The market is up 1.2% over the last week and has surged by 41% over the past 12 months, with earnings forecasted to grow by 17% annually. In this thriving environment, identifying high growth tech stocks that align with these robust market conditions can be crucial for investors looking to capitalize on India's booming technology sector.

Top 10 High Growth Tech Companies In India

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Tips Music | 24.69% | 24.16% | ★★★★★★ |

| Newgen Software Technologies | 21.66% | 22.51% | ★★★★★★ |

| Coforge | 14.32% | 22.54% | ★★★★★☆ |

| Happiest Minds Technologies | 22.15% | 22.22% | ★★★★★★ |

| C. E. Info Systems | 29.94% | 26.97% | ★★★★★★ |

| Netweb Technologies India | 33.65% | 35.61% | ★★★★★★ |

| GFL | 44.50% | 49.42% | ★★★★★☆ |

| Sterlite Technologies | 21.41% | 101.08% | ★★★★★☆ |

| Tejas Networks | 23.05% | 63.54% | ★★★★★☆ |

| INOX Leisure | 17.73% | 66.63% | ★★★★★☆ |

Here we highlight a subset of our preferred stocks from the screener.

Netweb Technologies India (NSEI:NETWEB)

Simply Wall St Growth Rating: ★★★★★★

Overview: Netweb Technologies India Limited designs, manufactures, and sells high-end computing solutions (HCS) in India with a market cap of ₹150.03 billion.

Operations: Netweb Technologies India Limited generates revenue primarily from the manufacturing and sale of computer servers, amounting to ₹8.14 billion. The company's market cap stands at ₹150.03 billion.

Netweb Technologies India, amid a vibrant tech landscape, demonstrates robust growth with its recent revenue surge by 156% to INR 1.53 billion and net income increase to INR 154.44 million, up from INR 50.91 million year-over-year. This growth trajectory is supported by a strategic expansion in product offerings including the launch of advanced server systems catering to both domestic and international markets. The company's commitment to innovation is evident from its R&D expenditure trends which are aligned with its aggressive revenue growth forecasts of 33.6% annually, outpacing the Indian market's average of 10.2%. Additionally, earnings are expected to grow at an impressive rate of 35.6% per year, suggesting a strong upward momentum in profitability that could reshape its industry standing.

Route Mobile (NSEI:ROUTE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Route Mobile Limited offers cloud-communication platform services to enterprises, over-the-top players, and mobile network operators globally, with a market cap of ₹100.85 billion.

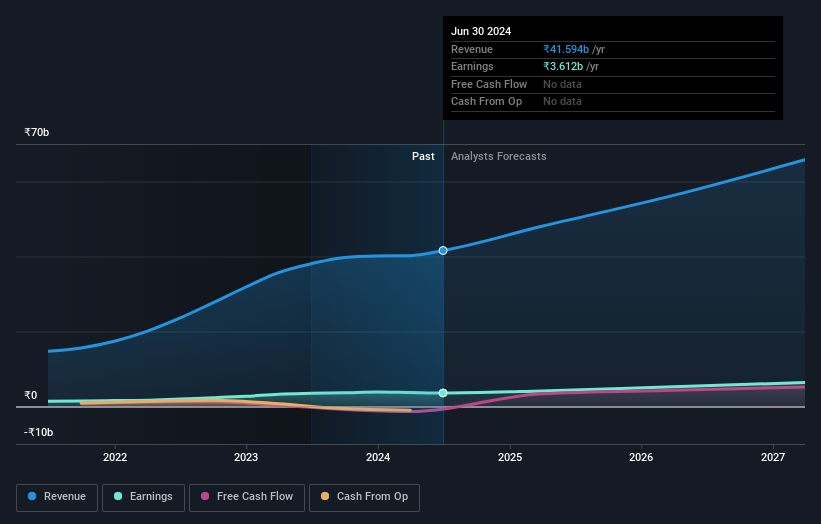

Operations: Route Mobile Limited generates revenue primarily through its messaging services, which accounted for ₹41.59 billion. The company focuses on providing cloud-communication solutions to a diverse range of clients globally.

Amidst a dynamic shift towards digital communication solutions, Route Mobile stands out with its strategic focus on cloud communications. The company's revenue is projected to grow by 16.8% annually, surpassing the broader Indian market's growth rate of 10.2%. This growth is supported by an aggressive R&D investment strategy, crucial for maintaining technological leadership in a competitive industry. Recently, Route Mobile has faced regulatory challenges and a significant divestment by Proximus Opal but continues to forecast robust earnings growth at 20.3% per year, indicating resilience and adaptability in its operational model. These factors collectively underscore Route Mobile's potential to leverage industry trends effectively while navigating through regulatory landscapes and shareholder changes.

- Click here and access our complete health analysis report to understand the dynamics of Route Mobile.

Examine Route Mobile's past performance report to understand how it has performed in the past.

R Systems International (NSEI:RSYSTEMS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: R Systems International Limited, a digital product engineering company, designs and builds chip-to-cloud software products and platforms with a market cap of ₹58.88 billion.

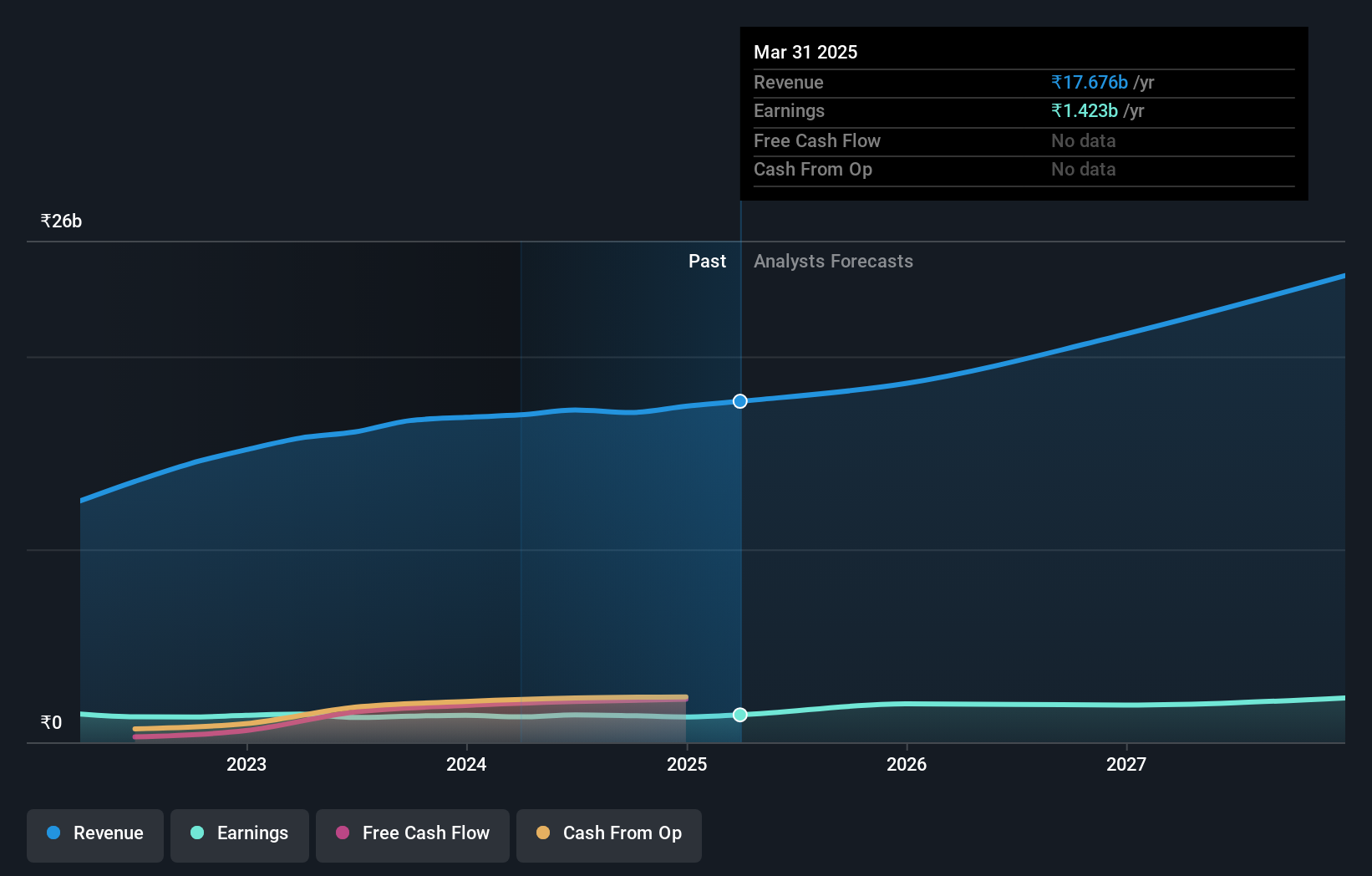

Operations: R Systems International Limited generates revenue primarily through Information Technology Services (₹15.53 billion) and Business Process Outsourcing Services (₹1.76 billion). The company's expertise lies in designing and building chip-to-cloud software products and platforms.

R Systems International is carving a niche in the high-growth tech landscape of India with its recent launch of the OptimaAI Suite, enhancing software development and digital transformation through AI. This innovation aligns with an impressive 12% annual revenue growth forecast, outpacing the broader Indian market's projection of 10.2%. Moreover, R&D investments have been robust, maintaining a competitive edge in technology advancement. With earnings expected to surge by 19.1% annually, R Systems is not just responding to current market demands but is setting trends with strategic product expansions and smart human resource acquisitions like the new CHRO from a notable industry background.

- Unlock comprehensive insights into our analysis of R Systems International stock in this health report.

Gain insights into R Systems International's past trends and performance with our Past report.

Turning Ideas Into Actions

- Navigate through the entire inventory of 39 Indian High Growth Tech and AI Stocks here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:ROUTE

Route Mobile

Provides cloud-communication platform services to enterprises, over-the-top players, and mobile network operators worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives