- India

- /

- Infrastructure

- /

- NSEI:BRNL

Bharat Road Network Limited's (NSE:BRNL) Shares Leap 25% Yet They're Still Not Telling The Full Story

The Bharat Road Network Limited (NSE:BRNL) share price has done very well over the last month, posting an excellent gain of 25%. Looking further back, the 16% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

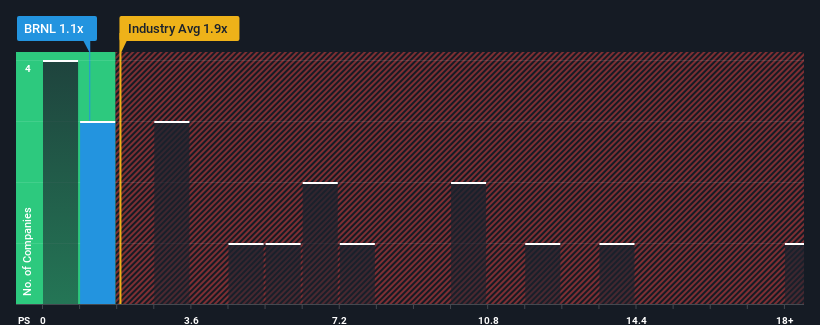

In spite of the firm bounce in price, Bharat Road Network may still be sending very bullish signals at the moment with its price-to-sales (or "P/S") ratio of 1.1x, since almost half of all companies in the Infrastructure industry in India have P/S ratios greater than 3.5x and even P/S higher than 11x are not unusual. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Bharat Road Network

How Bharat Road Network Has Been Performing

With revenue growth that's exceedingly strong of late, Bharat Road Network has been doing very well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Bharat Road Network will help you shine a light on its historical performance.Do Revenue Forecasts Match The Low P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as depressed as Bharat Road Network's is when the company's growth is on track to lag the industry decidedly.

Retrospectively, the last year delivered an exceptional 39% gain to the company's top line. Pleasingly, revenue has also lifted 97% in aggregate from three years ago, thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing revenue over that time.

When compared to the industry's one-year growth forecast of 21%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's peculiar that Bharat Road Network's P/S sits below the majority of other companies. It looks like most investors are not convinced the company can maintain its recent growth rates.

The Bottom Line On Bharat Road Network's P/S

Shares in Bharat Road Network have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Bharat Road Network revealed its three-year revenue trends aren't boosting its P/S anywhere near as much as we would have predicted, given they look better than current industry expectations. When we see robust revenue growth that outpaces the industry, we presume that there are notable underlying risks to the company's future performance, which is exerting downward pressure on the P/S ratio. At least price risks look to be very low if recent medium-term revenue trends continue, but investors seem to think future revenue could see a lot of volatility.

Having said that, be aware Bharat Road Network is showing 3 warning signs in our investment analysis, and 2 of those don't sit too well with us.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Bharat Road Network might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BRNL

Bharat Road Network

Owns, designs, develops, builds, and operates transfers road and related services in India.

Good value low.

Market Insights

Community Narratives