- India

- /

- Telecom Services and Carriers

- /

- NSEI:GTLINFRA

GTL Infrastructure (NSE:GTLINFRA) Share Prices Have Dropped 89% In The Last Three Years

It's nice to see the GTL Infrastructure Limited (NSE:GTLINFRA) share price up 30% in a week. But the last three years have seen a terrible decline. In that time the share price has melted like a snowball in the desert, down 89%. So we're relieved for long term holders to see a bit of uplift. Only time will tell if the company can sustain the turnaround.

While a drop like that is definitely a body blow, money isn't as important as health and happiness.

View our latest analysis for GTL Infrastructure

GTL Infrastructure wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last three years, GTL Infrastructure's revenue dropped 19% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 24%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

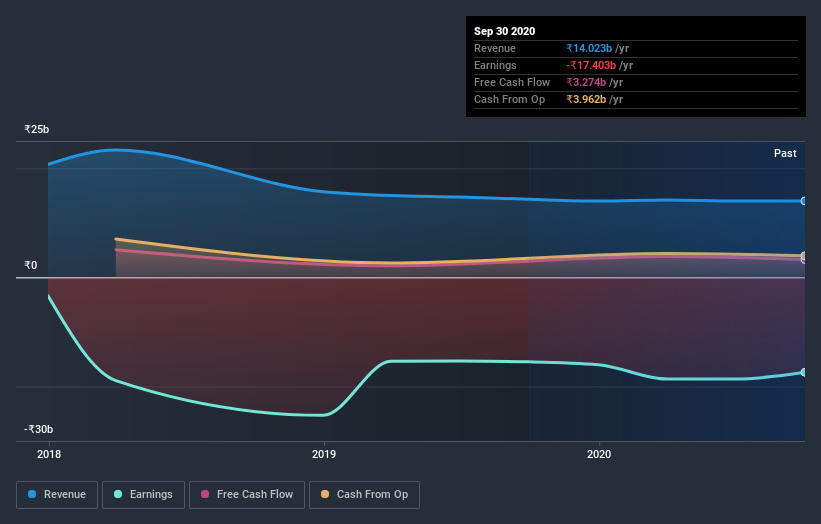

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on GTL Infrastructure's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's good to see that GTL Infrastructure has rewarded shareholders with a total shareholder return of 30% in the last twelve months. That certainly beats the loss of about 12% per year over the last half decade. We generally put more weight on the long term performance over the short term, but the recent improvement could hint at a (positive) inflection point within the business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that GTL Infrastructure is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

Of course GTL Infrastructure may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade GTL Infrastructure, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GTLINFRA

GTL Infrastructure

An independent and neutral telecom tower company, owns, builds, operates, and maintains shared passive telecom infrastructure sites primarily in India.

Good value with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion