- India

- /

- Retail Distributors

- /

- NSEI:KCK

We Ran A Stock Scan For Earnings Growth And Kck Industries (NSE:KCK) Passed With Ease

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Kck Industries (NSE:KCK). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Kck Industries with the means to add long-term value to shareholders.

View our latest analysis for Kck Industries

How Fast Is Kck Industries Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. It's good to see that Kck Industries' EPS has grown from ₹2.39 to ₹2.90 over twelve months. There's little doubt shareholders would be happy with that 21% gain.

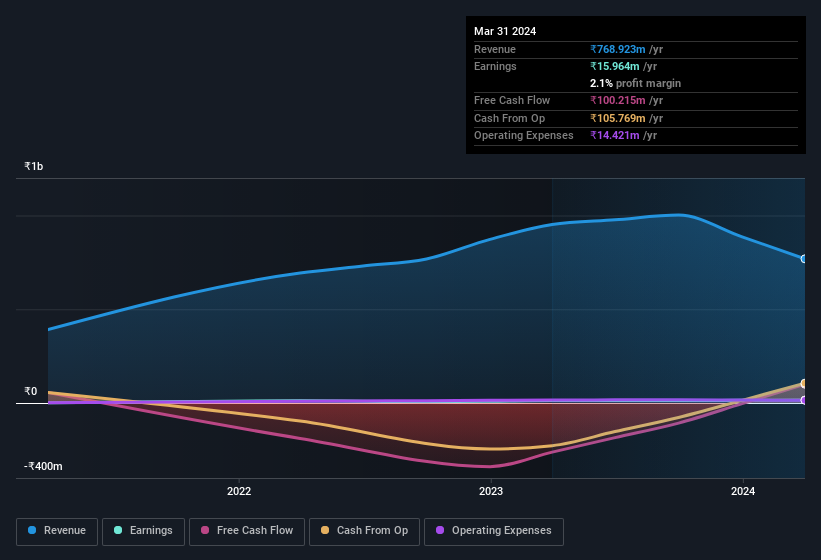

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. We note that while EBIT margins have improved from 3.8% to 6.2%, the company has actually reported a fall in revenue by 19%. That's not a good look.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Since Kck Industries is no giant, with a market capitalisation of ₹961m, you should definitely check its cash and debt before getting too excited about its prospects.

Are Kck Industries Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Kck Industries will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. To be exact, company insiders hold 55% of the company, so their decisions have a significant impact on their investments. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. Of course, Kck Industries is a very small company, with a market cap of only ₹961m. So despite a large proportional holding, insiders only have ₹528m worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. For companies with market capitalisations under ₹17b, like Kck Industries, the median CEO pay is around ₹3.3m.

The Kck Industries CEO received total compensation of only ₹548k in the year to March 2023. You could consider this pay as somewhat symbolic, which suggests the CEO does not need a lot of compensation to stay motivated. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Does Kck Industries Deserve A Spot On Your Watchlist?

One positive for Kck Industries is that it is growing EPS. That's nice to see. The growth of EPS may be the eye-catching headline for Kck Industries, but there's more to bring joy for shareholders. Boasting both modest CEO pay and considerable insider ownership, you'd argue this one is worthy of the watchlist, at least. We don't want to rain on the parade too much, but we did also find 3 warning signs for Kck Industries (2 shouldn't be ignored!) that you need to be mindful of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Indian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Kck Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:KCK

Kck Industries

Engages in the trading and distribution of combed and carded cotton yarns, chemicals and dyes in India.

Moderate risk with proven track record.

Similar Companies

Market Insights

Community Narratives