- India

- /

- Communications

- /

- NSEI:VINDHYATEL

Vindhya Telelinks Limited's (NSE:VINDHYATEL) CEO Compensation Is Looking A Bit Stretched At The Moment

Key Insights

- Vindhya Telelinks will host its Annual General Meeting on 2nd of August

- CEO Yashwant Lodha's total compensation includes salary of ₹22.8m

- Total compensation is 106% above industry average

- Vindhya Telelinks' EPS grew by 1.5% over the past three years while total shareholder return over the past three years was 130%

Under the guidance of CEO Yashwant Lodha, Vindhya Telelinks Limited (NSE:VINDHYATEL) has performed reasonably well recently. In light of this performance, CEO compensation will probably not be the main focus for shareholders as they go into the AGM on 2nd of August. However, some shareholders may still be hesitant of being overly generous with CEO compensation.

View our latest analysis for Vindhya Telelinks

Comparing Vindhya Telelinks Limited's CEO Compensation With The Industry

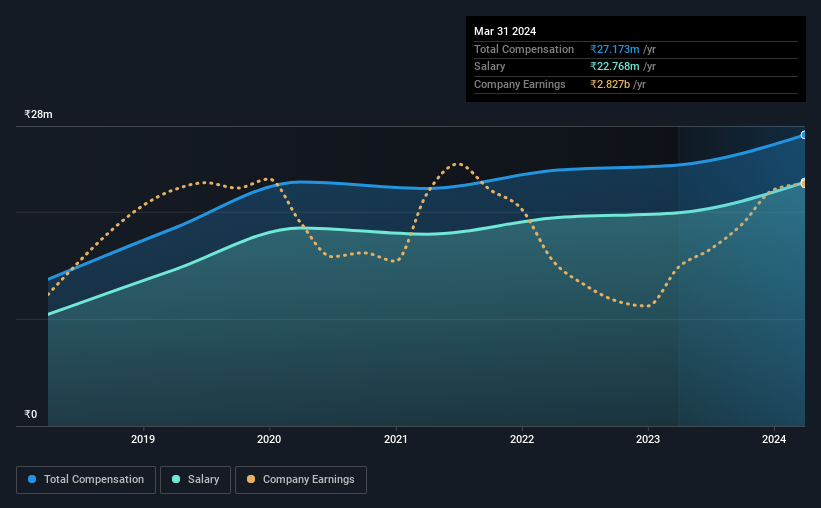

Our data indicates that Vindhya Telelinks Limited has a market capitalization of ₹36b, and total annual CEO compensation was reported as ₹27m for the year to March 2024. That's a notable increase of 12% on last year. In particular, the salary of ₹22.8m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the India Communications industry with market capitalizations ranging between ₹17b and ₹67b had a median total CEO compensation of ₹13m. Hence, we can conclude that Yashwant Lodha is remunerated higher than the industry median.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | ₹23m | ₹20m | 84% |

| Other | ₹4.4m | ₹4.5m | 16% |

| Total Compensation | ₹27m | ₹24m | 100% |

Talking in terms of the industry, salary represented approximately 84% of total compensation out of all the companies we analyzed, while other remuneration made up 16% of the pie. There isn't a significant difference between Vindhya Telelinks and the broader market, in terms of salary allocation in the overall compensation package. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Vindhya Telelinks Limited's Growth Numbers

Over the past three years, Vindhya Telelinks Limited has seen its earnings per share (EPS) grow by 1.5% per year. Its revenue is up 41% over the last year.

We like the look of the strong year-on-year improvement in revenue. Combined with modest EPS growth, we get a good impression of the company. We wouldn't say this is necessarily top notch growth, but it is certainly promising. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Vindhya Telelinks Limited Been A Good Investment?

Most shareholders would probably be pleased with Vindhya Telelinks Limited for providing a total return of 130% over three years. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. However, any decision to raise CEO pay might be met with some objections from the shareholders given that the CEO is already paid higher than the industry average.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. We identified 2 warning signs for Vindhya Telelinks (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:VINDHYATEL

Vindhya Telelinks

Engages in the manufacture and sale of cables in India.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026