- India

- /

- Specialty Stores

- /

- NSEI:KORE

If EPS Growth Is Important To You, Jay Jalaram Technologies (NSE:KORE) Presents An Opportunity

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Jay Jalaram Technologies (NSE:KORE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Jay Jalaram Technologies

Jay Jalaram Technologies' Improving Profits

Jay Jalaram Technologies has undergone a massive growth in earnings per share over the last three years. So much so that this three year growth rate wouldn't be a fair assessment of the company's future. So it would be better to isolate the growth rate over the last year for our analysis. Outstandingly, Jay Jalaram Technologies' EPS shot from ₹1.04 to ₹2.25, over the last year. It's a rarity to see 116% year-on-year growth like that. That could be a sign that the business has reached a true inflection point.

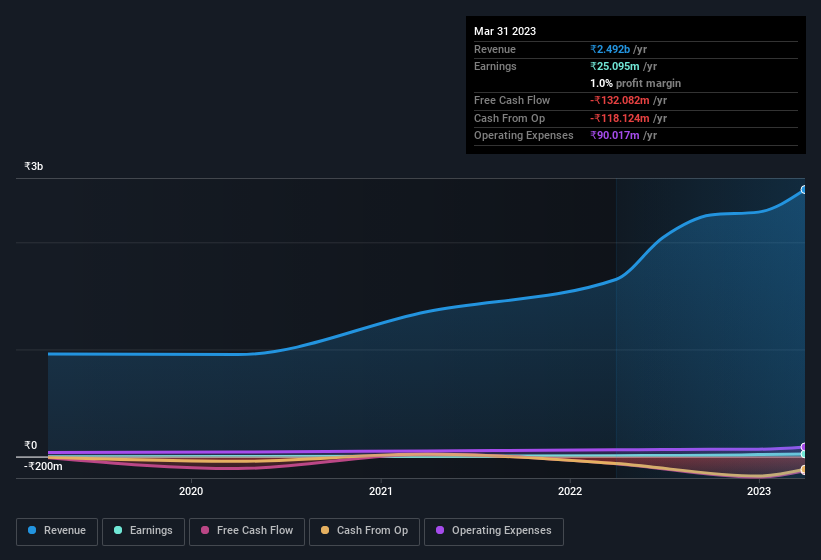

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. Jay Jalaram Technologies maintained stable EBIT margins over the last year, all while growing revenue 51% to ₹2.5b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Jay Jalaram Technologies isn't a huge company, given its market capitalisation of ₹3.0b. That makes it extra important to check on its balance sheet strength.

Are Jay Jalaram Technologies Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So as you can imagine, the fact that Jay Jalaram Technologies insiders own a significant number of shares certainly is appealing. In fact, they own 73% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. To give you an idea, the value of insiders' holdings in the business are valued at ₹2.2b at the current share price. So there's plenty there to keep them focused!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under ₹17b, like Jay Jalaram Technologies, the median CEO pay is around ₹3.3m.

Jay Jalaram Technologies' CEO only received compensation totalling ₹264k in the year to March 2023. This total may indicate that the CEO is sacrificing take home pay for performance-based benefits, ensuring that their motivations are synonymous with strong company results. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Should You Add Jay Jalaram Technologies To Your Watchlist?

Jay Jalaram Technologies' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Jay Jalaram Technologies is worth considering carefully. Before you take the next step you should know about the 4 warning signs for Jay Jalaram Technologies (3 don't sit too well with us!) that we have uncovered.

The beauty of investing is that you can invest in almost any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KORE

Jay Jalaram Technologies

Engages in the multi-brand retail selling business primarily in India.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives