We Think Sonata Software (NSE:SONATSOFTW) Can Manage Its Debt With Ease

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Sonata Software Limited (NSE:SONATSOFTW) makes use of debt. But is this debt a concern to shareholders?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Sonata Software

How Much Debt Does Sonata Software Carry?

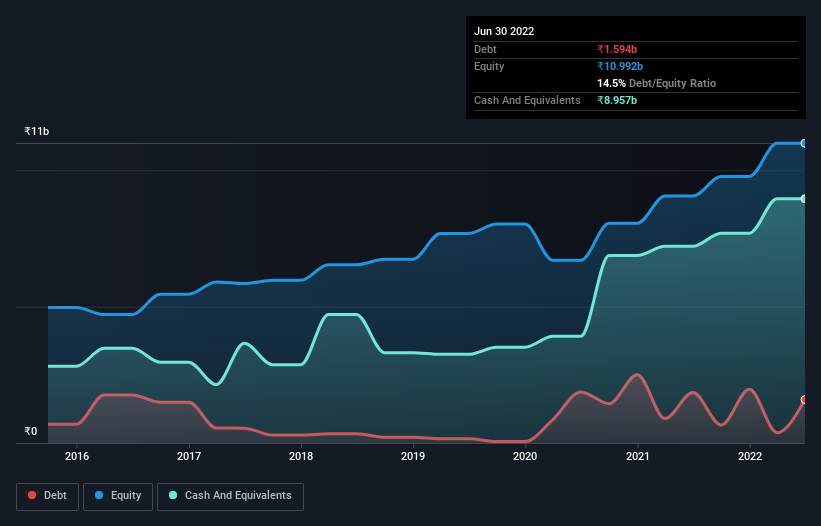

As you can see below, Sonata Software had ₹1.59b of debt at March 2022, down from ₹1.85b a year prior. But it also has ₹8.96b in cash to offset that, meaning it has ₹7.36b net cash.

How Strong Is Sonata Software's Balance Sheet?

The latest balance sheet data shows that Sonata Software had liabilities of ₹12.9b due within a year, and liabilities of ₹1.66b falling due after that. Offsetting this, it had ₹8.96b in cash and ₹9.81b in receivables that were due within 12 months. So it actually has ₹4.21b more liquid assets than total liabilities.

This surplus suggests that Sonata Software has a conservative balance sheet, and could probably eliminate its debt without much difficulty. Succinctly put, Sonata Software boasts net cash, so it's fair to say it does not have a heavy debt load!

On top of that, Sonata Software grew its EBIT by 31% over the last twelve months, and that growth will make it easier to handle its debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Sonata Software can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. Sonata Software may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Happily for any shareholders, Sonata Software actually produced more free cash flow than EBIT over the last three years. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Summing Up

While it is always sensible to investigate a company's debt, in this case Sonata Software has ₹7.36b in net cash and a decent-looking balance sheet. And it impressed us with free cash flow of ₹4.4b, being 110% of its EBIT. So is Sonata Software's debt a risk? It doesn't seem so to us. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example - Sonata Software has 2 warning signs we think you should be aware of.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

If you're looking to trade Sonata Software, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SONATSOFTW

Sonata Software

Provides information technology services and solutions in the United States, Europe, the Middle East, Asia, India, and Australia.

Outstanding track record with high growth potential and pays a dividend.