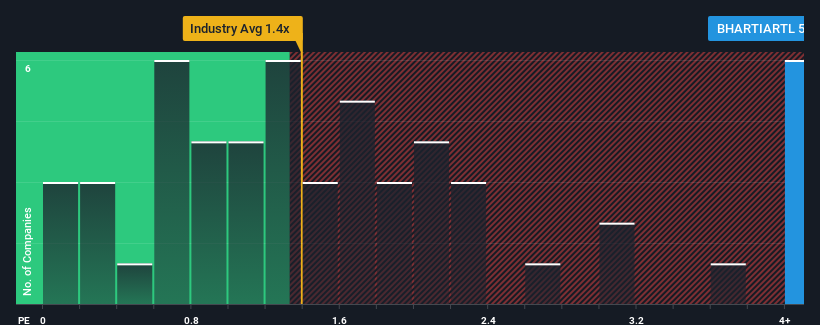

Bharti Airtel Limited's (NSE:BHARTIARTL) price-to-sales (or "P/S") ratio of 5.2x may look like a poor investment opportunity when you consider close to half the companies in the Wireless Telecom industry in India have P/S ratios below 1.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

View our latest analysis for Bharti Airtel

How Bharti Airtel Has Been Performing

Recent times have been advantageous for Bharti Airtel as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Bharti Airtel's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

Bharti Airtel's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 10% last year. Pleasingly, revenue has also lifted 49% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 12% per annum during the coming three years according to the analysts following the company. With the industry only predicted to deliver 6.0% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Bharti Airtel's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Bharti Airtel's P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our look into Bharti Airtel shows that its P/S ratio remains high on the merit of its strong future revenues. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

You should always think about risks. Case in point, we've spotted 3 warning signs for Bharti Airtel you should be aware of, and 1 of them can't be ignored.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Bharti Airtel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BHARTIARTL

Bharti Airtel

Operates as a telecommunications company in India and internationally.

Solid track record with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives