Exploring High Growth Tech Stocks Including Tanla Platforms And Two Others

Reviewed by Simply Wall St

In the wake of recent political shifts and economic policy adjustments, global markets have experienced a notable rally, with U.S. stocks reaching record highs driven by expectations of growth-friendly policies following a significant electoral outcome. The small-cap Russell 2000 Index has shown impressive gains, highlighting investor optimism in smaller companies amid hopes for looser regulations and lower corporate taxes. In this environment, high-growth tech stocks like Tanla Platforms are capturing attention as investors seek opportunities that align with the current market sentiment, emphasizing innovation and scalability as key attributes for potential success in today's dynamic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Sarepta Therapeutics | 23.89% | 42.65% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.48% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1271 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

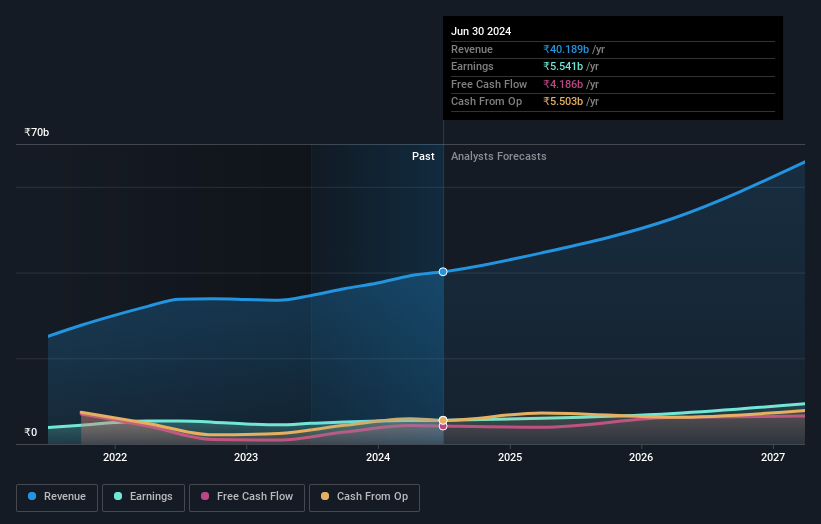

Tanla Platforms (NSEI:TANLA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tanla Platforms Limited, along with its subsidiaries, offers cloud communication platforms as a service to mobile operators and enterprises both in India and globally, with a market cap of ₹100.82 billion.

Operations: The company generates revenue primarily from its cloud communication platforms as a service, with the CPaaS provider segment contributing ₹40.11 billion.

Tanla Platforms, navigating through a competitive tech landscape, reported a slight dip in quarterly revenue to INR 10.11 billion from INR 10.15 billion year-over-year, with net income also falling to INR 1.30 billion from INR 1.43 billion. Despite these challenges, the company is poised for growth with projected annual revenue and earnings increases of 15.4% and 18%, respectively—outpacing the broader Indian market projections of 10.5% and 17.9%. Adding strategic depth to its board, Tanla welcomed François Ortalo-Magné, noted for his transformative leadership at London Business School, signaling a strong push towards innovation and governance that aligns with global best practices.

- Take a closer look at Tanla Platforms' potential here in our health report.

Understand Tanla Platforms' track record by examining our Past report.

Plover Bay Technologies (SEHK:1523)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Plover Bay Technologies Limited is an investment holding company that designs, develops, and markets software-defined wide area network routers, with a market capitalization of HK$5.73 billion.

Operations: The company generates revenue primarily from the sale of SD-WAN routers, with mobile first connectivity contributing $59.87 million and fixed first connectivity adding $15.19 million. Additionally, software licenses and warranty and support services account for $31.86 million in revenue.

Plover Bay Technologies, with a projected revenue growth of 16.9% per year, is outpacing the Hong Kong market average of 7.8%, highlighting its robust position in the tech sector. The company's earnings are also expected to rise by 17.3% annually, surpassing the local market forecast of 11.9%. This financial trajectory is supported by strategic board enhancements, including the recent appointment of Ms. Chiu Chi Ying, which strengthens governance and diversifies expertise in legal and intellectual property management—critical areas as Plover Bay continues to innovate and expand its technological offerings.

- Unlock comprehensive insights into our analysis of Plover Bay Technologies stock in this health report.

Learn about Plover Bay Technologies' historical performance.

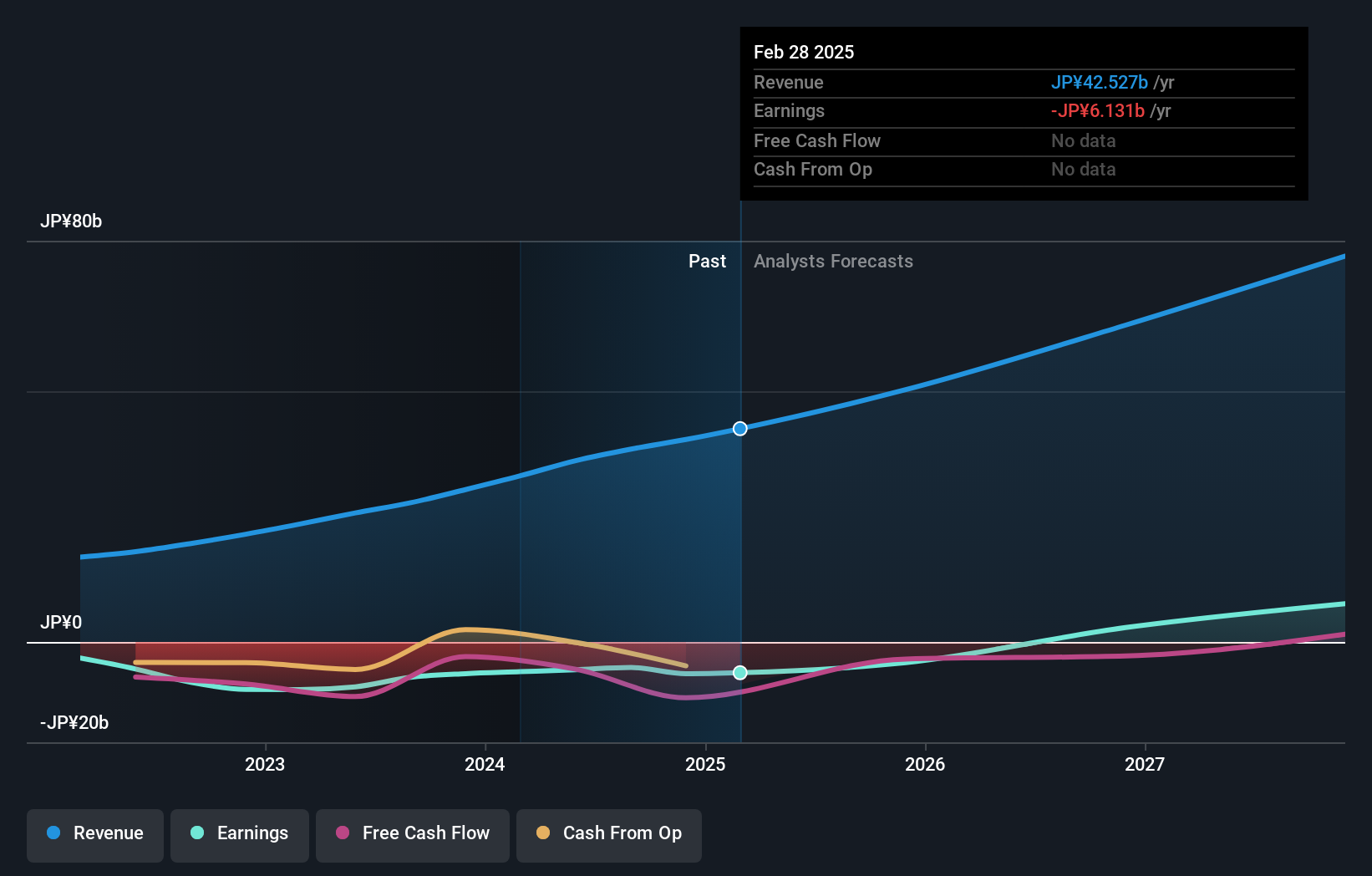

Money Forward (TSE:3994)

Simply Wall St Growth Rating: ★★★★★★

Overview: Money Forward, Inc. is a Japanese company offering financial solutions for individuals, financial institutions, and corporations with a market capitalization of ¥268.16 billion.

Operations: The company generates revenue primarily through its Platform Services Business, which contributed ¥38.47 billion.

Money Forward is navigating a challenging fiscal landscape, with an expected operating loss up to JPY 3.9 billion for FY 2024, yet it remains poised for significant revenue growth at 21.2% annually, outstripping Japan's market average of 4.2%. This growth trajectory is bolstered by strategic partnerships, such as the recent agreement with Sumitomo Mitsui Card Company, and a focus on fintech innovations through its subsidiary Money Forward Kessai. Despite current unprofitability and high share price volatility, the company's aggressive investment in R&D—evidenced by its substantial financial commitment relative to revenue—underscores a clear strategy to capture future market opportunities in digital financial services.

- Click here to discover the nuances of Money Forward with our detailed analytical health report.

Evaluate Money Forward's historical performance by accessing our past performance report.

Next Steps

- Take a closer look at our High Growth Tech and AI Stocks list of 1271 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3994

Money Forward

Provides financial solutions for individuals, financial institutions, and corporations primarily in Japan.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives