- India

- /

- Specialty Stores

- /

- NSEI:PCJEWELLER

Introducing PC Jeweller (NSE:PCJEWELLER), The Stock That Tanked 77%

PC Jeweller Limited (NSE:PCJEWELLER) shareholders should be happy to see the share price up 19% in the last month. But that is meagre solace when you consider how the price has plummeted over the last year. Indeed, the share price is down a whopping 77% in the last year. Arguably, the recent bounce is to be expected after such a bad drop. The real question is whether the company can turn around its fortunes.

See our latest analysis for PC Jeweller

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the PC Jeweller share price is down over the year, its EPS actually improved. Of course, the situation might betray previous over-optimism about growth. It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

Given the yield is quite low, at 0.6%, we doubt the dividend can shed much light on the share price. PC Jeweller managed to grow revenue over the last year, which is usually a real positive. Since we can't easily explain the share price movement based on these metrics, it might be worth considering how market sentiment has changed towards the stock.

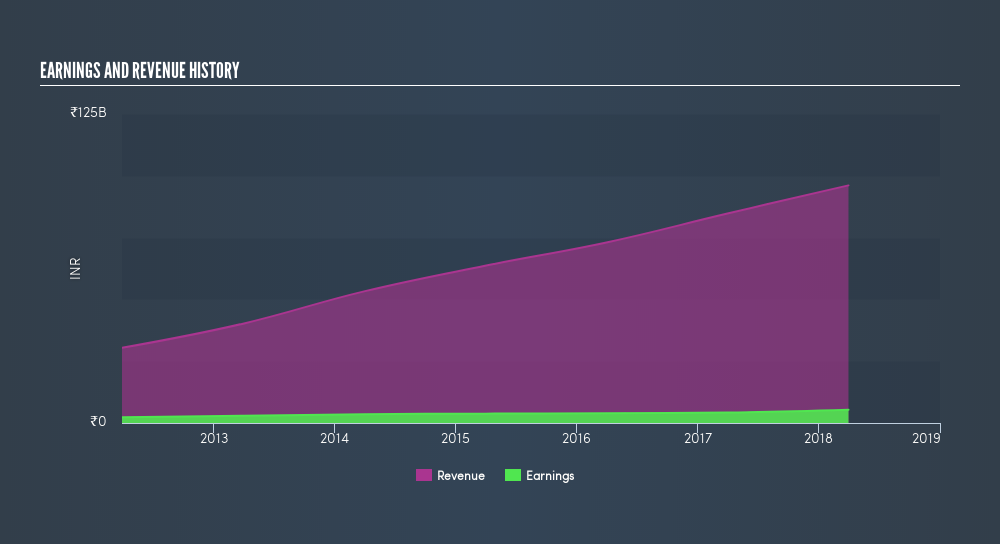

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

Balance sheet strength is crucual. It might be well worthwhile taking a look at our freereport on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between PC Jeweller's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. Its history of dividend payouts mean that PC Jeweller's TSR, which was a 76% drop over the last year, was not as bad as the share price return.

A Different Perspective

We regret to report that PC Jeweller shareholders are down 76% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 0.1%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. On the bright side, long term shareholders have made money, with a gain of 11% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before deciding if you like the current share price, check how PC Jeweller scores on these 3 valuation metrics.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NSEI:PCJEWELLER

PC Jeweller

Manufactures, sells, and trades in gold, diamond, silver, precious stone, and gold and diamond studded jewelry in India.

Acceptable track record low.

Similar Companies

Market Insights

Community Narratives