- India

- /

- Telecom Services and Carriers

- /

- NSEI:TTML

Revenues Not Telling The Story For Tata Teleservices (Maharashtra) Limited (NSE:TTML)

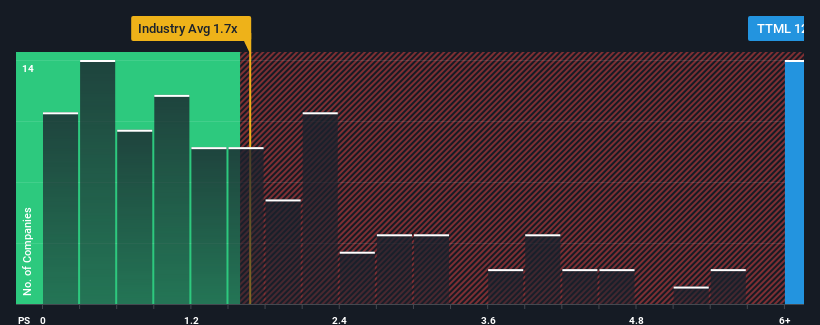

Tata Teleservices (Maharashtra) Limited's (NSE:TTML) price-to-sales (or "P/S") ratio of 12x may look like a poor investment opportunity when you consider close to half the companies in the Telecom industry in India have P/S ratios below 1.9x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for Tata Teleservices (Maharashtra)

What Does Tata Teleservices (Maharashtra)'s P/S Mean For Shareholders?

For example, consider that Tata Teleservices (Maharashtra)'s financial performance has been pretty ordinary lately as revenue growth is non-existent. It might be that many are expecting an improvement to the uninspiring revenue performance over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Although there are no analyst estimates available for Tata Teleservices (Maharashtra), take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Tata Teleservices (Maharashtra)'s is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Likewise, not much has changed from three years ago as revenue have been stuck during that whole time. Therefore, it's fair to say that revenue growth has definitely eluded the company recently.

This is in contrast to the rest of the industry, which is expected to grow by 5.5% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this in mind, we find it worrying that Tata Teleservices (Maharashtra)'s P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent revenue trends is likely to weigh heavily on the share price eventually.

The Bottom Line On Tata Teleservices (Maharashtra)'s P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Our examination of Tata Teleservices (Maharashtra) revealed its poor three-year revenue trends aren't detracting from the P/S as much as we though, given they look worse than current industry expectations. When we see slower than industry revenue growth but an elevated P/S, there's considerable risk of the share price declining, sending the P/S lower. If recent medium-term revenue trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you settle on your opinion, we've discovered 1 warning sign for Tata Teleservices (Maharashtra) that you should be aware of.

If you're unsure about the strength of Tata Teleservices (Maharashtra)'s business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Tata Teleservices (Maharashtra) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TTML

Tata Teleservices (Maharashtra)

Provides wire line voice, data, and managed telecom services to enterprise customers in Maharashtra and Goa.

Imperfect balance sheet with minimal risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026