- India

- /

- Specialty Stores

- /

- NSEI:RADHIKAJWE

Investors Still Aren't Entirely Convinced By Radhika Jeweltech Limited's (NSE:RADHIKAJWE) Earnings Despite 26% Price Jump

Radhika Jeweltech Limited (NSE:RADHIKAJWE) shareholders have had their patience rewarded with a 26% share price jump in the last month. The annual gain comes to 113% following the latest surge, making investors sit up and take notice.

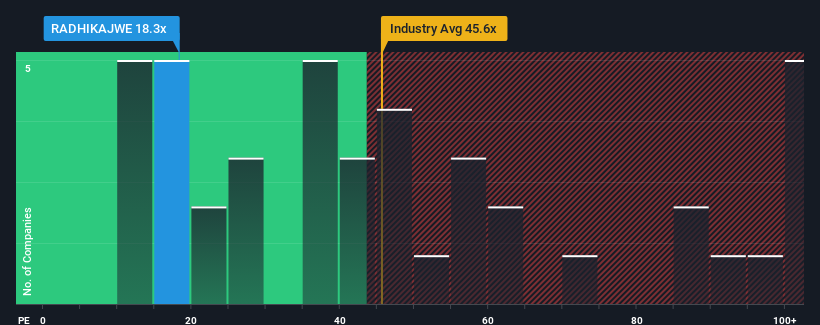

Although its price has surged higher, given about half the companies in India have price-to-earnings ratios (or "P/E's") above 35x, you may still consider Radhika Jeweltech as an attractive investment with its 18.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

Radhika Jeweltech certainly has been doing a great job lately as it's been growing earnings at a really rapid pace. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Radhika Jeweltech

Does Growth Match The Low P/E?

The only time you'd be truly comfortable seeing a P/E as low as Radhika Jeweltech's is when the company's growth is on track to lag the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 67% last year. The latest three year period has also seen an excellent 119% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 25% shows it's noticeably more attractive on an annualised basis.

With this information, we find it odd that Radhika Jeweltech is trading at a P/E lower than the market. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Radhika Jeweltech's P/E?

Radhika Jeweltech's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Radhika Jeweltech revealed its three-year earnings trends aren't contributing to its P/E anywhere near as much as we would have predicted, given they look better than current market expectations. When we see strong earnings with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Radhika Jeweltech that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:RADHIKAJWE

Radhika Jeweltech

Engages in the manufacture and retail of jewelry in India.

Excellent balance sheet with proven track record.