With EPS Growth And More, Saksoft (NSE:SAKSOFT) Makes An Interesting Case

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Saksoft (NSE:SAKSOFT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Saksoft with the means to add long-term value to shareholders.

View our latest analysis for Saksoft

How Fast Is Saksoft Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Impressively, Saksoft has grown EPS by 31% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be beaming.

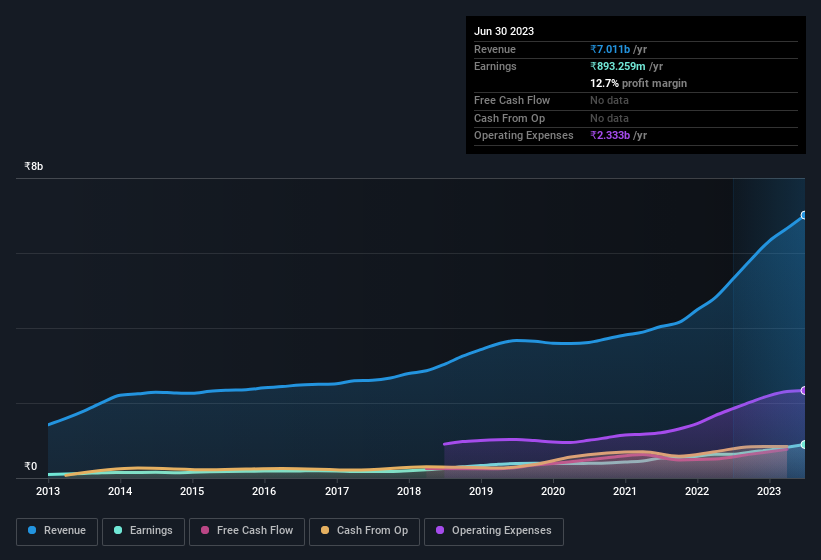

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Saksoft achieved similar EBIT margins to last year, revenue grew by a solid 32% to ₹7.0b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Saksoft's balance sheet strength, before getting too excited.

Are Saksoft Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Saksoft shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at ₹9.5b. That equates to 24% of the company, making insiders powerful and aligned with other shareholders. Looking very optimistic for investors.

It means a lot to see insiders invested in the business, but shareholders may be wondering if remuneration policies are in their best interest. Well, based on the CEO pay, you'd argue that they are indeed. Our analysis has discovered that the median total compensation for the CEOs of companies like Saksoft with market caps between ₹17b and ₹67b is about ₹24m.

The Saksoft CEO received total compensation of just ₹6.0m in the year to March 2023. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Saksoft Worth Keeping An Eye On?

If you believe that share price follows earnings per share you should definitely be delving further into Saksoft's strong EPS growth. If that's not enough, consider also that the CEO pay is quite reasonable, and insiders are well-invested alongside other shareholders. Everyone has their own preferences when it comes to investing but it definitely makes Saksoft look rather interesting indeed. Now, you could try to make up your mind on Saksoft by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:SAKSOFT

Saksoft

An information technology company, provides digital transformation solutions in Europe, the United States, the Asia Pacific, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Positioned to Win as the Streaming Wars Settle

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion