- India

- /

- Retail Distributors

- /

- NSEI:JMA

Here's Why I Think Jullundur Motor Agency (Delhi) (NSE:JMA) Might Deserve Your Attention Today

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like Jullundur Motor Agency (Delhi) (NSE:JMA). Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

Check out our latest analysis for Jullundur Motor Agency (Delhi)

How Quickly Is Jullundur Motor Agency (Delhi) Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so share price follows earnings per share (EPS) eventually. That means EPS growth is considered a real positive by most successful long-term investors. It certainly is nice to see that Jullundur Motor Agency (Delhi) has managed to grow EPS by 31% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

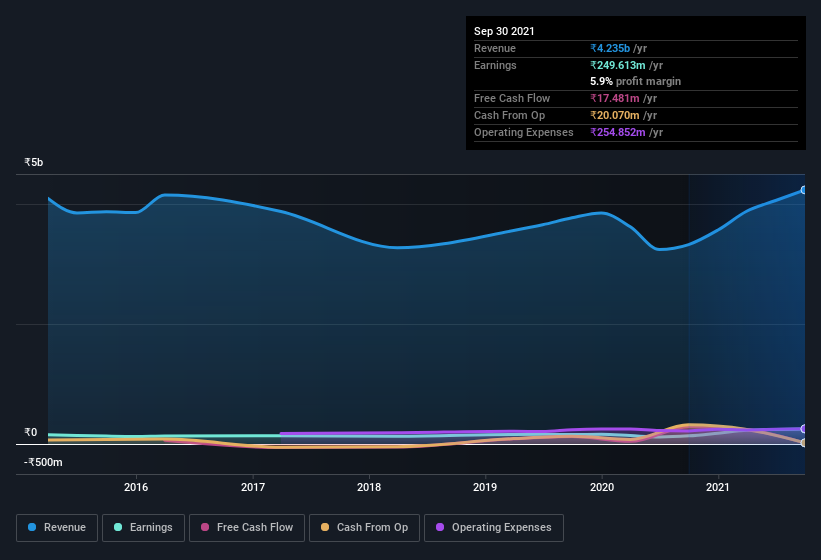

I like to take a look at earnings before interest and (EBIT) tax margins, as well as revenue growth, to get another take on the quality of the company's growth. The good news is that Jullundur Motor Agency (Delhi) is growing revenues, and EBIT margins improved by 2.7 percentage points to 6.6%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Jullundur Motor Agency (Delhi) is no giant, with a market capitalization of ₹1.9b, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Jullundur Motor Agency (Delhi) Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

We note that Jullundur Motor Agency (Delhi) insiders spent ₹4.0m on stock, over the last year; in contrast, we didn't see any selling. That puts the company in a nice light, as it makes me think its leaders are feeling confident. It is also worth noting that it was Non-Executive Non-Independent Director Deepak Arora who made the biggest single purchase, worth ₹982k, paying ₹62.54 per share.

On top of the insider buying, we can also see that Jullundur Motor Agency (Delhi) insiders own a large chunk of the company. In fact, they own 58% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. To me this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. Valued at only ₹1.9b Jullundur Motor Agency (Delhi) is really small for a listed company. So despite a large proportional holding, insiders only have ₹1.1b worth of stock. That's not a huge stake in absolute terms, but it should help keep insiders aligned with other shareholders.

Does Jullundur Motor Agency (Delhi) Deserve A Spot On Your Watchlist?

You can't deny that Jullundur Motor Agency (Delhi) has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Jullundur Motor Agency (Delhi) , and understanding them should be part of your investment process.

The good news is that Jullundur Motor Agency (Delhi) is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:JMA

Jullundur Motor Agency (Delhi)

Trades and distributes automobile parts, accessories, and petroleum products primarily in India.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives