- India

- /

- Real Estate

- /

- NSEI:PHOENIXLTD

These Analysts Just Made A Sizeable Downgrade To Their The Phoenix Mills Limited (NSE:PHOENIXLTD) EPS Forecasts

Market forces rained on the parade of The Phoenix Mills Limited (NSE:PHOENIXLTD) shareholders today, when the analysts downgraded their forecasts for this year. Both revenue and earnings per share (EPS) forecasts went under the knife, suggesting analysts have soured majorly on the business.

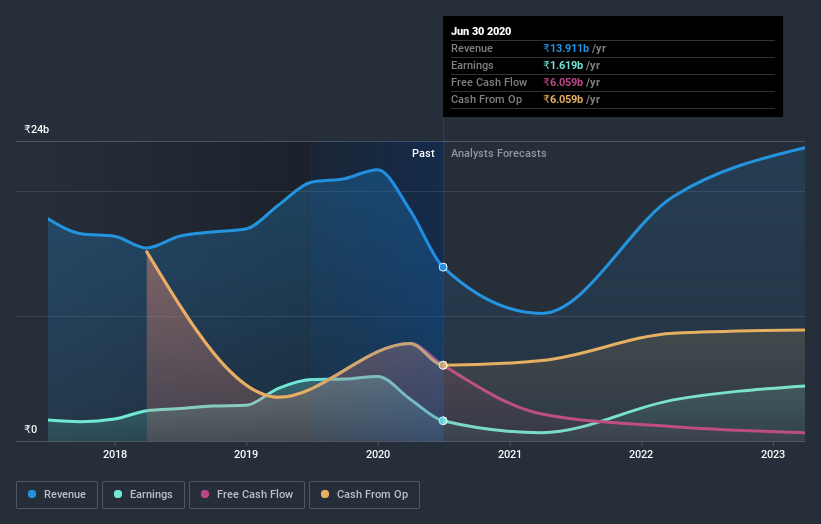

Following the latest downgrade, the ten analysts covering Phoenix Mills provided consensus estimates of ₹10b revenue in 2021, which would reflect a painful 26% decline on its sales over the past 12 months. Statutory earnings per share are supposed to nosedive 63% to ₹3.93 in the same period. Before this latest update, the analysts had been forecasting revenues of ₹12b and earnings per share (EPS) of ₹5.18 in 2021. Indeed, we can see that the analysts are a lot more bearish about Phoenix Mills' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

See our latest analysis for Phoenix Mills

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Phoenix Mills' past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast revenue decline of 26%, a significant reduction from annual growth of 1.9% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 14% annually for the foreseeable future. It's pretty clear that Phoenix Mills' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Regrettably, they also downgraded their revenue estimates, and the latest forecasts imply the business will grow sales slower than the wider market. After a cut like that, investors could be forgiven for thinking analysts are a lot more bearish on Phoenix Mills, and a few readers might choose to steer clear of the stock.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Phoenix Mills' business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other concerns we've identified.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you decide to trade Phoenix Mills, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PHOENIXLTD

Phoenix Mills

Engages in the operation and management of malls, construction of commercial and residential properties, and hotel business in India.

Reasonable growth potential with adequate balance sheet.