As global markets navigate the complexities of a new U.S. administration and shifting economic indicators, investors are observing notable fluctuations across key indices like the S&P 500 and Nasdaq Composite, with particular attention to sectors impacted by potential policy changes. In this dynamic environment, identifying high-growth tech stocks requires a keen understanding of how these companies can leverage innovation and adaptability to thrive amidst regulatory shifts and evolving market demands.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Seojin SystemLtd | 33.54% | 52.43% | ★★★★★★ |

| Pharma Mar | 26.94% | 56.39% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 25.59% | 31.50% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1301 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Growth Rating: ★★★★★☆

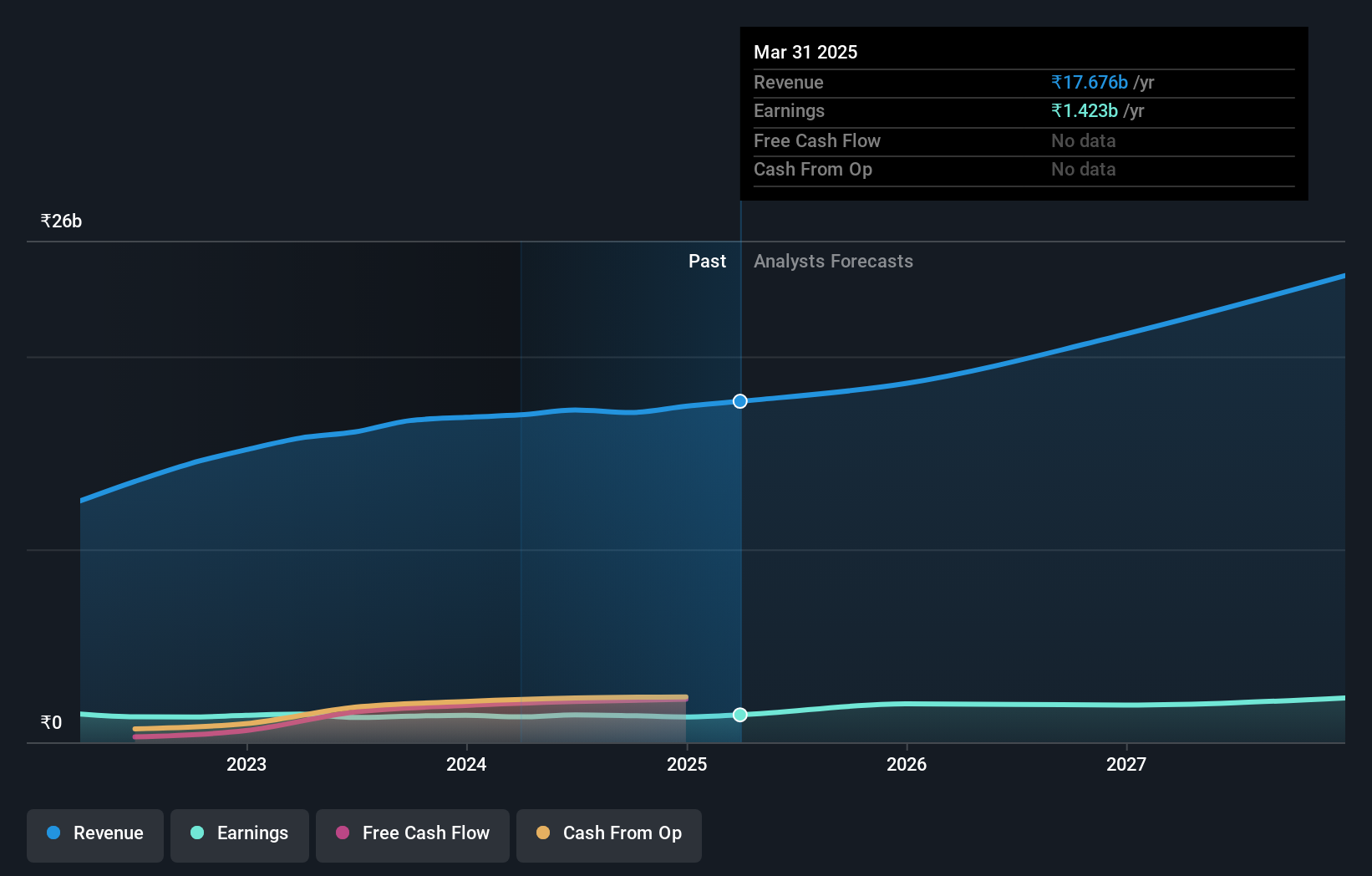

Overview: R Systems International Limited is a digital product engineering company that specializes in designing and building chip-to-cloud software products and platforms, with a market cap of ₹56.41 billion.

Operations: R Systems International generates revenue primarily from Information Technology Services, contributing ₹15.55 billion, and Business Process Outsourcing Services, adding ₹1.61 billion.

R Systems International, amidst a dynamic tech landscape, continues to strengthen its market position through strategic executive appointments and robust financial performance. The company's recent appointment of Srikara Rao as Chief Technology Officer underscores its commitment to advancing in cloud and cybersecurity services, pivotal areas for tech firms aiming to enhance digital resilience. Financially, R Systems reported a slight dip in Q3 earnings with net income at INR 398.12 million from INR 439.75 million year-over-year; however, this is balanced by a promising growth forecast in earnings at an impressive rate of 22.2% per year. Additionally, the firm's dedication to shareholder returns is evident from its recent declaration of a substantial interim dividend of INR 6.50 per share, reinforcing confidence in its financial health and operational strategy.

- Unlock comprehensive insights into our analysis of R Systems International stock in this health report.

Gain insights into R Systems International's past trends and performance with our Past report.

Beisen Holding (SEHK:9669)

