- India

- /

- Electronic Equipment and Components

- /

- NSEI:CENTUM

How Does Centum Electronics' (NSE:CENTUM) CEO Pay Compare With Company Performance?

This article will reflect on the compensation paid to Rao Mallavarapu who has served as CEO of Centum Electronics Limited (NSE:CENTUM) since 1993. This analysis will also assess whether Centum Electronics pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

View our latest analysis for Centum Electronics

Comparing Centum Electronics Limited's CEO Compensation With the industry

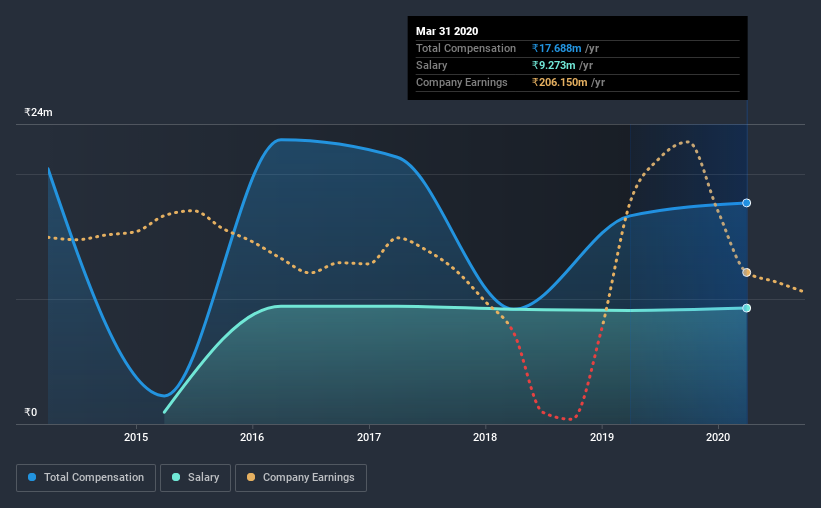

At the time of writing, our data shows that Centum Electronics Limited has a market capitalization of ₹5.9b, and reported total annual CEO compensation of ₹18m for the year to March 2020. That's a modest increase of 6.2% on the prior year. In particular, the salary of ₹9.27m, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹2.6m. Hence, we can conclude that Rao Mallavarapu is remunerated higher than the industry median. Moreover, Rao Mallavarapu also holds ₹3.0b worth of Centum Electronics stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹9.3m | ₹9.1m | 52% |

| Other | ₹8.4m | ₹7.6m | 48% |

| Total Compensation | ₹18m | ₹17m | 100% |

On an industry level, it's fascinating to see that all of total compensation represents salary and non-salary benefits do not factor into the equation at all. Centum Electronics sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

A Look at Centum Electronics Limited's Growth Numbers

Centum Electronics Limited has reduced its earnings per share by 3.9% a year over the last three years. In the last year, its revenue is down 12%.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Centum Electronics Limited Been A Good Investment?

With a three year total loss of 30% for the shareholders, Centum Electronics Limited would certainly have some dissatisfied shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

As we noted earlier, Centum Electronics pays its CEO higher than the norm for similar-sized companies belonging to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Add to that declining EPS growth, and you have the perfect recipe for shareholder irritation. Considering such poor performance, we think shareholders might be concerned if the CEO's compensation were to grow.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. That's why we did our research, and identified 6 warning signs for Centum Electronics (of which 1 is a bit concerning!) that you should know about in order to have a holistic understanding of the stock.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you’re looking to trade Centum Electronics, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:CENTUM

Centum Electronics

Designs, manufactures, exports, and sells electronic products in India, the United Kingdom, Europe, North America, and internationally.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives