- India

- /

- Telecom Services and Carriers

- /

- NSEI:TTML

Tata Teleservices (Maharashtra) Limited's (NSE:TTML) Price In Tune With Revenues

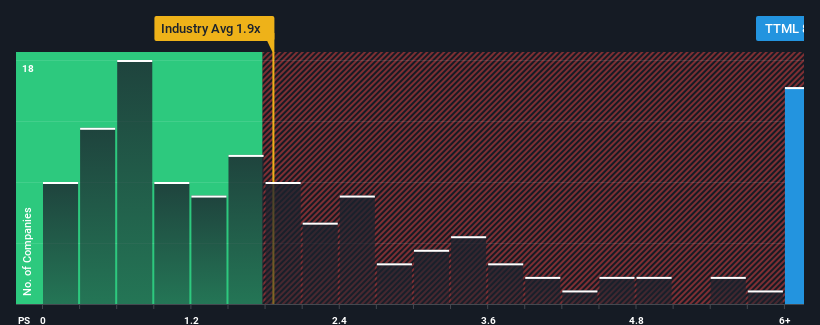

Tata Teleservices (Maharashtra) Limited's (NSE:TTML) price-to-sales (or "P/S") ratio of 8.3x may look like a poor investment opportunity when you consider close to half the companies in the Telecom industry in India have P/S ratios below 2.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Tata Teleservices (Maharashtra)

How Has Tata Teleservices (Maharashtra) Performed Recently?

The revenue growth achieved at Tata Teleservices (Maharashtra) over the last year would be more than acceptable for most companies. Perhaps the market is expecting this decent revenue performance to beat out the industry over the near term, which has kept the P/S propped up. However, if this isn't the case, investors might get caught out paying too much for the stock.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Tata Teleservices (Maharashtra)'s earnings, revenue and cash flow.How Is Tata Teleservices (Maharashtra)'s Revenue Growth Trending?

Tata Teleservices (Maharashtra)'s P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an exceptional 15% gain to the company's top line. Revenue has also lifted 22% in aggregate from three years ago, mostly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Comparing that to the industry, which is only predicted to deliver 4.8% growth in the next 12 months, the company's momentum is stronger based on recent medium-term annualised revenue results.

With this in consideration, it's not hard to understand why Tata Teleservices (Maharashtra)'s P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Final Word

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

It's no surprise that Tata Teleservices (Maharashtra) can support its high P/S given the strong revenue growth its experienced over the last three-year is superior to the current industry outlook. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Tata Teleservices (Maharashtra) that you should be aware of.

If you're unsure about the strength of Tata Teleservices (Maharashtra)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tata Teleservices (Maharashtra) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TTML

Tata Teleservices (Maharashtra)

Provides wire line voice, data, and managed telecom services to enterprise customers in Maharashtra and Goa.

Imperfect balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026