With EPS Growth And More, Tata Consultancy Services (NSE:TCS) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Tata Consultancy Services (NSE:TCS). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

View our latest analysis for Tata Consultancy Services

How Quickly Is Tata Consultancy Services Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That makes EPS growth an attractive quality for any company. Tata Consultancy Services managed to grow EPS by 7.4% per year, over three years. While that sort of growth rate isn't anything to write home about, it does show the business is growing.

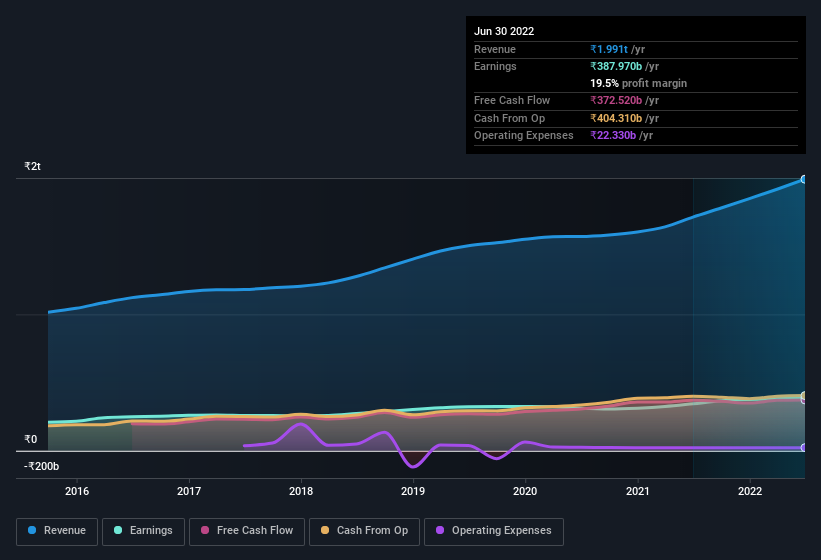

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Tata Consultancy Services achieved similar EBIT margins to last year, revenue grew by a solid 16% to ₹2.0t. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Tata Consultancy Services' future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Tata Consultancy Services Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a ₹12t company like Tata Consultancy Services. But we do take comfort from the fact that they are investors in the company. To be specific, they have ₹2.2b worth of shares. That's a lot of money, and no small incentive to work hard. While their ownership only accounts for 0.02%, this is still a considerable amount at stake to encourage the business to maintain a strategy that will deliver value to shareholders.

Does Tata Consultancy Services Deserve A Spot On Your Watchlist?

One important encouraging feature of Tata Consultancy Services is that it is growing profits. If that's not enough on its own, there is also the rather notable levels of insider ownership. These two factors are a huge highlight for the company which should be a strong contender your watchlists. Now, you could try to make up your mind on Tata Consultancy Services by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Tata Consultancy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:TCS

Tata Consultancy Services

Provides information technology (IT) and IT enabled services in the Americas, Europe, India, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives