- India

- /

- Specialty Stores

- /

- NSEI:CARTRADE

CarTrade Tech Limited's (NSE:CARTRADE) 27% Share Price Surge Not Quite Adding Up

CarTrade Tech Limited (NSE:CARTRADE) shares have continued their recent momentum with a 27% gain in the last month alone. The annual gain comes to 120% following the latest surge, making investors sit up and take notice.

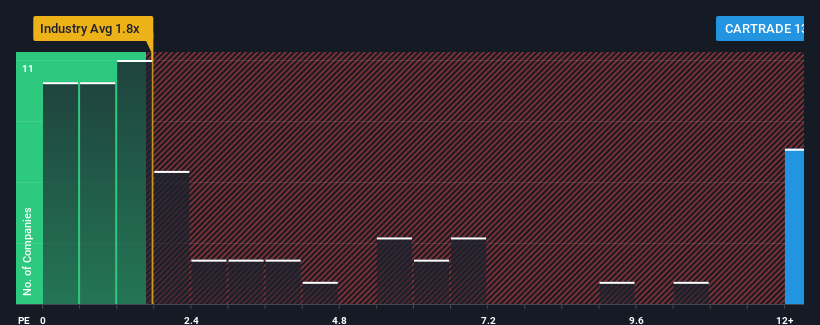

After such a large jump in price, given around half the companies in India's Specialty Retail industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider CarTrade Tech as a stock to avoid entirely with its 13.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for CarTrade Tech

What Does CarTrade Tech's Recent Performance Look Like?

CarTrade Tech could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on CarTrade Tech will help you uncover what's on the horizon.How Is CarTrade Tech's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as steep as CarTrade Tech's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 2.4%. Still, the latest three year period has seen an excellent 100% overall rise in revenue, in spite of its unsatisfying short-term performance. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 18% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 28% growth per year, the company is positioned for a weaker revenue result.

With this information, we find it concerning that CarTrade Tech is trading at a P/S higher than the industry. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

What We Can Learn From CarTrade Tech's P/S?

CarTrade Tech's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see CarTrade Tech trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. Unless these conditions improve markedly, it's very challenging to accept these prices as being reasonable.

You should always think about risks. Case in point, we've spotted 1 warning sign for CarTrade Tech you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:CARTRADE

CarTrade Tech

Operates a multi-channel online automotive platform in India and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives