- India

- /

- Professional Services

- /

- NSEI:FSL

Firstsource Solutions Limited's (NSE:FSL) Shares Lagging The Market But So Is The Business

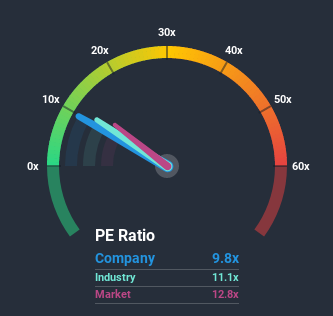

With a price-to-earnings (or "P/E") ratio of 9.8x Firstsource Solutions Limited (NSE:FSL) may be sending bullish signals at the moment, given that almost half of all companies in India have P/E ratios greater than 13x and even P/E's higher than 31x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

With earnings that are retreating more than the market's of late, Firstsource Solutions has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. You'd much rather the company wasn't bleeding earnings if you still believe in the business. If not, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Firstsource Solutions

What Are Growth Metrics Telling Us About The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Firstsource Solutions' is when the company's growth is on track to lag the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10%. Regardless, EPS has managed to lift by a handy 18% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to plummet, contracting by 4.1% during the coming year according to the twin analysts following the company. The market is also set to see earnings decline 1.5% but the stock is shaping up to perform materially worse.

In light of this, it's understandable that Firstsource Solutions' P/E sits below the majority of other companies. Nonetheless, with earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Even just maintaining these prices could be difficult achieve as the weak outlook is already weighing down the shares heavily.

The Bottom Line On Firstsource Solutions' P/E

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Firstsource Solutions' analyst forecasts revealed that its even shakier outlook against the market is contributing to its low P/E. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Although, we would be concerned whether the company can even maintain this level of performance under these tough market conditions. In the meantime, unless the company's prospects improve they will continue to form a barrier for the share price around these levels.

Before you take the next step, you should know about the 3 warning signs for Firstsource Solutions (1 shouldn't be ignored!) that we have uncovered.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Firstsource Solutions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:FSL

Firstsource Solutions

Provides tech-enabled business processes in India, the United Kingdom, the United States, Asia, South Africa, the Philippines, Australia, New Zealand, and internationally.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives