If You Had Bought 3i Infotech (NSE:3IINFOTECH) Stock Five Years Ago, You'd Be Sitting On A 71% Loss, Today

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Some stocks are best avoided. We really hate to see fellow investors lose their hard-earned money. Spare a thought for those who held 3i Infotech Limited (NSE:3IINFOTECH) for five whole years - as the share price tanked 71%. And some of the more recent buyers are probably worried, too, with the stock falling 20% in the last year. The falls have accelerated recently, with the share price down 12% in the last three months.

See our latest analysis for 3i Infotech

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

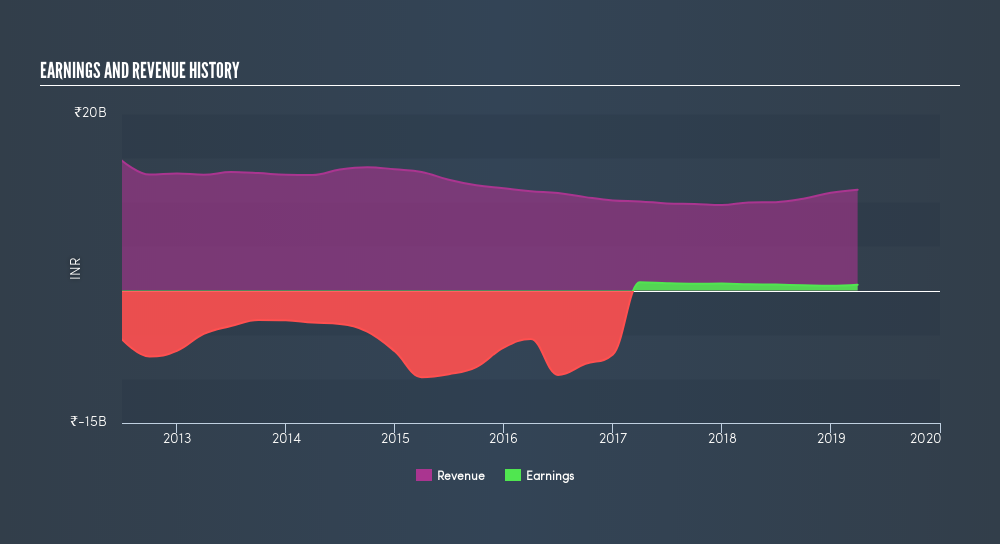

During five years of share price growth, 3i Infotech moved from a loss to profitability. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics may better explain the share price move.

Arguably, the revenue drop of 6.7% a year for half a decade suggests that the company can't grow in the long term. This has probably encouraged some shareholders to sell down the stock.

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

Take a more thorough look at 3i Infotech's financial health with this free report on its balance sheet.

A Different Perspective

3i Infotech shareholders are down 20% for the year, but the market itself is up 0.8%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 22% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Before forming an opinion on 3i Infotech you might want to consider these 3 valuation metrics.

Of course 3i Infotech may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:3IINFOLTD

3i Infotech

Provides IP based software solutions in India, the United States, the United Kingdom, the Middle East, Africa, South Asia, the Asia Pacific, and internationally.

Excellent balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives