- India

- /

- Infrastructure

- /

- NSEI:GPPL

Investors more bullish on Gujarat Pipavav Port (NSE:GPPL) this week as stock advances 8.5%, despite earnings trending downwards over past three years

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But if you buy shares in a really great company, you can more than double your money. For example, the Gujarat Pipavav Port Limited (NSE:GPPL) share price has soared 112% in the last three years. Most would be happy with that. It's also good to see the share price up 16% over the last quarter.

Since it's been a strong week for Gujarat Pipavav Port shareholders, let's have a look at trend of the longer term fundamentals.

See our latest analysis for Gujarat Pipavav Port

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, Gujarat Pipavav Port actually saw its earnings per share (EPS) drop 3.5% per year.

Companies are not always focussed on EPS growth in the short term, and looking at how the share price has reacted, we don't think EPS is the most important metric for Gujarat Pipavav Port at the moment. So other metrics may hold the key to understanding what is influencing investors.

We doubt the dividend payments explain the share price rise, since we don't see any improvement in that regard. But it's far more plausible that the revenue growth of 5.4% per year is viewed as evidence that Gujarat Pipavav Port is growing. It could be that investors are content with the revenue growth on the basis that the company isn't really focussed on profits just yet. And that might explain the higher price.

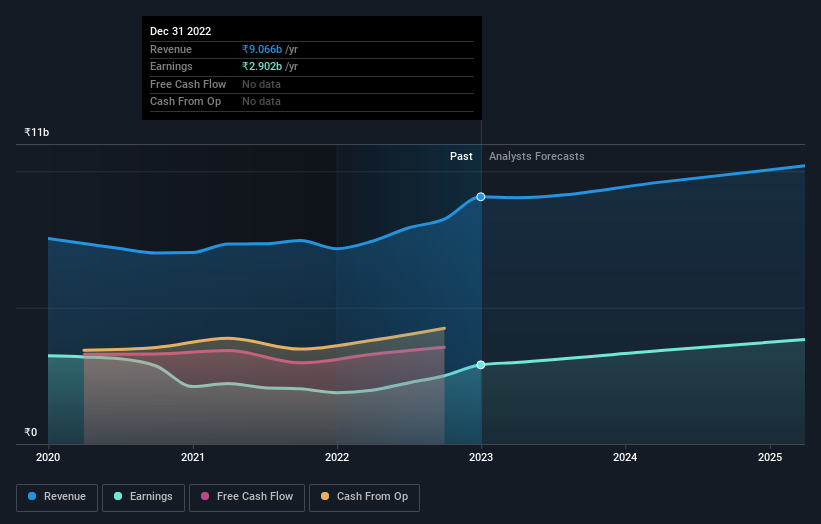

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We know that Gujarat Pipavav Port has improved its bottom line lately, but what does the future have in store? You can see what analysts are predicting for Gujarat Pipavav Port in this interactive graph of future profit estimates.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. As it happens, Gujarat Pipavav Port's TSR for the last 3 years was 151%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Gujarat Pipavav Port has rewarded shareholders with a total shareholder return of 57% in the last twelve months. And that does include the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 0.9% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. To that end, you should be aware of the 1 warning sign we've spotted with Gujarat Pipavav Port .

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GPPL

Gujarat Pipavav Port

Engages in the construction, operation, and maintenance of port at Pipavav in Gujarat, India.

Flawless balance sheet with solid track record.