- India

- /

- Electronic Equipment and Components

- /

- NSEI:DLINKINDIA

Investors Who Bought D-Link (India) (NSE:DLINKINDIA) Shares A Year Ago Are Now Up 61%

It's always best to build a diverse portfolio of shares, since any stock business could lag the broader market. But the goal is to pick stocks that do better than average. One such company is D-Link (India) Limited (NSE:DLINKINDIA), which saw its share price increase 61% in the last year, slightly above the market return of around 57% (not including dividends). The longer term returns have not been as good, with the stock price only 20% higher than it was three years ago.

See our latest analysis for D-Link (India)

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last year, D-Link (India) actually saw its earnings per share drop 8.6%.

This means it's unlikely the market is judging the company based on earnings growth. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We doubt the modest 1.3% dividend yield is doing much to support the share price. D-Link (India)'s revenue actually dropped 11% over last year. So the fundamental metrics don't provide an obvious explanation for the share price gain.

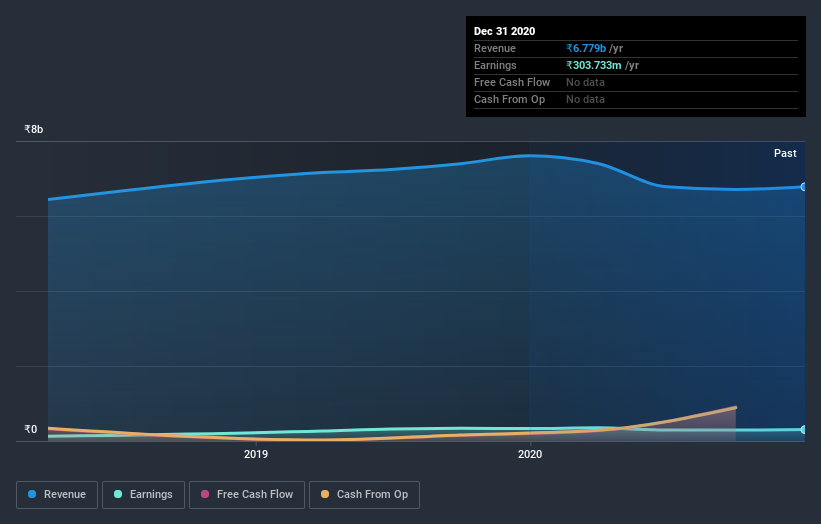

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling D-Link (India) stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

D-Link (India) shareholders have received returns of 63% over twelve months (even including dividends), which isn't far from the general market return. The silver lining is that the share price is up in the short term, which flies in the face of the annualised loss of 0.8% over the last five years. While 'turnarounds seldom turn' there are green shoots for D-Link (India). While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with D-Link (India) , and understanding them should be part of your investment process.

But note: D-Link (India) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you decide to trade D-Link (India), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:DLINKINDIA

D-Link (India)

D-Link (India) Limited markets and distributes D-Link branded networking products for consumers, small businesses, medium to large-sized enterprises, and service providers in India.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives