- India

- /

- Trade Distributors

- /

- NSEI:CNL

Shareholders Will Probably Hold Off On Increasing Creative Newtech Limited's (NSE:CREATIVE) CEO Compensation For The Time Being

Key Insights

- Creative Newtech to hold its Annual General Meeting on 25th of September

- Total pay for CEO Ketan Patel includes ₹5.31m salary

- Total compensation is 236% above industry average

- Creative Newtech's total shareholder return over the past three years was 359% while its EPS grew by 63% over the past three years

Performance at Creative Newtech Limited (NSE:CREATIVE) has been reasonably good and CEO Ketan Patel has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 25th of September. However, some shareholders will still be cautious of paying the CEO excessively.

See our latest analysis for Creative Newtech

Comparing Creative Newtech Limited's CEO Compensation With The Industry

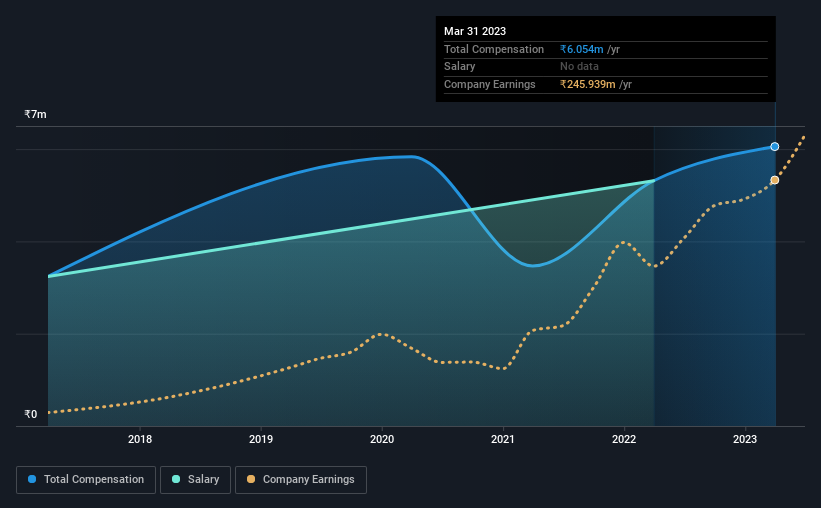

Our data indicates that Creative Newtech Limited has a market capitalization of ₹6.5b, and total annual CEO compensation was reported as ₹6.1m for the year to March 2023. That's a notable increase of 14% on last year. In particular, the salary of ₹5.31m, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the Indian Electronic industry with market capitalizations below ₹17b, reported a median total CEO compensation of ₹1.8m. Hence, we can conclude that Ketan Patel is remunerated higher than the industry median. Moreover, Ketan Patel also holds ₹4.1b worth of Creative Newtech stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | ₹5.3m | ₹5.3m | 88% |

| Other | ₹740k | - | 12% |

| Total Compensation | ₹6.1m | ₹5.3m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. Creative Newtech sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Creative Newtech Limited's Growth

Creative Newtech Limited's earnings per share (EPS) grew 63% per year over the last three years. In the last year, its revenue is up 56%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's great to see that revenue growth is strong, too. These metrics suggest the business is growing strongly. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has Creative Newtech Limited Been A Good Investment?

We think that the total shareholder return of 359%, over three years, would leave most Creative Newtech Limited shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Given that the company's overall performance has been reasonable, the CEO remuneration policy might not be shareholders' central point of focus in the upcoming AGM. Still, not all shareholders might be in favor of a pay raise to the CEO, seeing that they are already being paid higher than the industry.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. That's why we did our research, and identified 3 warning signs for Creative Newtech (of which 1 is potentially serious!) that you should know about in order to have a holistic understanding of the stock.

Important note: Creative Newtech is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CNL

Creative Newtech

Distributes information technology (IT), gaming, imaging, lifestyle, and security products in India and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Adobe (ADBE): Record Q1 AI-Revenue and the End of the Shantanu Narayen Era

MDxHealth (MDXH): Liquid Biopsy Hypergrowth and the Strategic Path to 10% EBITDA Margins

A Case For NeXGold Mining Corp, a 20+ bagger by 2030 (C$40-70) or a 10 bagger by Christmas 2026 (C$16), or both?

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks