- India

- /

- Electronic Equipment and Components

- /

- NSEI:CYIENTDLM

High Growth Tech Stocks To Explore In November 2024

Reviewed by Simply Wall St

As global markets navigate the impact of rising U.S. Treasury yields and a cautious economic outlook, the tech-heavy Nasdaq Composite Index has shown resilience, slightly gaining despite broader market declines. In this environment, identifying high-growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to shifting economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Cyient DLM (NSEI:CYIENTDLM)

Simply Wall St Growth Rating: ★★★★★☆

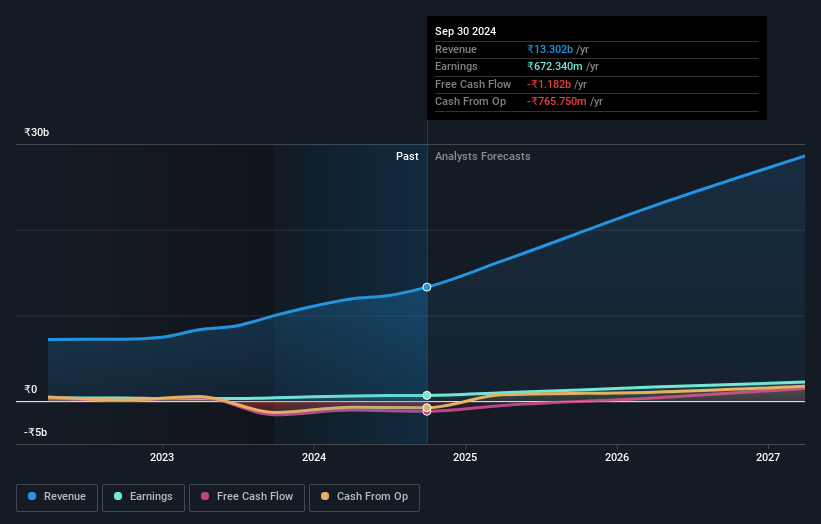

Overview: Cyient DLM Limited offers electronic manufacturing solutions both domestically in India and internationally, with a market capitalization of ₹51.09 billion.

Operations: The company generates revenue primarily from its electronic manufacturing solutions, totaling ₹13.30 billion.

Cyient DLM has demonstrated robust financial performance with a significant revenue increase to INR 3,965.45 million in Q2 2024 from INR 3,011.2 million the previous year, reflecting a growth of 24.6%. This surge is supported by strategic expansions such as the recent board decision to acquire a US entity, potentially broadening its market reach and enhancing operational capabilities. The firm's commitment to innovation is evident in its R&D investments, crucial for sustaining its rapid earnings growth rate of 45.8% per year, outpacing the industry average significantly. With these developments and an expected continuation of high earnings growth, Cyient DLM is positioning itself as a dynamic player in the tech sector amidst evolving industry demands.

- Dive into the specifics of Cyient DLM here with our thorough health report.

Gain insights into Cyient DLM's past trends and performance with our Past report.

Ditto (Thailand) (SET:DITTO)

Simply Wall St Growth Rating: ★★★★★☆

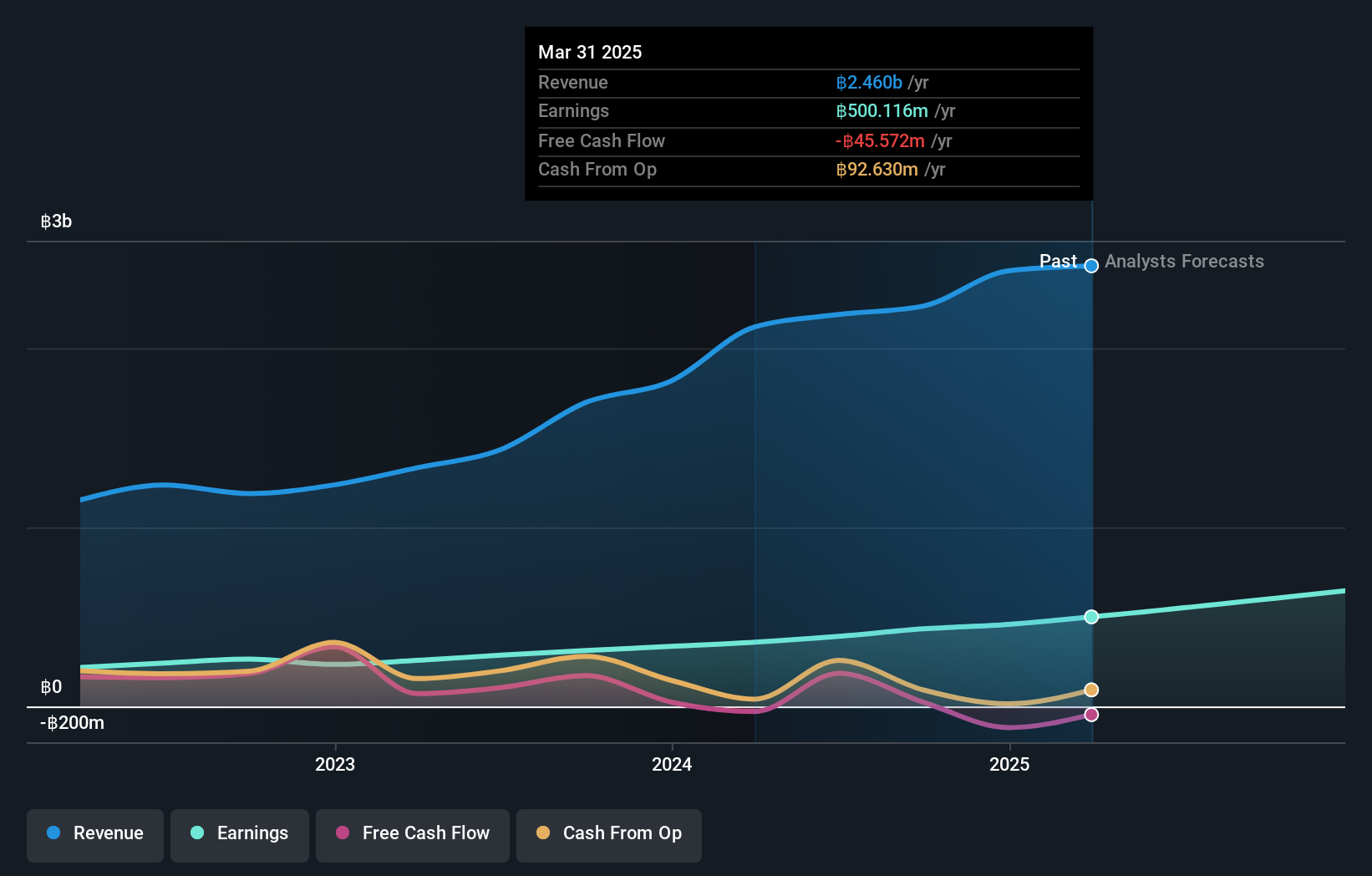

Overview: Ditto (Thailand) Public Company Limited focuses on distributing data and document management solutions in Thailand with a market capitalization of THB13.05 billion.

Operations: The company generates revenue primarily through three segments: Technology Engineering Services (THB926.39 million), Data and Document Management Solutions (THB709.59 million), and Photocopiers, Printers, and Technology Products (THB551.91 million).

Ditto (Thailand) is setting a brisk pace in the tech sector with its revenue and earnings growth significantly outpacing market averages. In the last year, revenue surged by 26.2% annually, eclipsing the Thai market's 6.3%, while projected earnings are expected to climb by 27.4% per year, well above the local market's 15.4%. This financial vitality is complemented by a recent report highlighting Q2 sales up to THB 511.63 million from THB 442.31 million in the previous year and net income rising to THB 125.38 million from THB 92.56 million, signaling robust operational efficiency and market adaptation. Moreover, Ditto’s commitment to innovation is underscored by its strategic R&D investments which are crucial for maintaining its competitive edge and supporting sustained growth in a challenging electronic industry landscape where it has already achieved a remarkable earnings growth of 36.7% over the past year, surpassing industry growth of just 12%. These efforts not only enhance Ditto’s product offerings but also secure its position as an influential player amidst evolving technological demands.

- Delve into the full analysis health report here for a deeper understanding of Ditto (Thailand).

Understand Ditto (Thailand)'s track record by examining our Past report.

PLAIDInc (TSE:4165)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PLAID, Inc. is a company that develops and operates KARTE, a customer experience SaaS platform in Japan, with a market capitalization of ¥39.77 billion.

Operations: The company generates revenue primarily through its SaaS Business and The Advertising Business, with a combined total of ¥10.39 billion. The gross profit margin is a key financial metric to consider when evaluating the company's profitability.

PLAIDInc is navigating the competitive tech landscape with a strategic focus on R&D, dedicating a significant portion of its budget to innovation. Last year, R&D expenses reached JPY 1.5 billion, representing 17.6% of total revenue—a substantial investment that underscores their commitment to advancing technology and staying ahead in the market. This approach appears promising as earnings are projected to surge by an impressive 109.8% annually, positioning PLAIDInc well for future profitability and growth in a sector driven by constant technological evolution. Recent corporate maneuvers further highlight PLAIDInc's proactive stance; following an upward revision in earnings guidance due to better-than-expected sales and improved operational efficiency, the company now anticipates net sales of JPY 11 billion for FY2024. This adjustment reflects not only robust sales performance but also effective cost management strategies that have led to a lower SG&A ratio, enhancing overall financial health and potentially attracting more investor interest as PLAIDInc transitions from unprofitable status towards expected profitability within three years.

- Click to explore a detailed breakdown of our findings in PLAIDInc's health report.

Examine PLAIDInc's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 1281 High Growth Tech and AI Stocks by clicking on this link.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:CYIENTDLM

Cyient DLM

Provides electronic manufacturing solutions in India, NAM, rest of the Asia-Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives