- India

- /

- Communications

- /

- NSEI:FROG

Is Frog Cellsat Limited's (NSE:FROG) Recent Stock Performance Influenced By Its Fundamentals In Any Way?

Most readers would already be aware that Frog Cellsat's (NSE:FROG) stock increased significantly by 13% over the past month. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. In this article, we decided to focus on Frog Cellsat's ROE.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How To Calculate Return On Equity?

The formula for return on equity is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Frog Cellsat is:

15% = ₹236m ÷ ₹1.6b (Based on the trailing twelve months to March 2025).

The 'return' is the profit over the last twelve months. So, this means that for every ₹1 of its shareholder's investments, the company generates a profit of ₹0.15.

Check out our latest analysis for Frog Cellsat

What Is The Relationship Between ROE And Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

A Side By Side comparison of Frog Cellsat's Earnings Growth And 15% ROE

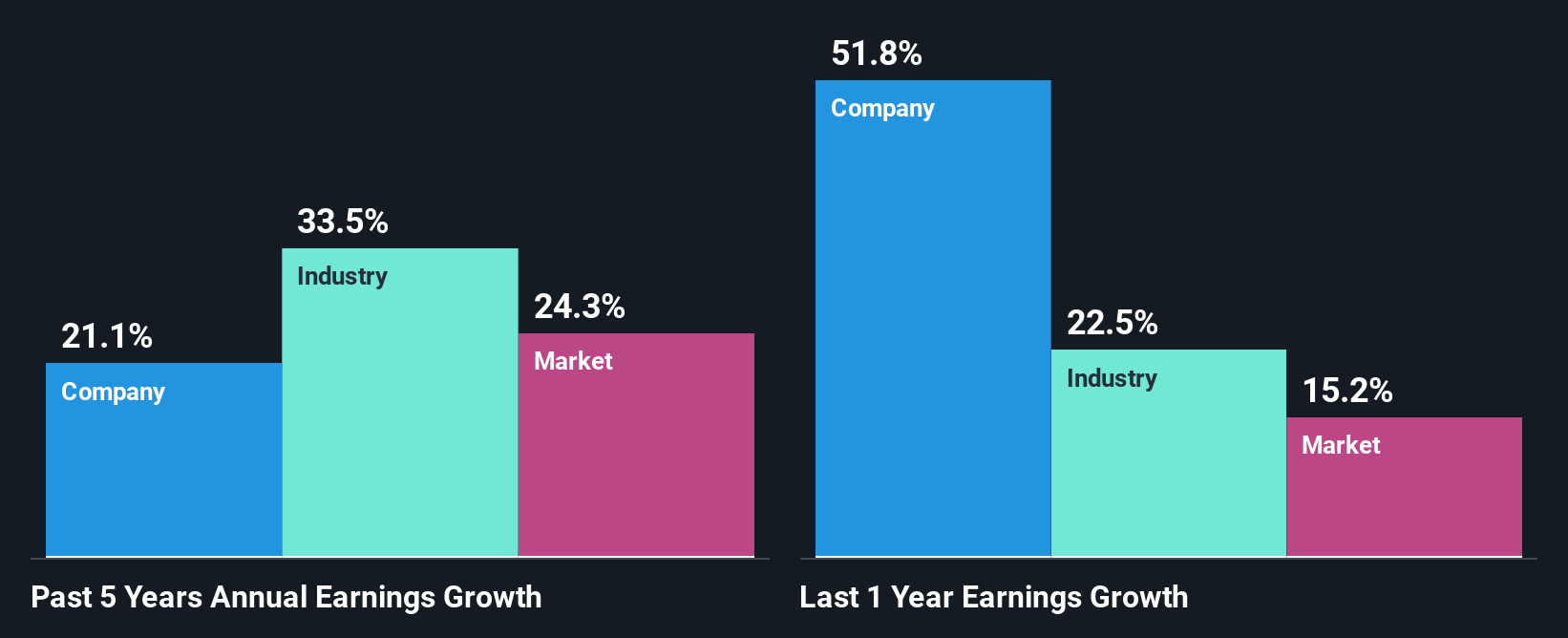

At first glance, Frog Cellsat's ROE doesn't look very promising. Although a closer study shows that the company's ROE is higher than the industry average of 12% which we definitely can't overlook. Particularly, the substantial 21% net income growth seen by Frog Cellsat over the past five years is impressive . That being said, the company does have a slightly low ROE to begin with, just that it is higher than the industry average. So, there might well be other reasons for the earnings to grow. E.g the company has a low payout ratio or could belong to a high growth industry.

We then compared Frog Cellsat's net income growth with the industry and found that the company's growth figure is lower than the average industry growth rate of 34% in the same 5-year period, which is a bit concerning.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Frog Cellsat is trading on a high P/E or a low P/E, relative to its industry.

Is Frog Cellsat Making Efficient Use Of Its Profits?

While the company did pay out a portion of its dividend in the past, it currently doesn't pay a regular dividend. This is likely what's driving the high earnings growth number discussed above.

Conclusion

In total, it does look like Frog Cellsat has some positive aspects to its business. Particularly, its earnings have grown respectably as we saw earlier, which was likely achieved due to the company reinvesting most of its earnings at a decent rate of return, to grow its business. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 2 risks we have identified for Frog Cellsat by visiting our risks dashboard for free on our platform here.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:FROG

Frog Cellsat

Manufactures and installs in-building coverage solutions and mobile network accessories in Asia, Europe, Africa, and the Middle East.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026