What Can We Conclude About Megasoft's (NSE:MEGASOFT) CEO Pay?

The CEO of Megasoft Limited (NSE:MEGASOFT) is Gandaravakottai Kumar, and this article examines the executive's compensation against the backdrop of overall company performance. This analysis will also assess whether Megasoft pays its CEO appropriately, considering recent earnings growth and total shareholder returns.

Check out our latest analysis for Megasoft

Comparing Megasoft Limited's CEO Compensation With the industry

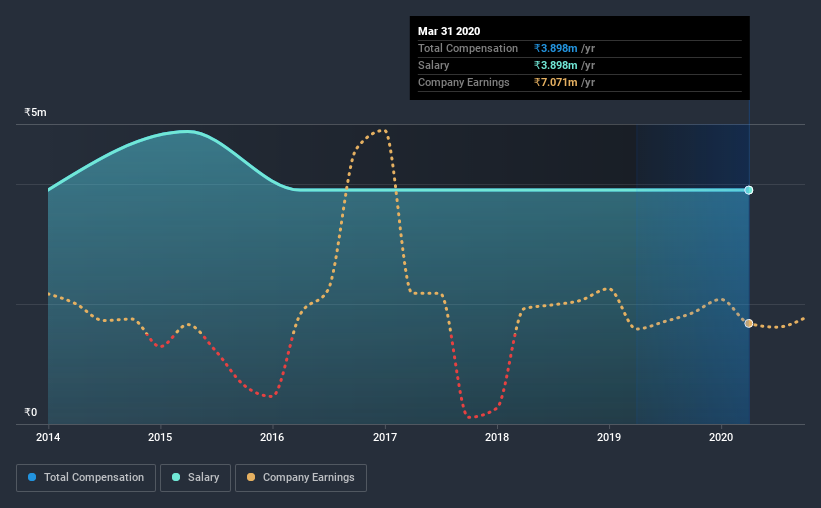

Our data indicates that Megasoft Limited has a market capitalization of ₹376m, and total annual CEO compensation was reported as ₹3.9m for the year to March 2020. That's mostly flat as compared to the prior year's compensation. It is worth noting that the CEO compensation consists entirely of the salary, worth ₹3.9m.

In comparison with other companies in the industry with market capitalizations under ₹15b, the reported median total CEO compensation was ₹5.0m. This suggests that Megasoft remunerates its CEO largely in line with the industry average. What's more, Gandaravakottai Kumar holds ₹19m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | ₹3.9m | ₹3.9m | 100% |

| Other | - | - | - |

| Total Compensation | ₹3.9m | ₹3.9m | 100% |

Talking in terms of the industry, salary represents all of total compensation among the companies we analyzed, while other remuneration is, interestingly, completely ignored. On a company level, Megasoft prefers to reward its CEO through a salary, opting not to pay Gandaravakottai Kumar through non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

Megasoft Limited's Growth

Megasoft Limited has seen its earnings per share (EPS) increase by 66% a year over the past three years. Its revenue is up 3.8% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's good to see a bit of revenue growth, as this suggests the business is able to grow sustainably. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has Megasoft Limited Been A Good Investment?

Given the total shareholder loss of 37% over three years, many shareholders in Megasoft Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Megasoft pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. As we touched on above, Megasoft Limited is currently paying a compensation that's close to the median pay for CEOs of companies belonging to the same industry and with similar market capitalizations. On the other hand, the company has logged negative shareholder returns over the previous three years. However, EPS growth is positive over the same time frame. It's tough for us to say CEO compensation is too generous when EPS growth is positive, but negative investor returns will irk shareholders and reduce any chances of a raise.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We've identified 1 warning sign for Megasoft that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Megasoft, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:MEGASOFT

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026