Simply Wall St Growth Rating: ★★★★☆☆

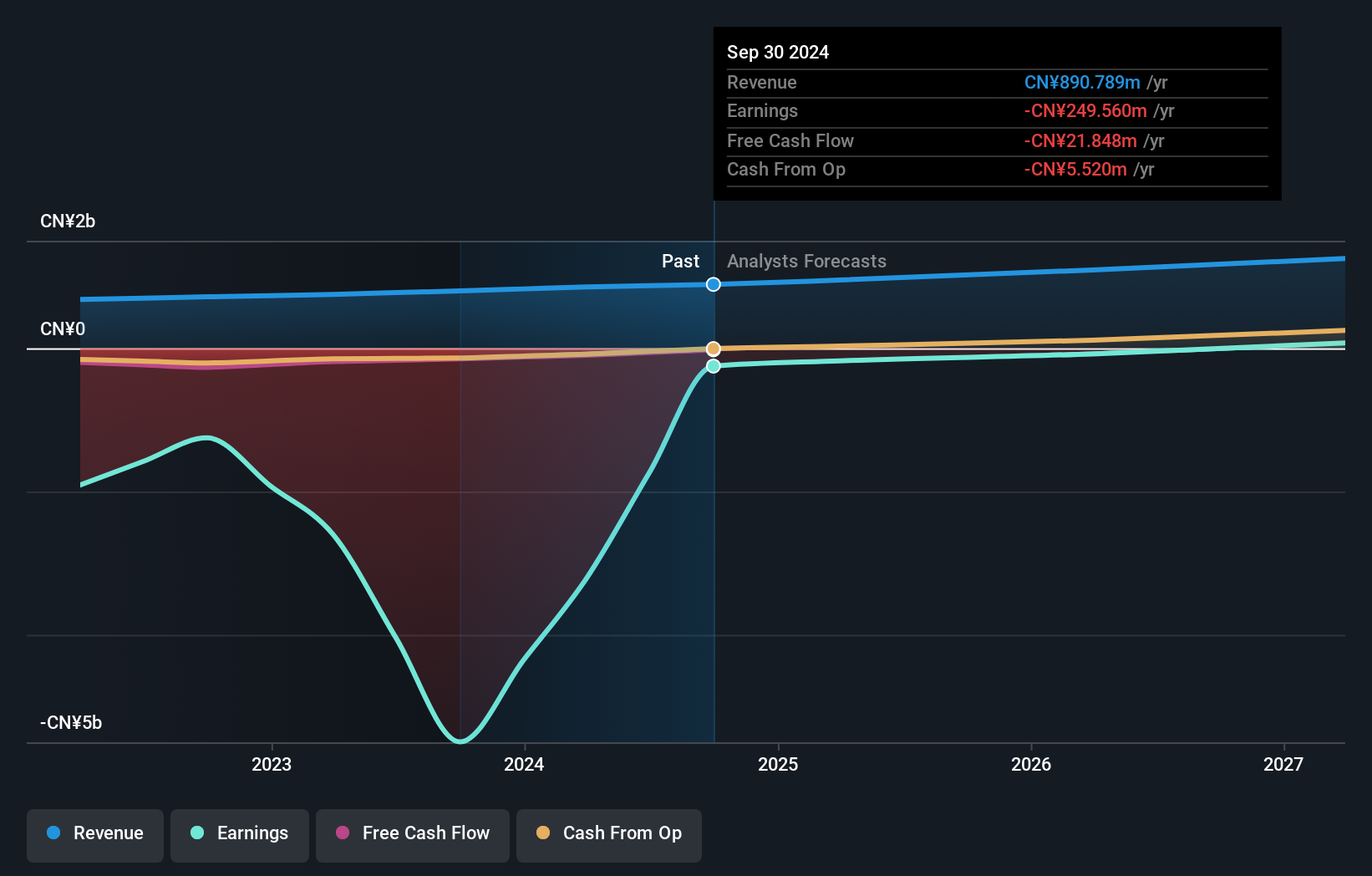

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions to help enterprises in the People's Republic of China with talent recruitment, evaluation, management, development, and retention, with a market capitalization of approximately HK$2.85 billion.

Operations: Beisen Holding generates revenue primarily from providing cloud-based human capital management solutions and related professional services, amounting to CN¥854.74 million.

Beisen Holding, amidst its challenges, showcases resilience with a notable reduction in losses and an uptick in revenue. For the half-year ended September 2024, it reported a substantial decrease in net loss to CNY 99.04 million from CNY 3,058.07 million year-over-year and a rise in sales to CNY 436.58 million, marking an improvement of approximately 9%. This performance is underpinned by aggressive R&D investments that fuel innovation—critical as the firm navigates the competitive tech landscape where R&D spending is often linked directly to future capabilities and market adaptability. The company's focus on enhancing product offerings through these investments could be pivotal for its trajectory in high-growth sectors like software development and AI-driven solutions.

Takara Bio (TSE:4974)

Simply Wall St Growth Rating: ★★★★☆☆

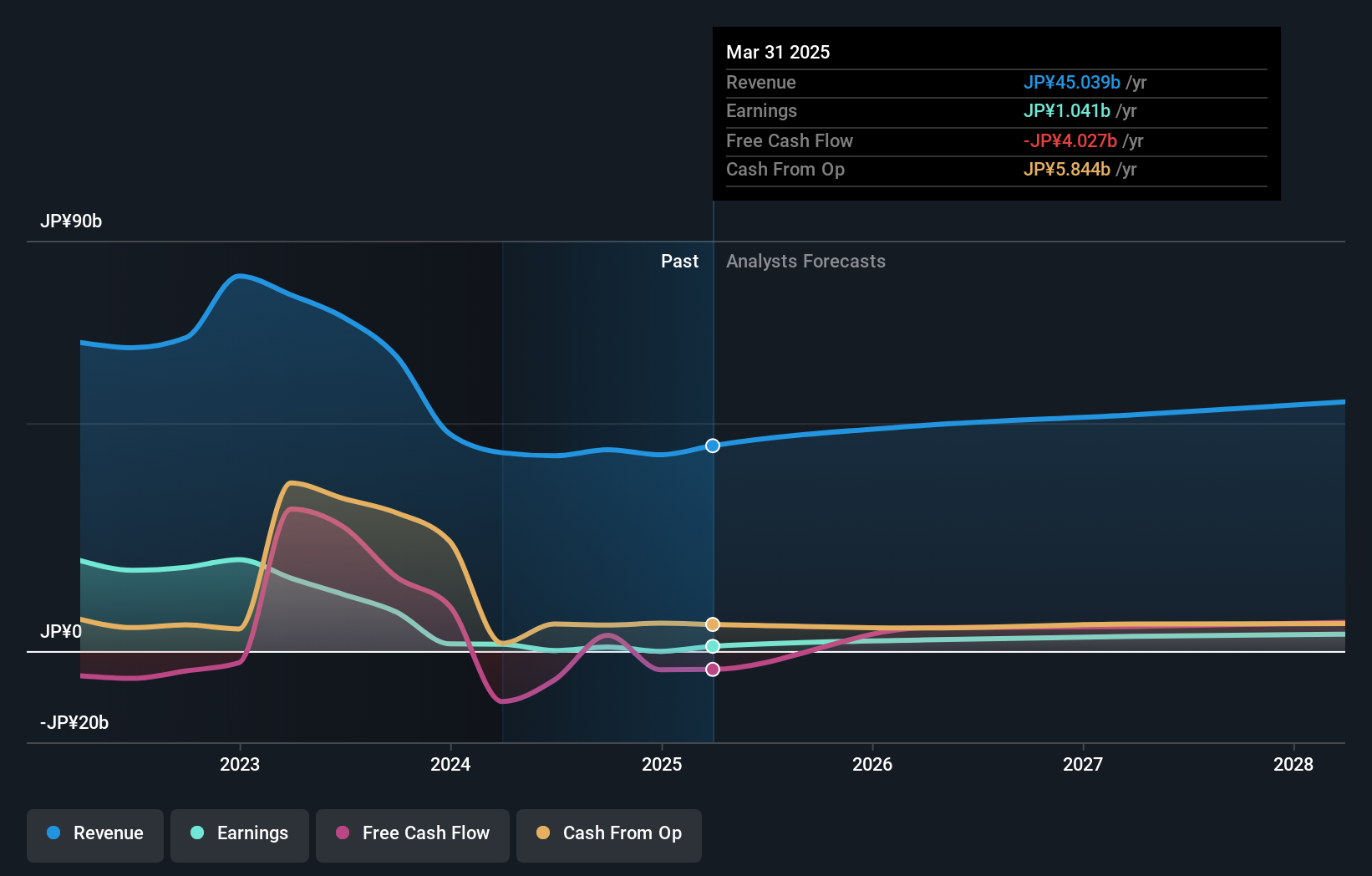

Overview: Takara Bio Inc. operates in the bioindustry, CDMO, and gene therapy sectors across Japan, China, other parts of Asia, the United States, Europe, and internationally with a market capitalization of ¥130.53 billion.

Operations: Takara Bio Inc. generates revenue through its operations in the bioindustry, CDMO, and gene therapy sectors across multiple regions including Asia, the United States, and Europe. The company focuses on providing specialized services and products in these fields to a diverse international market.

Takara Bio, navigating through a competitive biotech landscape, has demonstrated a commitment to innovation with its R&D expenses reaching ¥662M. This investment is crucial as it supports the company's strategic focus on developing gene therapies and reagents, sectors poised for substantial growth. Despite facing challenges such as a significant one-off loss impacting its recent financial performance, Takara Bio's revenue is expected to grow by 5.3% annually, outpacing the Japanese market's 4.2%. Moreover, earnings are projected to surge by an impressive 25.2% per year, highlighting potential in its operational efficiency and market positioning.

- Get an in-depth perspective on Takara Bio's performance by reading our health report here.

Assess Takara Bio's past performance with our detailed historical performance reports.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1298 High Growth Tech and AI Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Beisen Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9669

Beisen Holding

An investment holding company, provides cloud-based human capital management (HCM) solutions for enterprises in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion