- India

- /

- Infrastructure

- /

- NSEI:GMRAIRPORT

GMR Infrastructure (NSE:GMRINFRA) Shareholders Have Enjoyed An Impressive 120% Share Price Gain

The most you can lose on any stock (assuming you don't use leverage) is 100% of your money. But when you pick a company that is really flourishing, you can make more than 100%. One great example is GMR Infrastructure Limited (NSE:GMRINFRA) which saw its share price drive 120% higher over five years. And in the last month, the share price has gained 3.4%. But this could be related to good market conditions -- stocks in its market are up 8.1% in the last month.

Check out our latest analysis for GMR Infrastructure

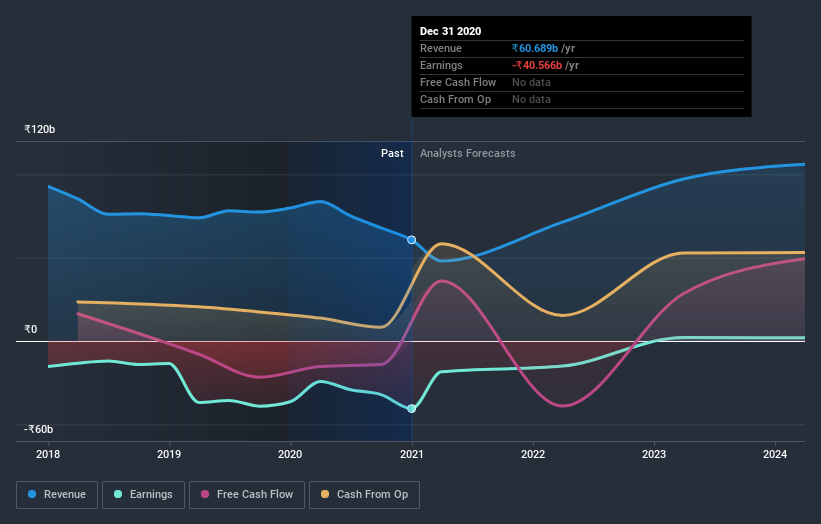

GMR Infrastructure wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Over the last half decade GMR Infrastructure's revenue has actually been trending down at about 7.2% per year. Given that scenario, we wouldn't have expected the share price to rise 17% per year, but that's what it did. It's a good reminder that expectations about the future, not the past history, always impact share prices. Still, we are a bit cautious in this kind of situation.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling GMR Infrastructure stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

GMR Infrastructure shareholders are up 30% for the year. Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 17% over half a decade This suggests the company might be improving over time. Before spending more time on GMR Infrastructure it might be wise to click here to see if insiders have been buying or selling shares.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading GMR Infrastructure or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:GMRAIRPORT

High growth potential and fair value.