Here's Why We Think KPIT Technologies (NSE:KPITTECH) Might Deserve Your Attention Today

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like KPIT Technologies (NSE:KPITTECH). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide KPIT Technologies with the means to add long-term value to shareholders.

Check out our latest analysis for KPIT Technologies

How Fast Is KPIT Technologies Growing?

If a company can keep growing earnings per share (EPS) long enough, its share price should eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. To the delight of shareholders, KPIT Technologies has achieved impressive annual EPS growth of 59%, compound, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

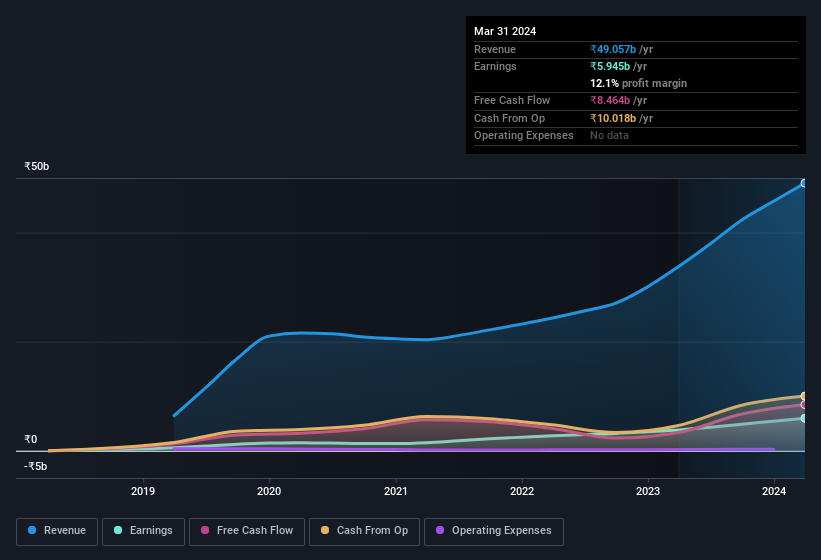

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of KPIT Technologies shareholders is that EBIT margins have grown from 15% to 17% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for KPIT Technologies.

Are KPIT Technologies Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

For the sake of balance, it should be noted that KPIT Technologies insiders sold ₹21m worth of shares last year. This falls short of the share acquisition by company insider Srinath Batni, who has acquired ₹32m worth of shares, at an average price of ₹1,587. Overall, that is something good to take away.

Along with the insider buying, another encouraging sign for KPIT Technologies is that insiders, as a group, have a considerable shareholding. We note that their impressive stake in the company is worth ₹32b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

Should You Add KPIT Technologies To Your Watchlist?

KPIT Technologies' earnings per share growth have been climbing higher at an appreciable rate. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe KPIT Technologies deserves timely attention. Don't forget that there may still be risks. For instance, we've identified 1 warning sign for KPIT Technologies that you should be aware of.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of KPIT Technologies, you'll probably love this curated collection of companies in IN that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KPIT Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:KPITTECH

KPIT Technologies

Provides embedded software, artificial intelligence, and digital solutions for the automobile and mobility sector in the Americas, the United Kingdom, rest of Europe, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion