- India

- /

- Telecom Services and Carriers

- /

- NSEI:INDUSTOWER

Indus Towers' (NSE:INDUSTOWER) five-year total shareholder returns outpace the underlying earnings growth

While Indus Towers Limited (NSE:INDUSTOWER) shareholders are probably generally happy, the stock hasn't had particularly good run recently, with the share price falling 15% in the last quarter. But the silver lining is the stock is up over five years. In that time, it is up 79%, which isn't bad, but is below the market return of 173%.

While the stock has fallen 3.0% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

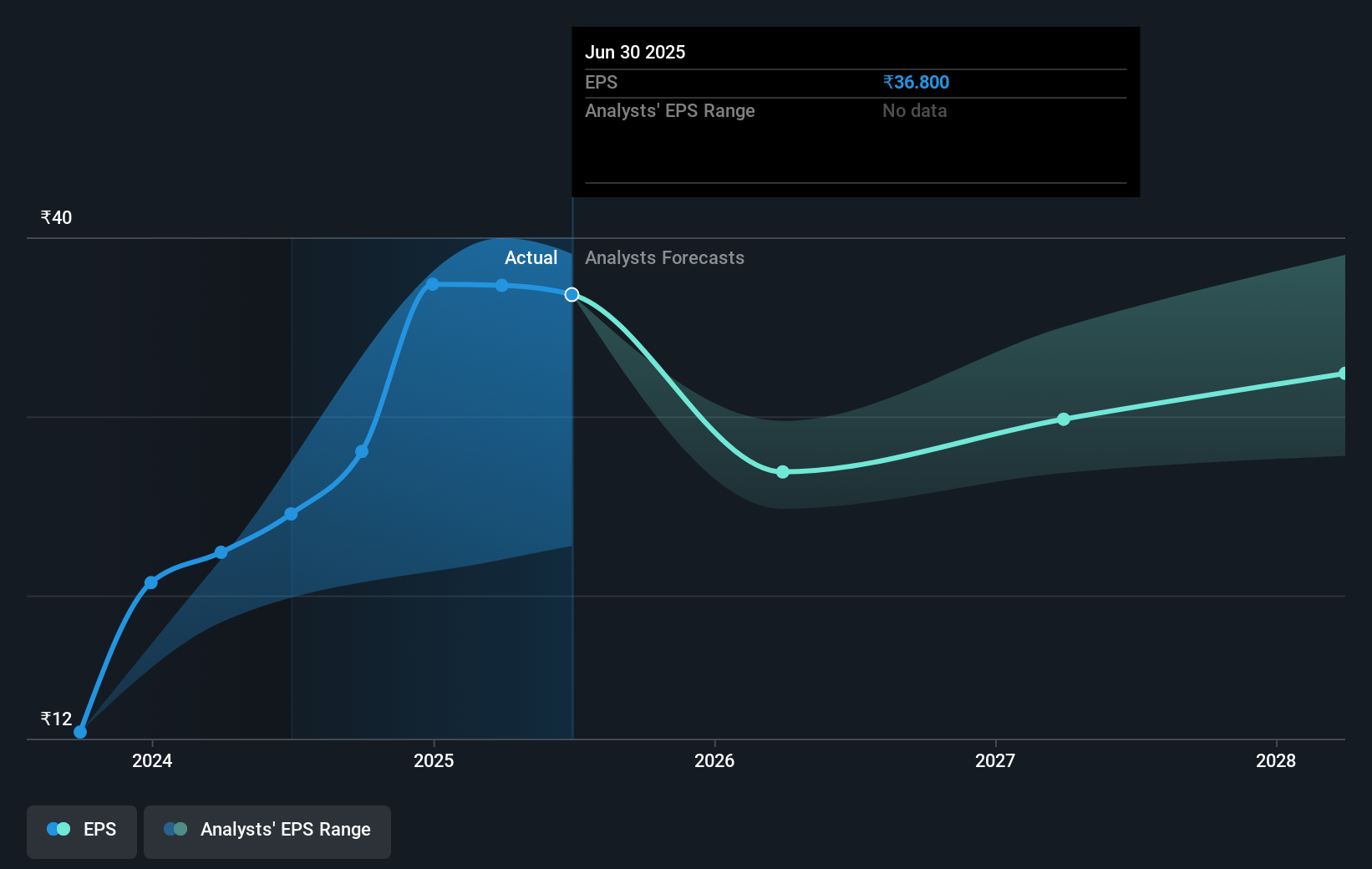

Over half a decade, Indus Towers managed to grow its earnings per share at 17% a year. The EPS growth is more impressive than the yearly share price gain of 12% over the same period. So it seems the market isn't so enthusiastic about the stock these days. This cautious sentiment is reflected in its (fairly low) P/E ratio of 9.28.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Indus Towers has improved its bottom line lately, but is it going to grow revenue? Check if analysts think Indus Towers will grow revenue in the future.

What About The Total Shareholder Return (TSR)?

We've already covered Indus Towers' share price action, but we should also mention its total shareholder return (TSR). The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Indus Towers shareholders, and that cash payout contributed to why its TSR of 103%, over the last 5 years, is better than the share price return.

A Different Perspective

While the broader market lost about 1.1% in the twelve months, Indus Towers shareholders did even worse, losing 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 15%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Indus Towers , and understanding them should be part of your investment process.

But note: Indus Towers may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Indian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:INDUSTOWER

Indus Towers

A telecom infrastructure company, engages in the operation and maintenance of wireless communication towers and related infrastructures for various telecom service providers in India, Nigeria, Uganda, and Zambia.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success