Market Participants Recognise Genesys International Corporation Limited's (NSE:GENESYS) Revenues Pushing Shares 25% Higher

Despite an already strong run, Genesys International Corporation Limited (NSE:GENESYS) shares have been powering on, with a gain of 25% in the last thirty days. The annual gain comes to 112% following the latest surge, making investors sit up and take notice.

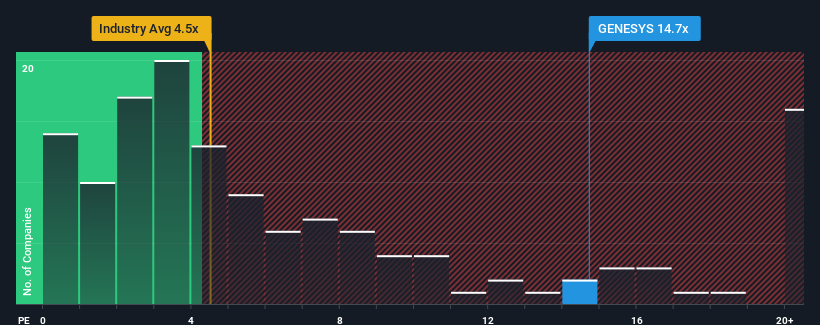

After such a large jump in price, Genesys International may be sending strong sell signals at present with a price-to-sales (or "P/S") ratio of 14.7x, when you consider almost half of the companies in the IT industry in India have P/S ratios under 4.5x and even P/S lower than 2x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Genesys International

What Does Genesys International's P/S Mean For Shareholders?

Revenue has risen firmly for Genesys International recently, which is pleasing to see. One possibility is that the P/S ratio is high because investors think this respectable revenue growth will be enough to outperform the broader industry in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Genesys International's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Genesys International?

In order to justify its P/S ratio, Genesys International would need to produce outstanding growth that's well in excess of the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 27%. Pleasingly, revenue has also lifted 145% in aggregate from three years ago, thanks to the last 12 months of growth. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

When compared to the industry's one-year growth forecast of 7.3%, the most recent medium-term revenue trajectory is noticeably more alluring

With this information, we can see why Genesys International is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Key Takeaway

Shares in Genesys International have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of Genesys International revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

It is also worth noting that we have found 2 warning signs for Genesys International that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Genesys International, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:GENESYS

Genesys International

Provides geographical information services in India and internationally.

Solid track record with adequate balance sheet.