Future Supply Chain Solutions Limited (NSE:FSC) Insiders Have Been Selling

We often see insiders buying up shares in companies that perform well over the long term. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Future Supply Chain Solutions Limited (NSE:FSC), you may well want to know whether insiders have been buying or selling.

Do Insider Transactions Matter?

It's quite normal to see company insiders, such as board members, trading in company stock, from time to time. However, such insiders must disclose their trading activities, and not trade on inside information.

Insider transactions are not the most important thing when it comes to long-term investing. But equally, we would consider it foolish to ignore insider transactions altogether. For example, a Columbia University study found that 'insiders are more likely to engage in open market purchases of their own company’s stock when the firm is about to reveal new agreements with customers and suppliers'.

Check out our latest analysis for Future Supply Chain Solutions

Future Supply Chain Solutions Insider Transactions Over The Last Year

While no particular insider transaction stood out, we can still look at the overall trading.

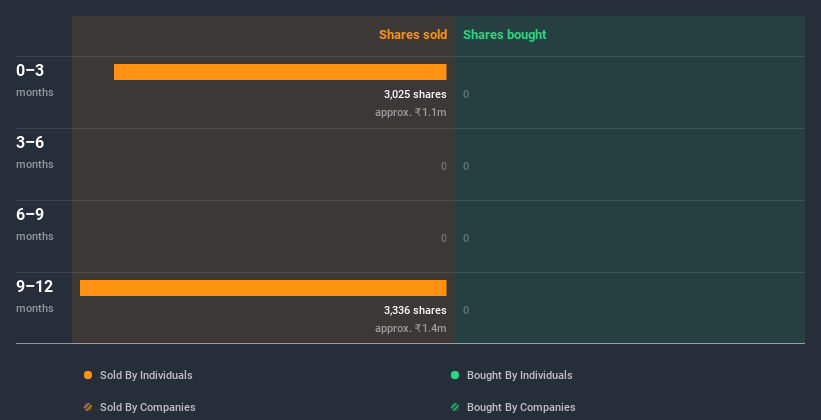

In the last year Future Supply Chain Solutions insiders didn't buy any company stock. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Future Supply Chain Solutions Insiders Are Selling The Stock

The last three months saw some Future Supply Chain Solutions insider selling. insider Vimal Dhruve only netted ₹1.1m selling shares, in that period. Neither the lack of buying nor the presence of selling is heartening. But the amount sold isn't enough for us to put any weight on it.

Insider Ownership of Future Supply Chain Solutions

For a common shareholder, it is worth checking how many shares are held by company insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Based on our data, Future Supply Chain Solutions insiders have about 1.2% of the stock, worth approximately ₹56m. But they may have an indirect interest through a corporate structure that we haven't picked up on. We prefer to see high levels of insider ownership.

So What Does This Data Suggest About Future Supply Chain Solutions Insiders?

An insider sold Future Supply Chain Solutions shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. Insider ownership isn't particularly high, so this analysis makes us cautious about the company. We're in no rush to buy! While we like knowing what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. When we did our research, we found 4 warning signs for Future Supply Chain Solutions (2 are a bit concerning!) that we believe deserve your full attention.

But note: Future Supply Chain Solutions may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you’re looking to trade Future Supply Chain Solutions, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:FSC

Future Supply Chain Solutions

Together with its subsidiary, provides third-party supply chain solutions and logistics services in India.

Very low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives