We Think 3i Infotech (NSE:3IINFOTECH) Is Taking Some Risk With Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, 3i Infotech Limited (NSE:3IINFOTECH) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for 3i Infotech

What Is 3i Infotech's Net Debt?

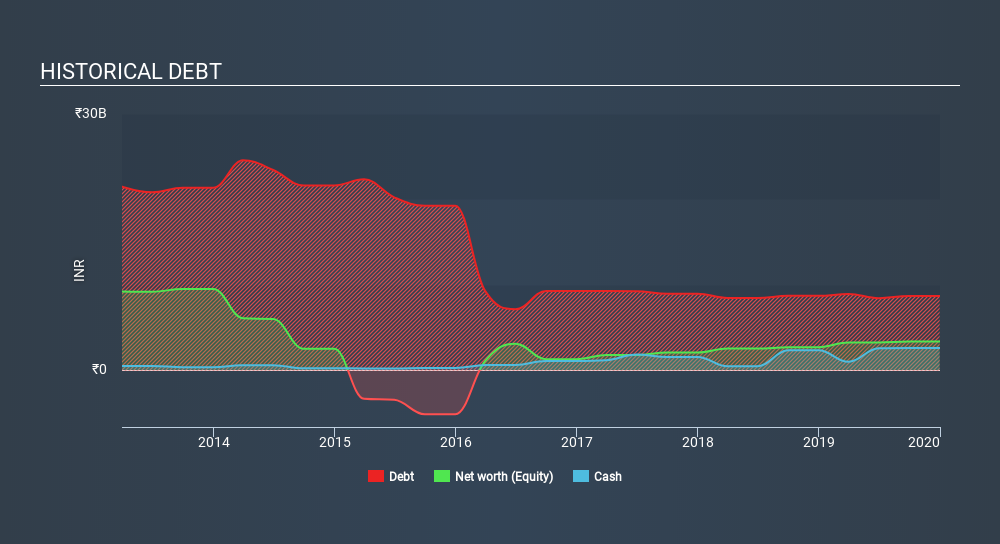

The chart below, which you can click on for greater detail, shows that 3i Infotech had ₹8.71b in debt in September 2019; about the same as the year before. However, because it has a cash reserve of ₹2.62b, its net debt is less, at about ₹6.09b.

How Strong Is 3i Infotech's Balance Sheet?

According to the last reported balance sheet, 3i Infotech had liabilities of ₹3.25b due within 12 months, and liabilities of ₹8.88b due beyond 12 months. Offsetting this, it had ₹2.62b in cash and ₹2.31b in receivables that were due within 12 months. So it has liabilities totalling ₹7.20b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the ₹2.65b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, 3i Infotech would probably need a major re-capitalization if its creditors were to demand repayment.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While we wouldn't worry about 3i Infotech's net debt to EBITDA ratio of 3.8, we think its super-low interest cover of 2.2 times is a sign of high leverage. So shareholders should probably be aware that interest expenses appear to have really impacted the business lately. On a slightly more positive note, 3i Infotech grew its EBIT at 10% over the last year, further increasing its ability to manage debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since 3i Infotech will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. In the last three years, 3i Infotech's free cash flow amounted to 50% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Our View

We'd go so far as to say 3i Infotech's level of total liabilities was disappointing. But at least it's pretty decent at growing its EBIT; that's encouraging. Overall, it seems to us that 3i Infotech's balance sheet is really quite a risk to the business. For this reason we're pretty cautious about the stock, and we think shareholders should keep a close eye on its liquidity. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. For instance, we've identified 3 warning signs for 3i Infotech (1 shouldn't be ignored) you should be aware of.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NSEI:3IINFOLTD

3i Infotech

Provides IP based software solutions in India, the United States, the United Kingdom, the Middle East, Africa, South Asia, the Asia Pacific, and internationally.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives