Earnings Working Against Nucleus Software Exports Limited's (NSE:NUCLEUS) Share Price

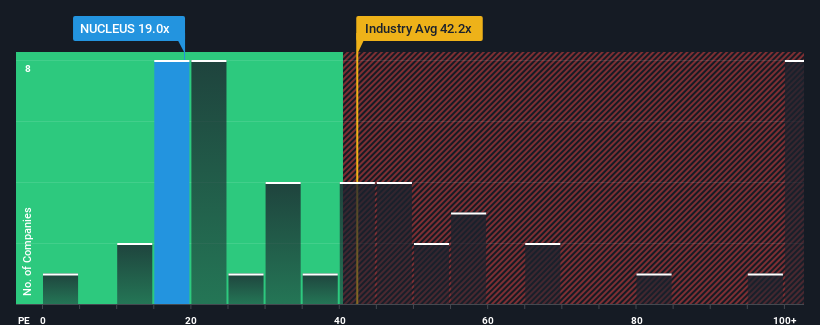

When close to half the companies in India have price-to-earnings ratios (or "P/E's") above 33x, you may consider Nucleus Software Exports Limited (NSE:NUCLEUS) as an attractive investment with its 19x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Nucleus Software Exports hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. The P/E is probably low because investors think this poor earnings performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

View our latest analysis for Nucleus Software Exports

How Is Nucleus Software Exports' Growth Trending?

In order to justify its P/E ratio, Nucleus Software Exports would need to produce sluggish growth that's trailing the market.

Retrospectively, the last year delivered a frustrating 23% decrease to the company's bottom line. Even so, admirably EPS has lifted 159% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 16% per annum during the coming three years according to the only analyst following the company. With the market predicted to deliver 19% growth per annum, the company is positioned for a weaker earnings result.

In light of this, it's understandable that Nucleus Software Exports' P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Bottom Line On Nucleus Software Exports' P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Nucleus Software Exports' analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Nucleus Software Exports that you need to be mindful of.

You might be able to find a better investment than Nucleus Software Exports. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Nucleus Software Exports might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:NUCLEUS

Nucleus Software Exports

Provides lending and transaction banking products to the financial services industry in India, the Far East, South East Asia, Europe, the Middle East, Africa, Australia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026