- India

- /

- Marine and Shipping

- /

- NSEI:SCI

Does Shipping Corporation of India (NSE:SCI) Deserve A Spot On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like Shipping Corporation of India (NSE:SCI), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Shipping Corporation of India with the means to add long-term value to shareholders.

View our latest analysis for Shipping Corporation of India

Shipping Corporation of India's Improving Profits

Even with very modest growth rates, a company will usually do well if it improves earnings per share (EPS) year after year. So it's easy to see why many investors focus in on EPS growth. It's good to see that Shipping Corporation of India's EPS has grown from ₹14.39 to ₹16.14 over twelve months. This amounts to a 12% gain; a figure that shareholders will be pleased to see.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. Despite consistency in EBIT margins year on year, Shipping Corporation of India has actually recorded a dip in revenue. Suffice it to say that is not a great sign of growth.

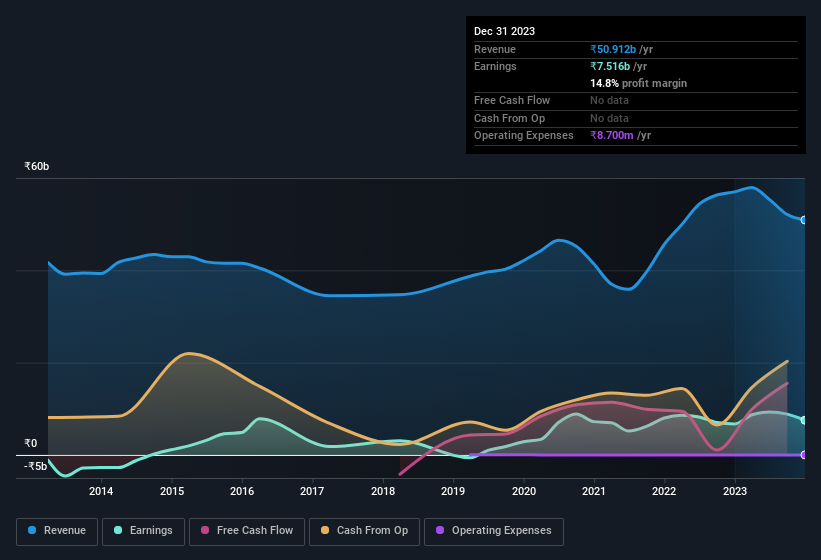

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While profitability drives the upside, prudent investors always check the balance sheet, too.

Are Shipping Corporation of India Insiders Aligned With All Shareholders?

It's a good habit to check into a company's remuneration policies to ensure that the CEO and management team aren't putting their own interests before that of the shareholder with excessive salary packages. The median total compensation for CEOs of companies similar in size to Shipping Corporation of India, with market caps between ₹83b and ₹266b, is around ₹35m.

Shipping Corporation of India's CEO took home a total compensation package of ₹6.5m in the year prior to March 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Shipping Corporation of India To Your Watchlist?

One positive for Shipping Corporation of India is that it is growing EPS. That's nice to see. On top of that, our faith in the board of directors is strengthened by the fact of the reasonable CEO pay. So all in all Shipping Corporation of India is worthy at least considering for your watchlist. It is worth noting though that we have found 1 warning sign for Shipping Corporation of India that you need to take into consideration.

While opting for stocks without growing earnings and absent insider buying can yield results, for investors valuing these key metrics, here is a carefully selected list of companies in IN with promising growth potential and insider confidence.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SCI

Shipping Corporation of India

A marginal liner shipping company, engages in the business of transporting goods in India.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives