Nucleus Software Exports Limited (NSE:NUCLEUS) Looks Inexpensive After Falling 26% But Perhaps Not Attractive Enough

Nucleus Software Exports Limited (NSE:NUCLEUS) shareholders won't be pleased to see that the share price has had a very rough month, dropping 26% and undoing the prior period's positive performance. The good news is that in the last year, the stock has shone bright like a diamond, gaining 112%.

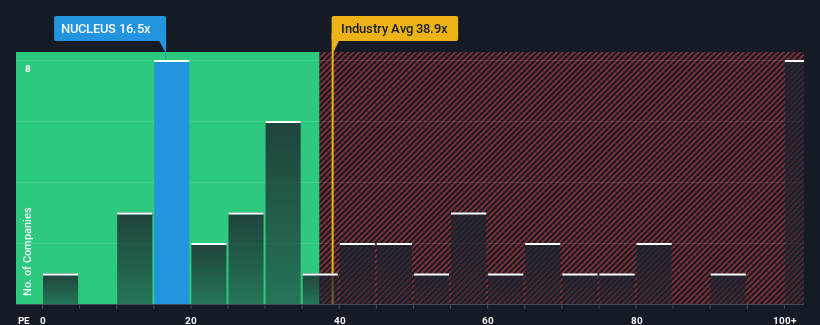

Although its price has dipped substantially, Nucleus Software Exports may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 16.5x, since almost half of all companies in India have P/E ratios greater than 32x and even P/E's higher than 59x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Nucleus Software Exports certainly has been doing a good job lately as it's been growing earnings more than most other companies. One possibility is that the P/E is low because investors think this strong earnings performance might be less impressive moving forward. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Nucleus Software Exports

How Is Nucleus Software Exports' Growth Trending?

Nucleus Software Exports' P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 166%. The latest three year period has also seen an excellent 89% overall rise in EPS, aided by its short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 7.5% as estimated by the only analyst watching the company. Meanwhile, the rest of the market is forecast to expand by 25%, which is noticeably more attractive.

With this information, we can see why Nucleus Software Exports is trading at a P/E lower than the market. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

The softening of Nucleus Software Exports' shares means its P/E is now sitting at a pretty low level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Nucleus Software Exports' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Nucleus Software Exports that you should be aware of.

If these risks are making you reconsider your opinion on Nucleus Software Exports, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Nucleus Software Exports might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NUCLEUS

Nucleus Software Exports

Provides lending and transaction banking products to the financial services industry in India, the Far East, South East Asia, Europe, the Middle East, Africa, Australia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026