R Systems International And 2 Other Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

In a week marked by a flurry of earnings reports and economic data, global markets experienced mixed performances, with small-cap stocks demonstrating resilience compared to their large-cap counterparts. As investors navigate these complex market dynamics, the search for undiscovered gems becomes increasingly appealing, particularly those that show potential for growth despite broader economic uncertainties. Identifying promising stocks often involves looking at companies with strong fundamentals and innovative strategies that can thrive even in challenging environments.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Morris State Bancshares | 17.84% | 4.83% | 6.58% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Hermes Transportes Blindados | 58.80% | 4.29% | 2.04% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 40.13% | 22.83% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Value Rating: ★★★★★★

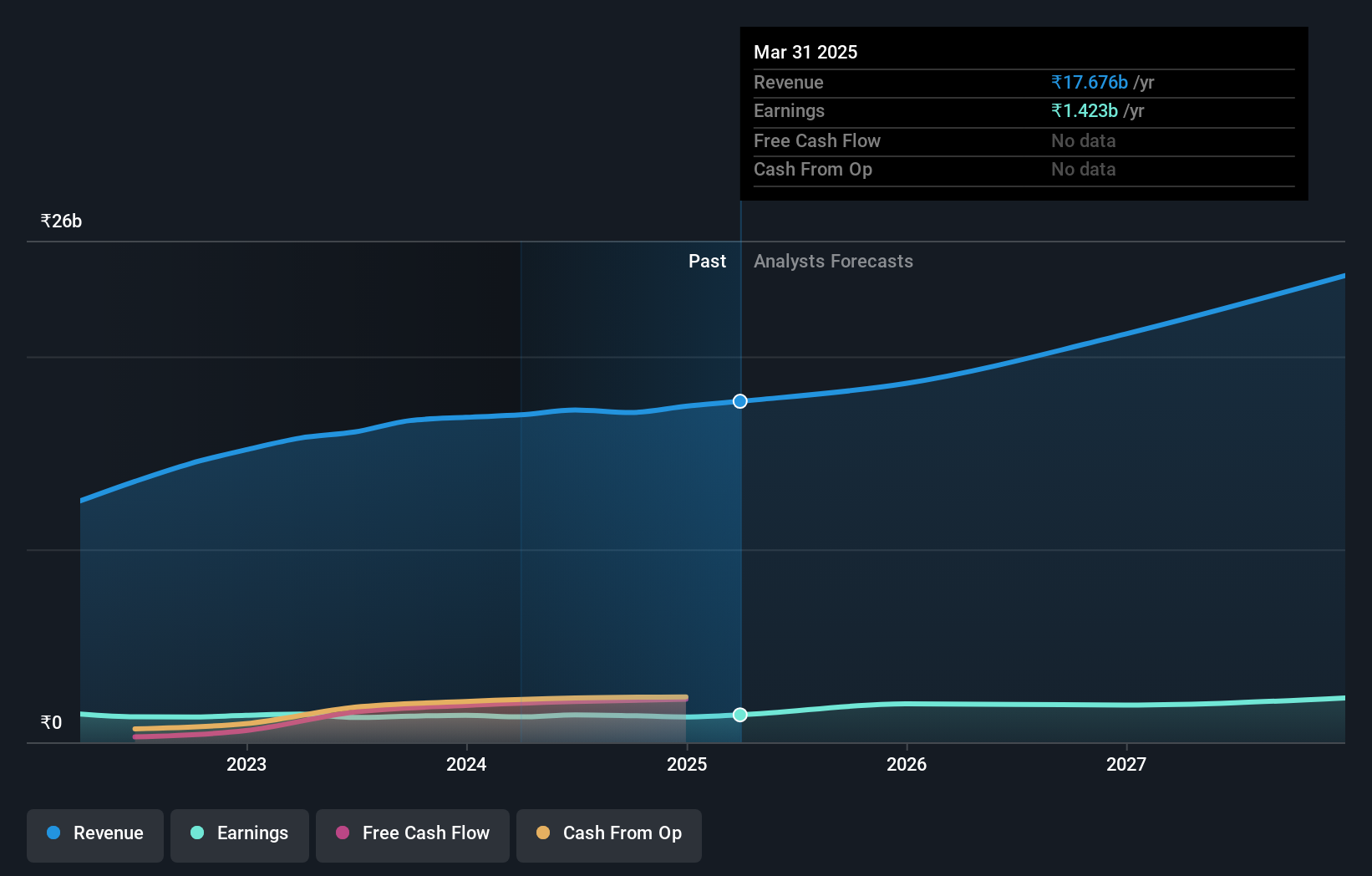

Overview: R Systems International Limited is a digital product engineering company that designs and builds chip-to-cloud software products and platforms, with a market cap of ₹59.96 billion.

Operations: R Systems generates revenue primarily from Information Technology Services, contributing ₹15.53 billion, and Business Process Outsourcing Services, adding ₹1.76 billion.

R Systems, a nimble player in the IT sector, showcases robust financial health with its debt to equity ratio dropping from 1.2% to 0.3% over five years and interest payments well covered at 52 times by EBIT. The company’s earnings have grown annually at 17.6%, although they lag slightly behind the industry’s pace of 12.9%. Recent leadership additions like Shardul Sangal as SVP and Srikara Rao as CTO signal strategic moves to enhance delivery and technology capabilities, while innovations such as the OptimaAI Suite aim to bolster growth through AI-driven solutions across various industries.

- Get an in-depth perspective on R Systems International's performance by reading our health report here.

Gain insights into R Systems International's past trends and performance with our Past report.

Prima Marine (SET:PRM)

Simply Wall St Value Rating: ★★★★★☆

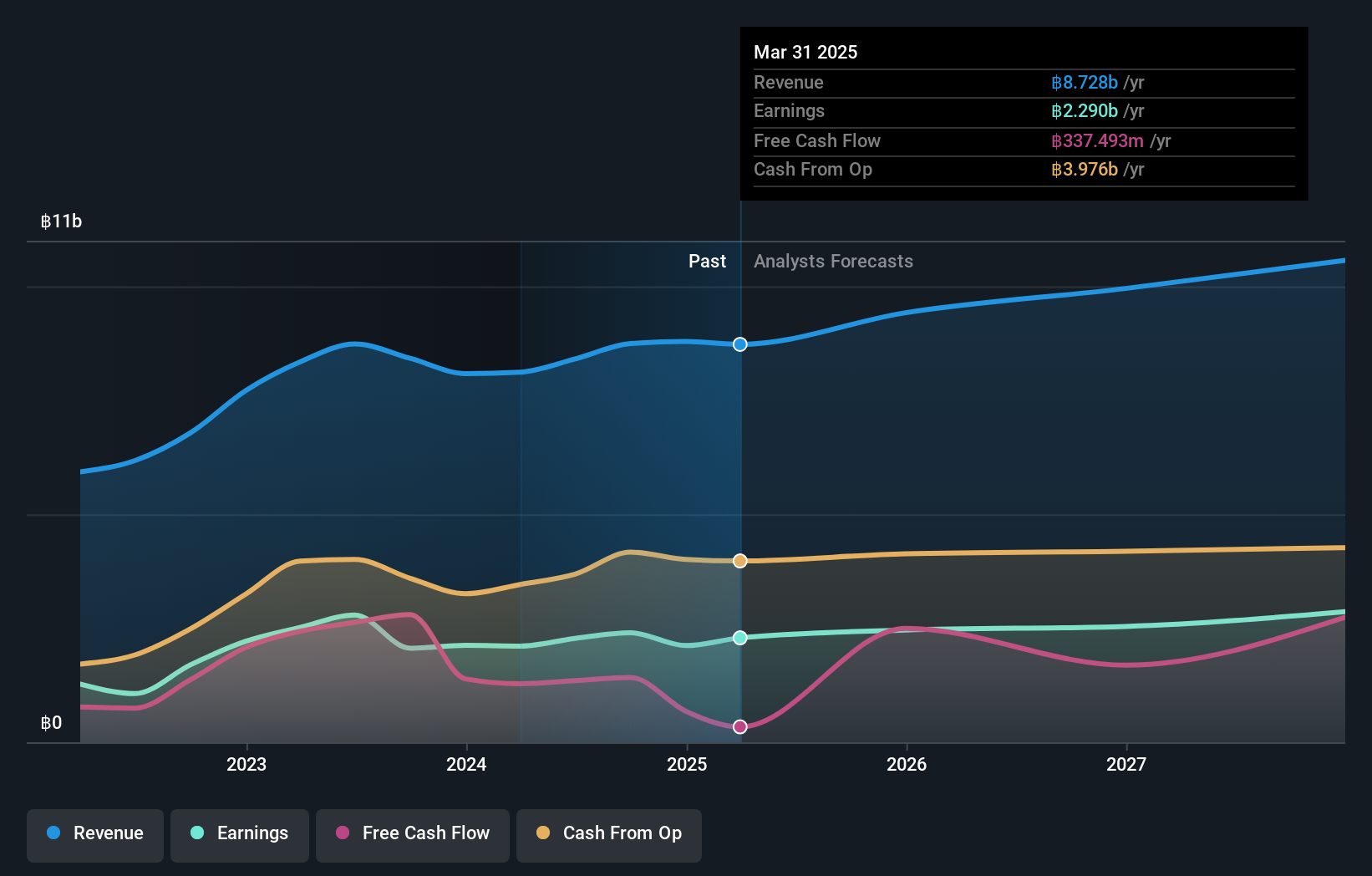

Overview: Prima Marine Public Company Limited specializes in marine transportation of petroleum and chemical products across Thailand, Singapore, and internationally, with a market capitalization of THB21.64 billion.

Operations: Prima Marine generates revenue primarily from marine transportation of petroleum and chemical products (THB6.26 billion) and storage of petroleum products (THB3.40 billion). Additional income is derived from ship management, ship agent services, recruitment and transportation services for crews (THB1.22 billion), as well as supporting offshore petroleum exploration through staff transport and accommodation work barges (THB0.81 billion).

Prima Marine, a notable player in the maritime sector, is trading at 27.1% below its fair value estimate, which might catch the eye of value investors. The company's debt situation appears healthy with a net debt to equity ratio at 3.7%, down from 70.5% over five years, indicating prudent financial management. Despite recent earnings growth challenges (-18.3%), its interest payments are well-covered by EBIT at 10.9 times coverage, suggesting solid operational capacity to handle debts. Recent activities include a significant share repurchase of 172 million shares and an interim dividend payout totaling THB 558 million for shareholders' benefit.

- Delve into the full analysis health report here for a deeper understanding of Prima Marine.

Examine Prima Marine's past performance report to understand how it has performed in the past.

Kindom Development (TWSE:2520)

Simply Wall St Value Rating: ★★★★★★

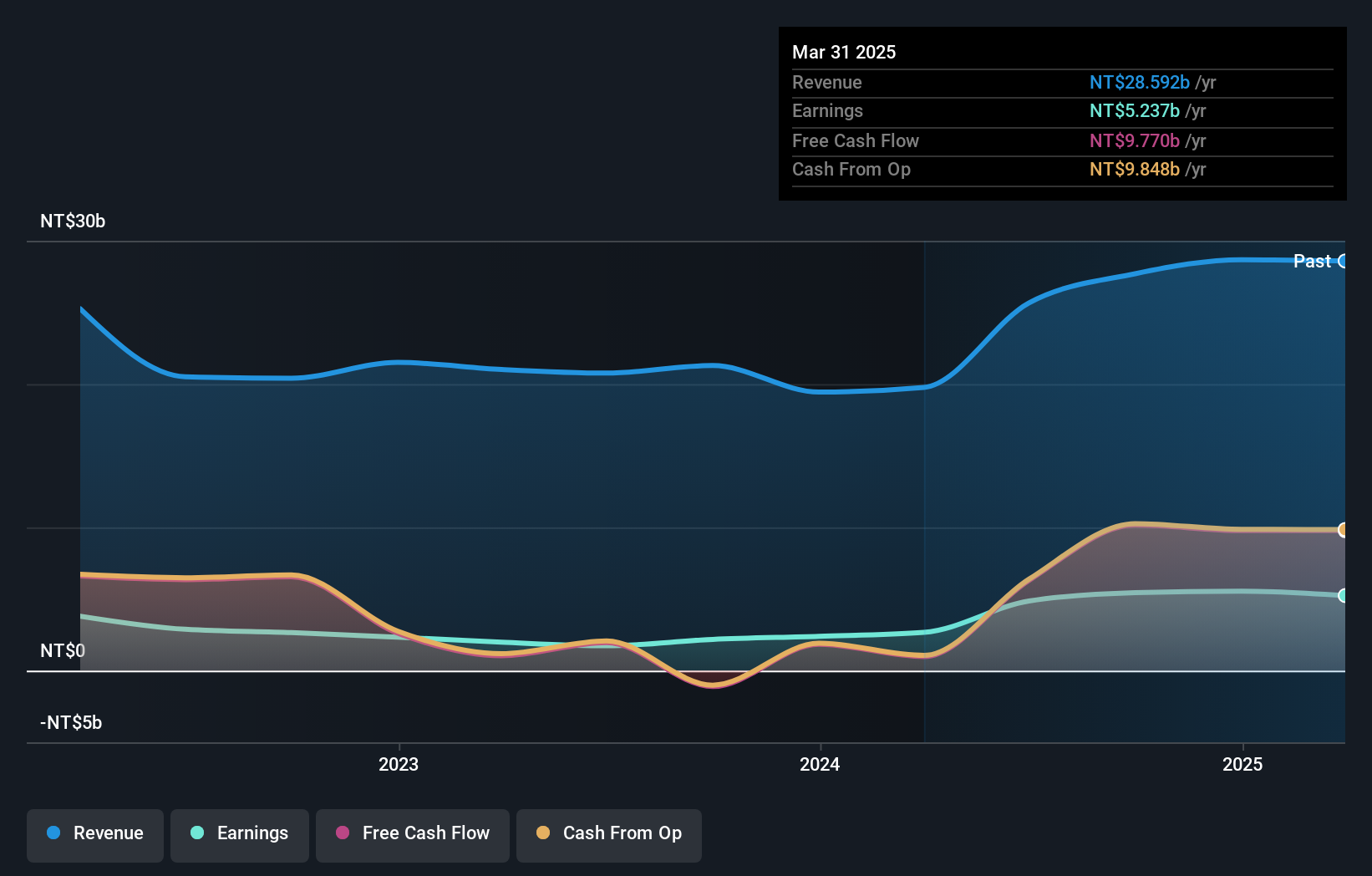

Overview: Kindom Development Co., Ltd. is a Taiwanese company that, along with its subsidiaries, focuses on constructing, developing, and selling real estate properties in Taiwan with a market capitalization of NT$25.93 billion.

Operations: Kindom Development generates revenue primarily from its construction segment, contributing NT$21.75 billion, followed by manufacturing at NT$5.76 billion and department stores at NT$1.74 billion. Adjustments and eliminations account for a negative impact of NT$3.59 billion on the total revenue.

Kindom Development, a dynamic player in the real estate sector, has showcased remarkable growth with earnings surging by 180.1% over the past year, outpacing industry peers. Trading at 67.6% below its estimated fair value, it presents an appealing valuation opportunity. The company's debt to equity ratio has impressively decreased from 201.3% to 63.7% over five years, signaling improved financial health. Recent earnings reports highlight a significant boost in sales and net income for Q2 2024 compared to last year, with sales reaching TWD 10 billion and net income at TWD 2 billion. Notably, Kindom's interest payments are well covered by EBIT at a robust coverage of 73x.

Where To Now?

- Get an in-depth perspective on all 4704 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RSYSTEMS

R Systems International

A digital product engineering company, designs and builds chip-to-cloud software products and platforms.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives