- India

- /

- Diversified Financial

- /

- NSEI:APTUS

Anupam Rasayan India And Two More Growth Leaders With High Insider Stakes On The Indian Exchange

Reviewed by Simply Wall St

Despite a flat performance over the last week, the Indian market has shown robust growth, surging 45% over the past year with earnings expected to grow by 16% annually. In such an optimistic climate, companies like Anupam Rasayan India with high insider ownership can be particularly compelling, as they often reflect a deep commitment by those who know the business best.

Top 10 Growth Companies With High Insider Ownership In India

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 28.9% |

| Pitti Engineering (BSE:513519) | 30.3% | 28.0% |

| Kirloskar Pneumatic (BSE:505283) | 30.6% | 29.8% |

| Shivalik Bimetal Controls (BSE:513097) | 19.5% | 28.7% |

| Jupiter Wagons (NSEI:JWL) | 10.8% | 27.2% |

| Rajratan Global Wire (BSE:517522) | 19.8% | 33.5% |

| Dixon Technologies (India) (NSEI:DIXON) | 24.9% | 34.5% |

| Paisalo Digital (BSE:532900) | 16.3% | 23.8% |

| JNK India (NSEI:JNKINDIA) | 23.8% | 31.8% |

| Aether Industries (NSEI:AETHER) | 31.1% | 40.9% |

Here's a peek at a few of the choices from the screener.

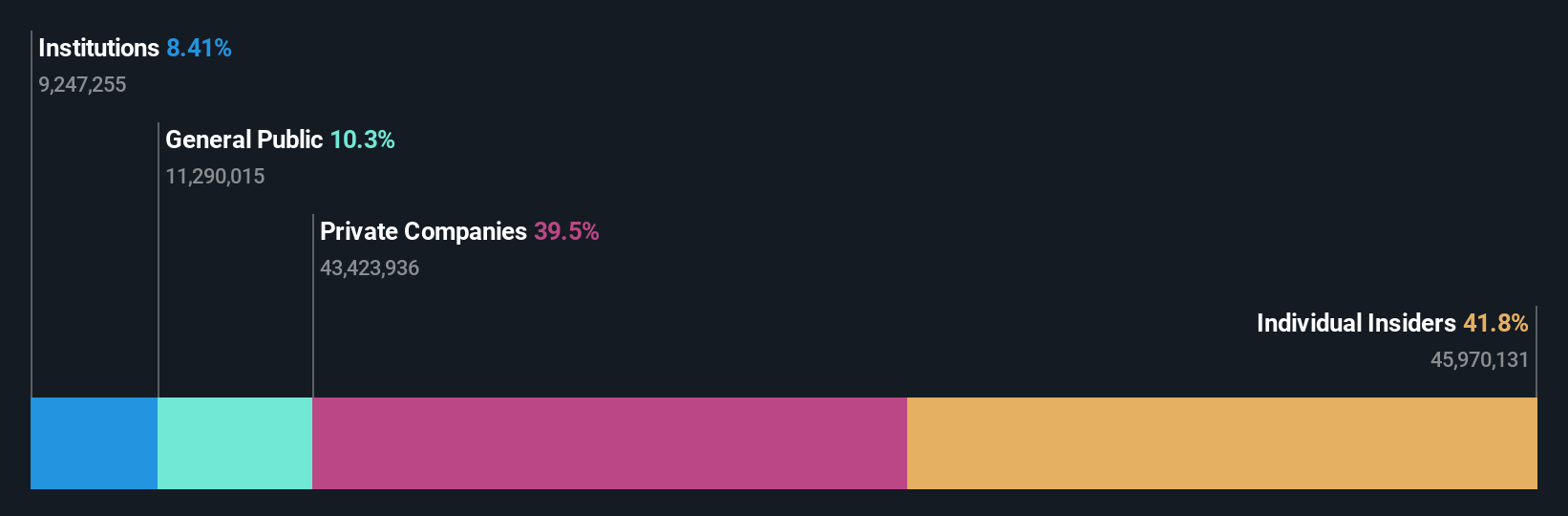

Anupam Rasayan India (NSEI:ANURAS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Anupam Rasayan India Ltd specializes in the custom synthesis and manufacturing of specialty chemicals, operating across India, Europe, Japan, Singapore, China, and North America with a market capitalization of ₹85.25 billion.

Operations: The company generates ₹14.75 billion from the manufacturing of industrial chemicals.

Insider Ownership: 39.6%

Earnings Growth Forecast: 33% p.a.

Anupam Rasayan India has shown a mixed financial performance with a recent decline in quarterly sales and net income, reporting INR 4,010.12 million in sales and INR 309.05 million in net income for Q4 2024, down from the previous year. Despite this downturn, the company's earnings are expected to grow by 33% annually, outpacing the Indian market forecast of 15.9%. Additionally, revenue is projected to increase by 19% annually, which is double the national market rate of 9.6%. However, shareholder dilution occurred over the past year and Return on Equity is anticipated to be low at 11.2% in three years' time.

- Delve into the full analysis future growth report here for a deeper understanding of Anupam Rasayan India.

- Our expertly prepared valuation report Anupam Rasayan India implies its share price may be too high.

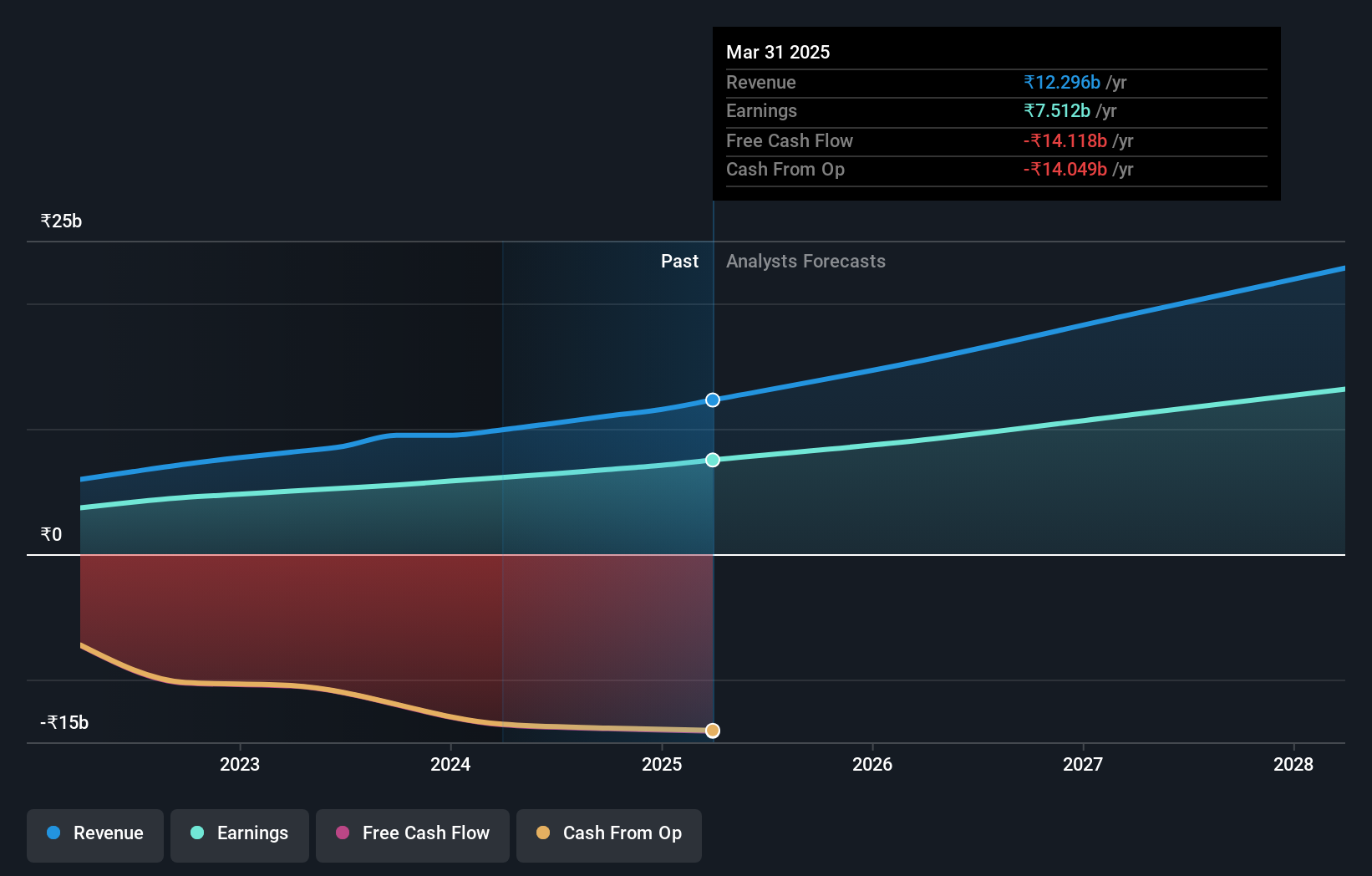

Aptus Value Housing Finance India (NSEI:APTUS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aptus Value Housing Finance India Limited, along with its subsidiary, functions as a housing finance company in India, boasting a market capitalization of approximately ₹162.07 billion.

Operations: The company generates revenue primarily from providing long-term housing finance, loans against property, and refinance loans, totaling approximately ₹9.998 billion.

Insider Ownership: 25.2%

Earnings Growth Forecast: 17.4% p.a.

Aptus Value Housing Finance India Limited, a growth-oriented company with significant insider ownership, reported a robust financial performance for FY 2024. The company's revenue surged to INR 14.17 billion, up from INR 11.34 billion the previous year, while net income increased to INR 6.12 billion from INR 5.03 billion. Despite these gains, its dividend coverage remains weak with recent interim dividends declared at INR 2.50 per share not well covered by free cash flows. The firm also appointed Mr. Vijayaraghavan Kannan as Chief Risk Officer, strengthening its management team amid expanding operations and solid earnings growth forecasts of approximately 17% annually.

- Dive into the specifics of Aptus Value Housing Finance India here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Aptus Value Housing Finance India's share price might be too optimistic.

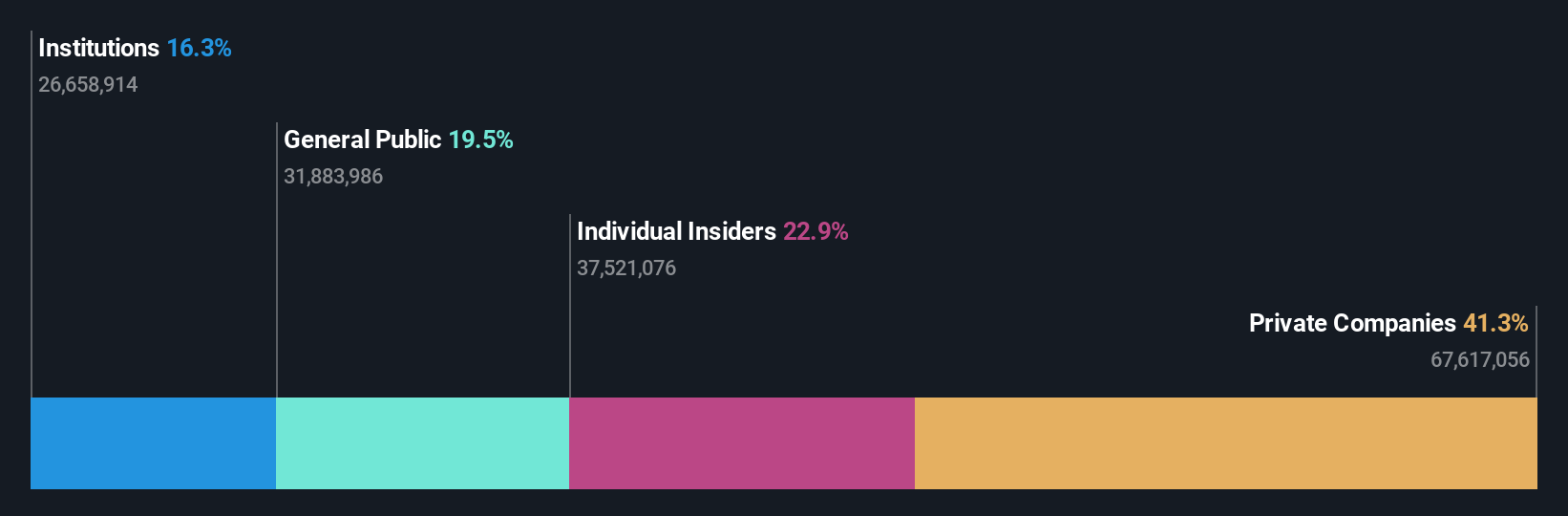

Senco Gold (NSEI:SENCO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Senco Gold Limited is an Indian company engaged in the manufacturing and trading of jewelry and articles crafted from gold, silver, platinum, and various precious and semi-precious stones, with a market capitalization of approximately ₹75.78 billion.

Operations: The company's primary revenue of ₹52.41 billion is derived from the sale of gold jewellery and other related articles.

Insider Ownership: 24.1%

Earnings Growth Forecast: 21.4% p.a.

Senco Gold Limited, a key player in India's specialty retail sector, demonstrates substantial insider ownership with promising growth prospects. The company's earnings are expected to grow by 21.4% annually over the next three years, outpacing the Indian market forecast of 15.9%. Despite recent regulatory challenges and a service tax demand of INR 2.27 million which the company plans to contest, Senco Gold has shown robust financial health with significant revenue and net income increases in FY 2024. However, concerns about interest coverage and moderate insider transactions may temper investor enthusiasm.

- Click to explore a detailed breakdown of our findings in Senco Gold's earnings growth report.

- Our comprehensive valuation report raises the possibility that Senco Gold is priced lower than what may be justified by its financials.

Make It Happen

- Explore the 83 names from our Fast Growing Indian Companies With High Insider Ownership screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:APTUS

Aptus Value Housing Finance India

Together with its subsidiary, Aptus Finance India Private Limited, provides housing finance solutions in India.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives