- India

- /

- Communications

- /

- NSEI:ITI

ITI Limited's (NSE:ITI) Business Is Yet to Catch Up With Its Share Price

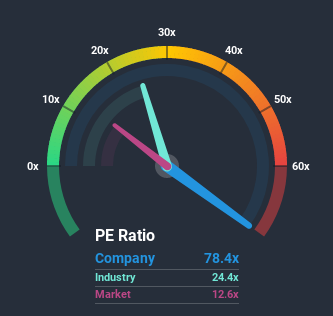

When close to half the companies in India have price-to-earnings ratios (or "P/E's") below 12x, you may consider ITI Limited (NSE:ITI) as a stock to avoid entirely with its 78.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

ITI certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for ITI

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, ITI would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered an exceptional 117% gain to the company's bottom line. Still, incredibly EPS has fallen 73% in total from three years ago, which is quite disappointing. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for a contraction of 7.3% shows the market is more attractive on an annualised basis regardless.

With this information, it's strange that ITI is trading at a higher P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Maintaining these prices will be extremely difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that ITI currently trades on a much higher than expected P/E since its recent three-year earnings are even worse than the forecasts for a struggling market. When we see below average earnings, we suspect the share price is at risk of declining, sending the high P/E lower. We're also cautious about the company's ability to stay its recent medium-term course and resist even greater pain to its business from the broader market turmoil. Unless the company's relative performance improves markedly, it's very challenging to accept these prices as being reasonable.

We don't want to rain on the parade too much, but we did also find 3 warning signs for ITI (1 shouldn't be ignored!) that you need to be mindful of.

If you're unsure about the strength of ITI's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

If you’re looking to trade ITI, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ITI

ITI

Engages in the manufacture, sale, trading, and servicing of telecommunication equipment in India.

Mediocre balance sheet and slightly overvalued.