- India

- /

- Specialty Stores

- /

- NSEI:THANGAMAYL

Is Now The Time To Put Thangamayil Jewellery (NSE:THANGAMAYL) On Your Watchlist?

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like Thangamayil Jewellery (NSE:THANGAMAYL). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

View our latest analysis for Thangamayil Jewellery

Thangamayil Jewellery's Earnings Per Share Are Growing.

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. It's no surprise, then, that I like to invest in companies with EPS growth. Who among us would not applaud Thangamayil Jewellery's stratospheric annual EPS growth of 51%, compound, over the last three years? Growth that fast may well be fleeting, but like a lotus blooming from a murky pond, it sparks joy for the wary stock pickers.

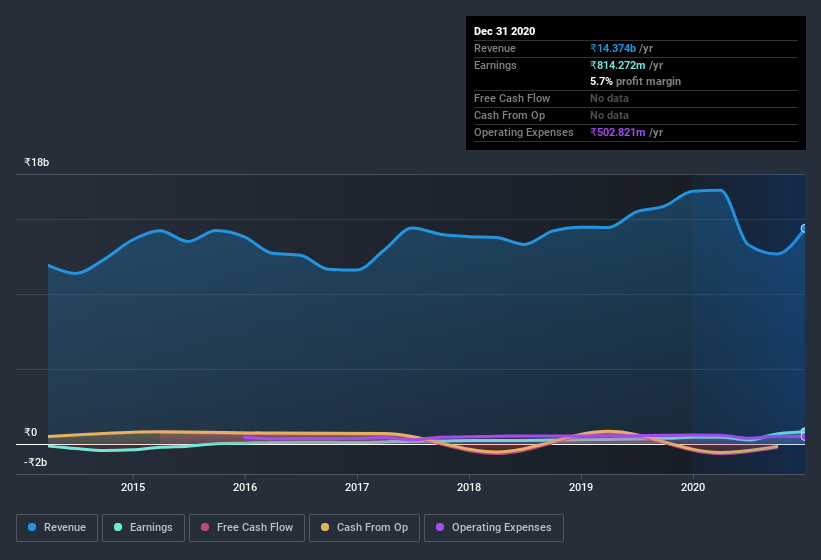

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Unfortunately, Thangamayil Jewellery's revenue dropped 15% last year, but the silver lining is that EBIT margins improved from 5.2% to 8.9%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Thangamayil Jewellery isn't a huge company, given its market capitalization of ₹8.2b. That makes it extra important to check on its balance sheet strength.

Are Thangamayil Jewellery Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's a pleasure to note that insiders spent ₹114m buying Thangamayil Jewellery shares, over the last year, without reporting any share sales whatsoever. And so I find myself almost expectant, and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Joint MD & Whole-Time Director N. Kumar who made the biggest single purchase, worth ₹11m, paying ₹339 per share.

On top of the insider buying, we can also see that Thangamayil Jewellery insiders own a large chunk of the company. Actually, with 45% of the company to their names, insiders are profoundly invested in the business. I'm always comforted by solid insider ownership like this, as it implies that those running the business are genuinely motivated to create shareholder value. In terms of absolute value, insiders have ₹3.7b invested in the business, using the current share price. That should be more than enough to keep them focussed on creating shareholder value!

Is Thangamayil Jewellery Worth Keeping An Eye On?

Thangamayil Jewellery's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Thangamayil Jewellery deserves timely attention. However, before you get too excited we've discovered 2 warning signs for Thangamayil Jewellery (1 makes us a bit uncomfortable!) that you should be aware of.

As a growth investor I do like to see insider buying. But Thangamayil Jewellery isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading Thangamayil Jewellery or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thangamayil Jewellery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NSEI:THANGAMAYL

Thangamayil Jewellery

Operates a chain of retail jewelry stores in India.

Exceptional growth potential, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives