- India

- /

- Specialty Stores

- /

- NSEI:BCONCEPTS

With EPS Growth And More, Brand Concepts (NSE:BCONCEPTS) Makes An Interesting Case

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Brand Concepts (NSE:BCONCEPTS). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Brand Concepts

How Fast Is Brand Concepts Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. Which is why EPS growth is looked upon so favourably. It is awe-striking that Brand Concepts' EPS went from ₹0.60 to ₹8.82 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

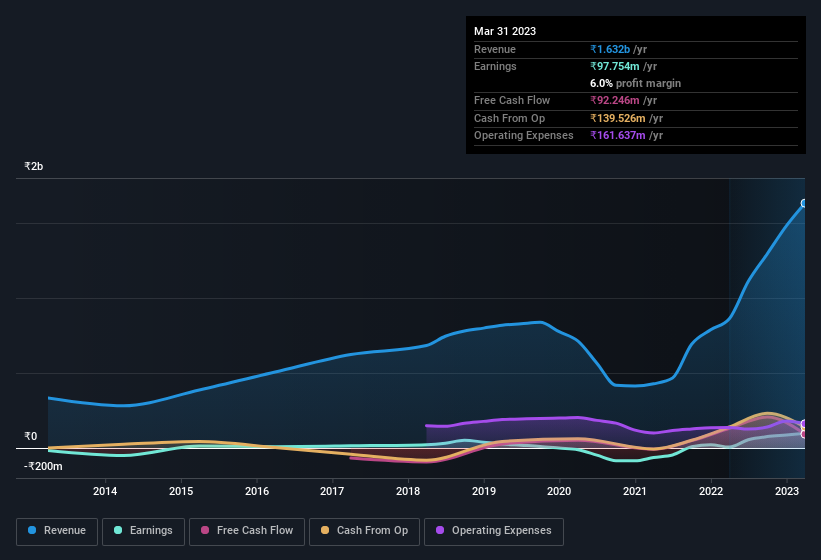

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. The music to the ears of Brand Concepts shareholders is that EBIT margins have grown from 6.1% to 11% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

Since Brand Concepts is no giant, with a market capitalisation of ₹4.2b, you should definitely check its cash and debt before getting too excited about its prospects.

Are Brand Concepts Insiders Aligned With All Shareholders?

Insider interest in a company always sparks a bit of intrigue and many investors are on the lookout for companies where insiders are putting their money where their mouth is. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

The good news for Brand Concepts shareholders is that no insiders reported selling shares in the last year. Add in the fact that Govind Shrikhande, the Independent Director of the company, paid ₹2.9m for shares at around ₹321 each. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

And the insider buying isn't the only sign of alignment between shareholders and the board, since Brand Concepts insiders own more than a third of the company. In fact, they own 65% of the company, so they will share in the same delights and challenges experienced by the ordinary shareholders. This makes it apparent they will be incentivised to plan for the long term - a positive for shareholders with a sit and hold strategy. In terms of absolute value, insiders have ₹2.7b invested in the business, at the current share price. So there's plenty there to keep them focused!

Does Brand Concepts Deserve A Spot On Your Watchlist?

Brand Concepts' earnings have taken off in quite an impressive fashion. The cherry on top is that insiders own a bunch of shares, and one has been buying more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Brand Concepts belongs near the top of your watchlist. It is worth noting though that we have found 4 warning signs for Brand Concepts that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Brand Concepts, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Brand Concepts might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NSEI:BCONCEPTS

Brand Concepts

Manufactures and retails bags, travel gear, and fashion accessories in India and internationally.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.