- India

- /

- Semiconductors

- /

- NSEI:URJA

Can You Imagine How Elated Urja Global's (NSE:URJA) Shareholders Feel About Its 334% Share Price Gain?

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. While not every stock performs well, when investors win, they can win big. For example, the Urja Global Limited (NSE:URJA) share price rocketed moonwards 334% in just one year. It's also good to see the share price up 127% over the last quarter. In contrast, the longer term returns are negative, since the share price is 3.8% lower than it was three years ago.

Check out our latest analysis for Urja Global

We don't think that Urja Global's modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. As a general rule, we think this kind of company is more comparable to loss-making stocks, since the actual profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Urja Global actually shrunk its revenue over the last year, with a reduction of 29%. So it's very confusing to see that the share price gained a whopping 334%. It's pretty clear the market isn't basing its valuation on fundamental metrics like revenue. To us, a gain like this looks like speculation, but there might be historical trends to back it up.

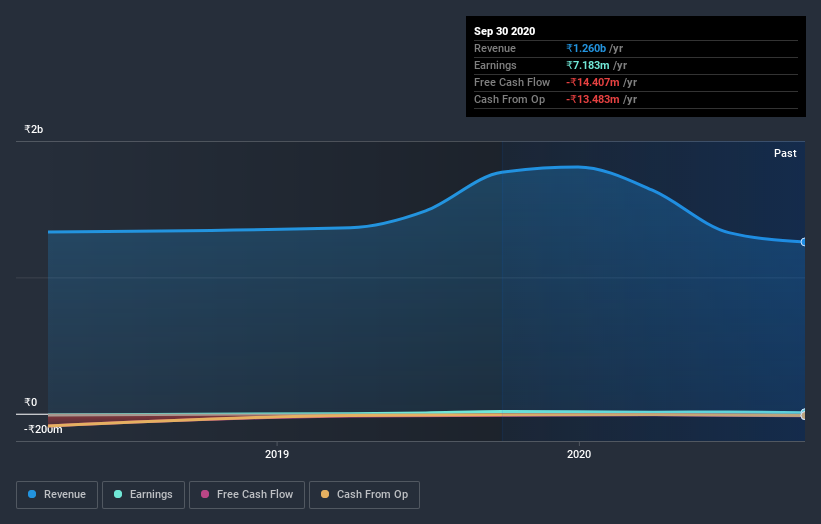

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Pleasingly, Urja Global's total shareholder return last year was 334%. That certainly beats the loss of about 1.2% per year over three years. It could well be that the business has turned around -- or else regained the confidence of investors. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Urja Global , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

If you’re looking to trade Urja Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:URJA

Urja Global

Engages in the design, consultancy, integration, supply, installation, commissioning, and maintenance of off-grid and grid-connected solar power plants and decentralized solar applications in India.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives