m of debt at September 2022, down from ₹1.05b a year prior. However, because it has a cash reserve of ₹18.3m, its net debt is less, at about ₹779.4m.

How Healthy Is Tara Chand Logistic Solutions' Balance Sheet?

According to the last reported balance sheet, Tara Chand Logistic Solutions had liabilities of ₹873.1m due within 12 months, and liabilities of ₹415.2m due beyond 12 months. Offsetting these obligations, it had cash of ₹18.3m as well as receivables valued at ₹543.8m due within 12 months. So its liabilities total ₹726.2m more than the combination of its cash and short-term receivables.

This is a mountain of leverage relative to its market capitalization of ₹820.1m. Should its lenders demand that it shore up the balance sheet, shareholders would likely face severe dilution.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Even though Tara Chand Logistic Solutions's debt is only 2.2, its interest cover is really very low at 1.6. In large part that's it has so much depreciation and amortisation. While companies often boast that these charges are non-cash, most such businesses will therefore require ongoing investment (that is not expensed.) In any case, it's safe to say the company has meaningful debt. Unfortunately, Tara Chand Logistic Solutions saw its EBIT slide 5.9% in the last twelve months. If earnings continue on that decline then managing that debt will be difficult like delivering hot soup on a unicycle. There's no doubt that we learn most about debt from the balance sheet. But it is Tara Chand Logistic Solutions's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we always check how much of that EBIT is translated into free cash flow. Considering the last three years, Tara Chand Logistic Solutions actually recorded a cash outflow, overall. Debt is usually more expensive, and almost always more risky in the hands of a company with negative free cash flow. Shareholders ought to hope for an improvement.

Our View

To be frank both Tara Chand Logistic Solutions's interest cover and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. But at least its net debt to EBITDA is not so bad. Overall, it seems to us that Tara Chand Logistic Solutions's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 5 warning signs for Tara Chand Logistic Solutions (of which 4 are potentially serious!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Tara Chand Infralogistic Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TARACHAND

Tara Chand Infralogistic Solutions

Provides logistics solutions in India.

Adequate balance sheet with slight risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026